Last week’s market and economic data key points:

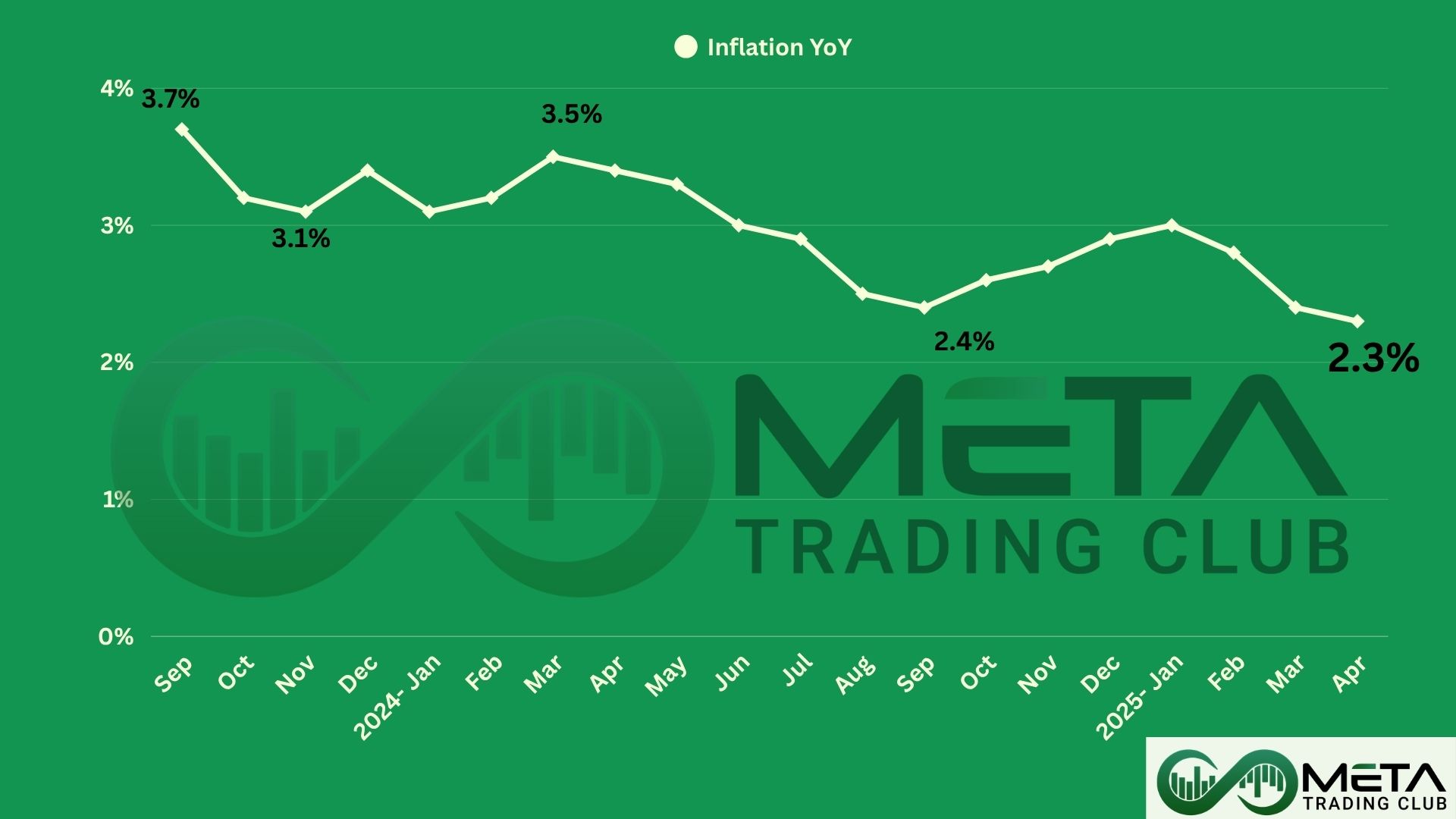

- CPI Inflation slowed to 2.3% in April

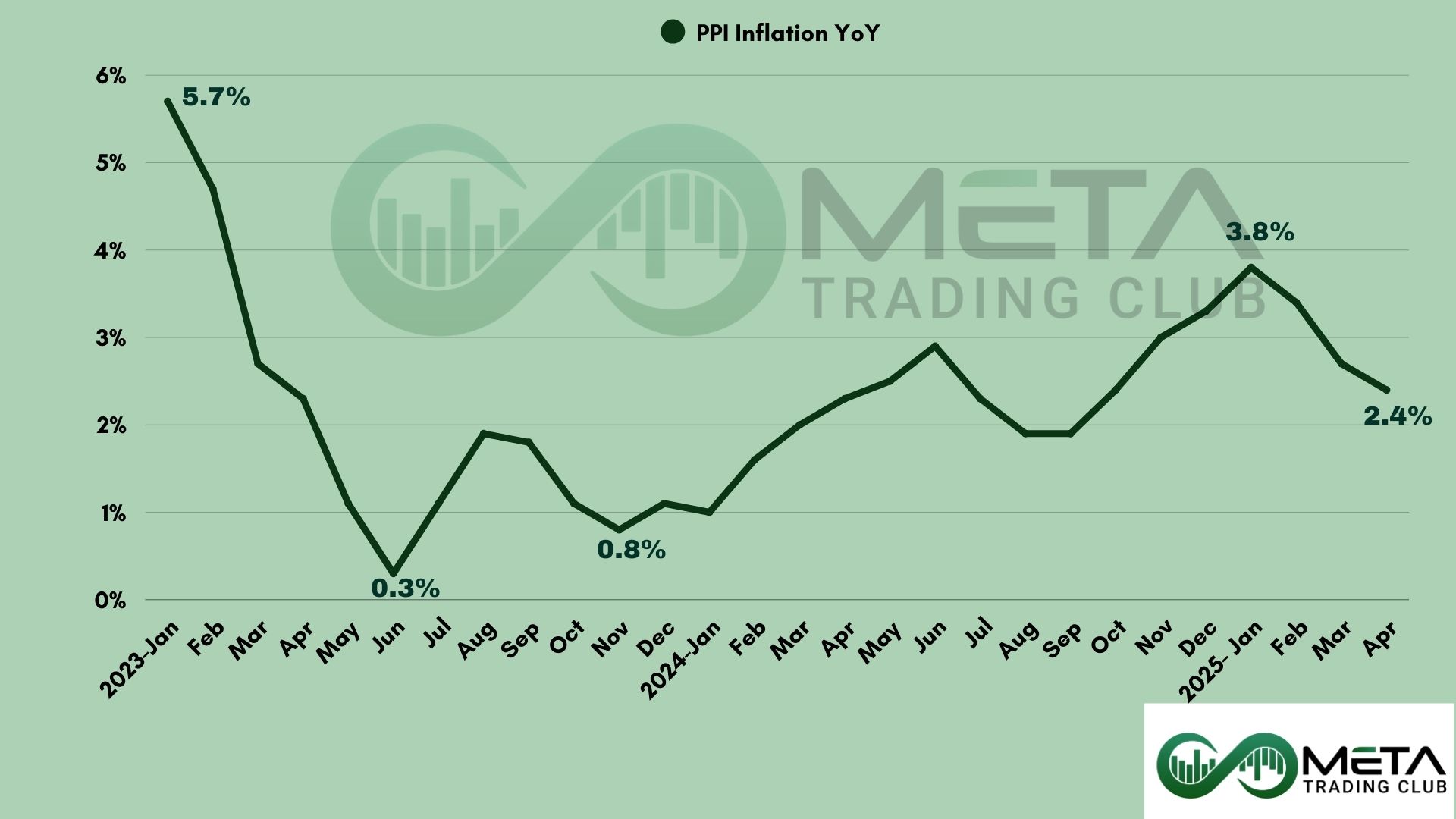

- Producer prices take an unexpected dip

- Consumer sentiment takes a hit in May

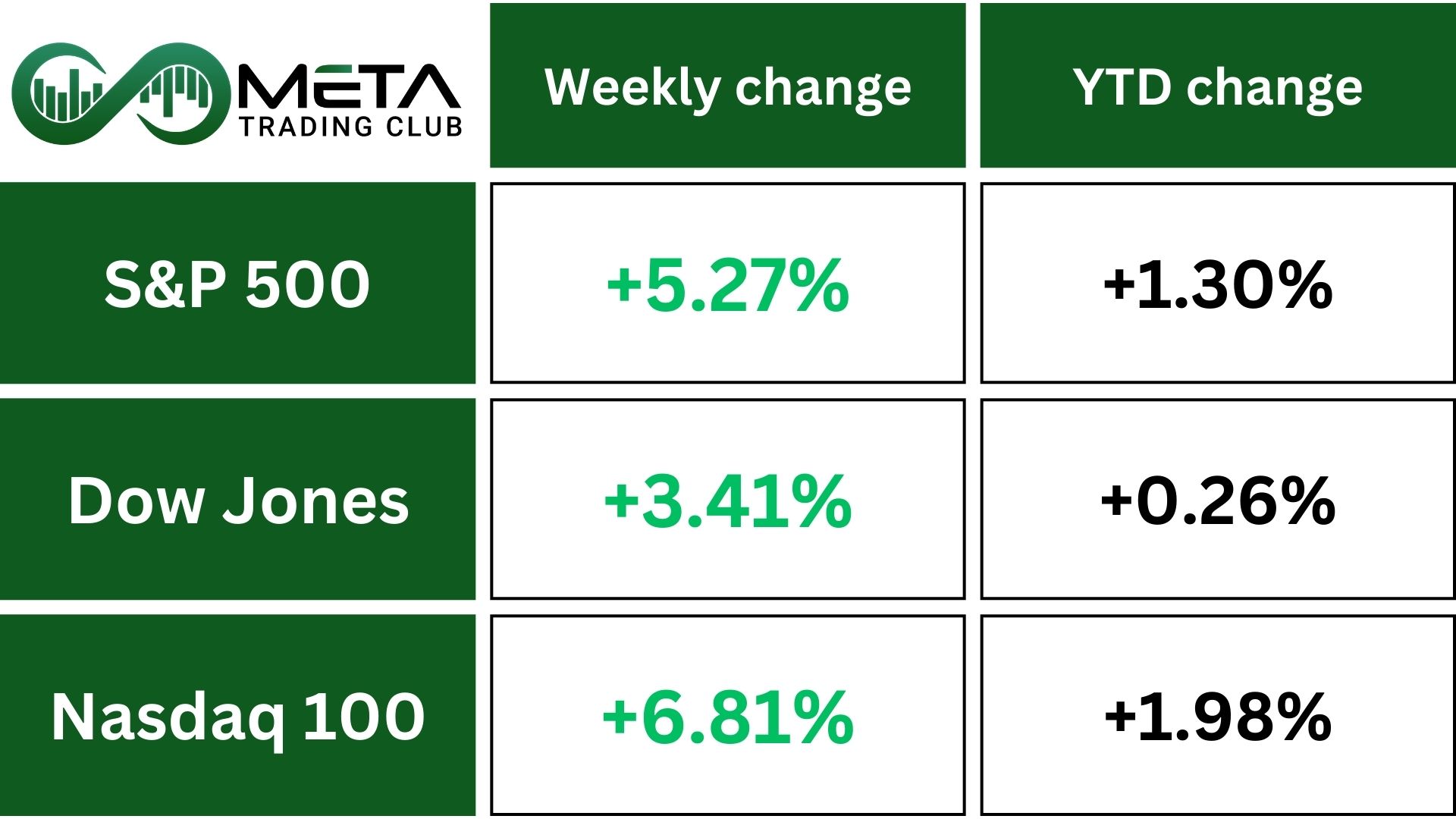

- S&P 500 climbed back into the green for the year

- European stocks notch fifth straight week of gains

- Techs up 8% as chipmakers ride tariff cuts and AI deals

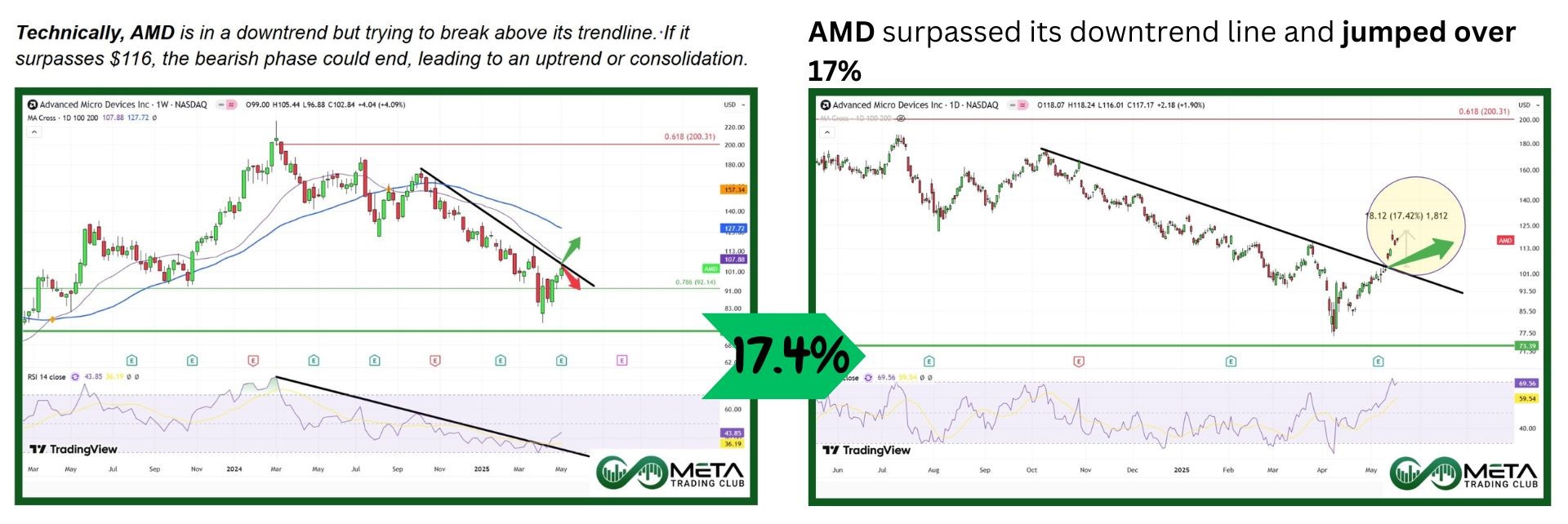

- SMCI soared 44%, AMD unveiled $6B buyback

- Semiconductor stocks rally, pushing index up 10%

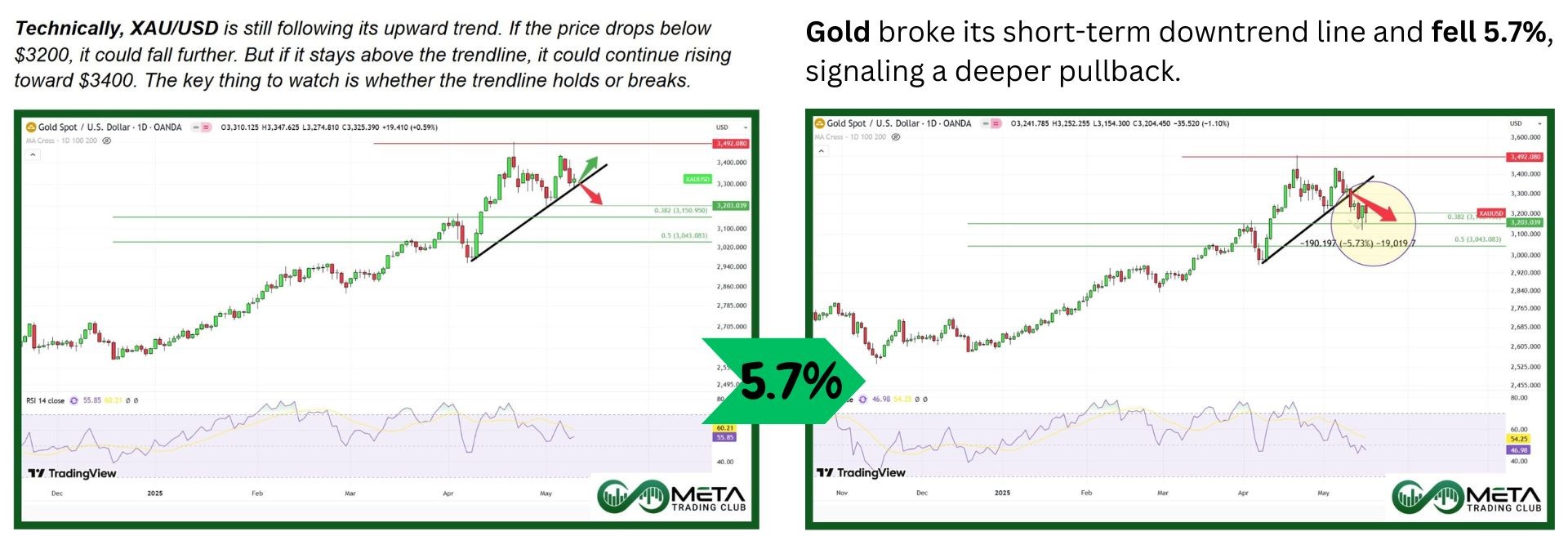

- Gold prices tumbled as trade tensions ease

- Oil finds stability after a volatile week

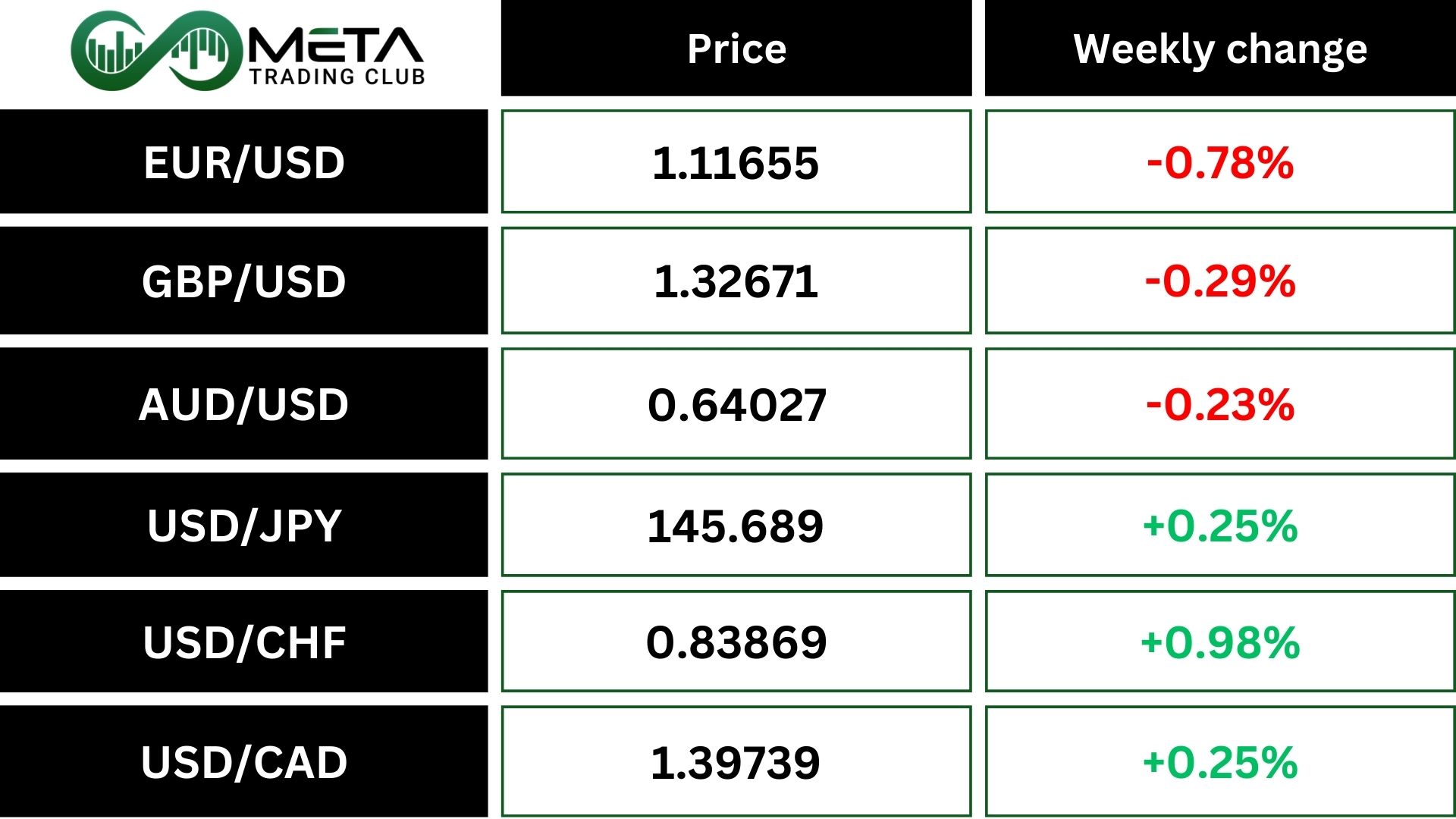

- Dollar set for fourth week of gains

- Ethereum soared with a massive weekly gain

Table of Contents

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

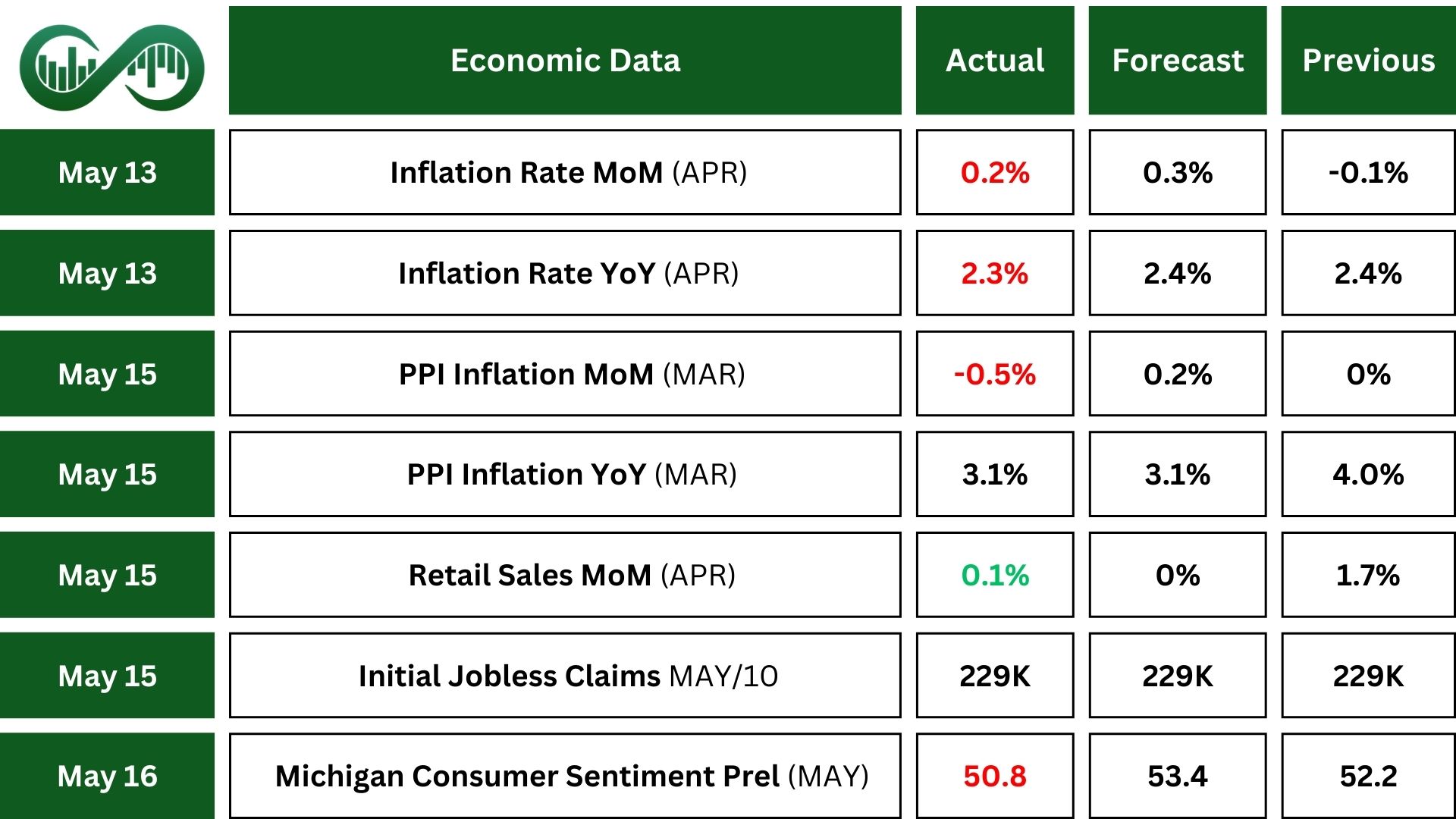

U.S. inflation fell to 2.3% in April, down from 2.8% in January. Inflation eased for food and transportation while energy costs dropped. The Consumer Price Index (CPI) rose 0.2%, driven mostly by higher shelter costs. Core inflation remained at 2.8%, as expected. This lower inflation eases cost pressures, and the Federal Reserve may reconsider its stance on rates if inflation remains under control.

U.S. jobless claims stayed at 229K after dropping from April’s report. Ongoing claims rose slightly to 1.88M but remained below expectations. The data signals a strong labor market, in line with chair Powell’s assessment.

U.S. retail sales edged up 0.1% in April, following a strong increase in March. The slight gain suggests consumers pulled back spending due to tariff concerns, though results still beat expectations.

U.S. Producer Price Index (PPI) fell 0.5% in April, the first drop since October 2023, after staying flat in March. Annual producer inflation still increased 2.4%. Also, the core PPI, which excludes food, energy, and trade services, dipped 0.1%, its first decline since April 2020. Over the past 12 months, core PPI rose 2.9%, showing moderate inflation pressures.

Fed Chair Jerome Powell said long-term interest rates have risen due to higher real rates, not inflation expectations. He stressed the importance of anchored inflation expectations, which have supported long economic expansions. Powell warned that unstable expectations could lead to job losses.

U.S. consumer sentiment fell sharply to 50.8 in May, its lowest since June 2022 and second lowest ever. This marks five straight months of decline, as inflation concerns and tariff worries weigh on consumers.

Inflation expectations for the next year jumped to 4.6%, the highest since 1981, while long-term inflation edged up to 7.3%.

Earnings Reports

Cisco

Cisco (CSCO) reported Q3 revenue of $14.1 billion, slightly missing expectations, while EPS of $0.96 beat forecasts.

Product growth remained strong, with Security up 54%, Observability up 24%, and Networking up 8%. Also, non- GAAP net income reached $3.8 billion.

AI-related orders exceeded $600 million, surpassing Cisco’s annual target early, helping CSCO shares rose over 6%.

Technically, CSCO is approaching its all-time high around the $66 level. If it manages to break this resistance, we could anticipate further upward movement. However, failure to surpass this level may lead to a corrective decline towards the $62 range or lower.

Walmart

Walmart (WMT) reported Q1 revenue of $165.6 billion, up 2.5%, but slightly below estimates. While online sales grew 22%, achieving profitability in e-commerce for the first time. Advertising revenue jumped 50%, fueled by Walmart Connect and VIZIO.

Membership income rose 14.8%, lifting total membership revenue 3.7%, while operating income increased 4.3% thanks to improved margins. Earnings per share (EPS) hit $0.61, beating forecasts.

Also, the company also raised $4 billion in debt at favorable rates for corporate needs but warned that tariffs and rising costs could impact future profit margins.

Technically, WMT is currently facing resistance around the $100 level. A breakout above this barrier could pave the way for a retest of its all-time high. Conversely, if the resistance holds and the price remains below it, a pullback toward the $90 range could be expected.

Deere & Co

Deere & Company (DE) reported Q2 2025 net income of $1.804 billion ($6.64 per share), beating estimates.

However, sales and revenue fell 16% to $12.763 billion, from $15.24 billion last year.

Despite challenges, the company showed strong resilience, with employees and dealers continuing to support customers. Deere adjusted its full-year net income outlook due to shifting economic conditions.

Technically, DE has successfully broken above its all-time high, signaling potential growth. Meanwhile, the $513 zone is expected to act as a key support level.

Applied Material

Applied Materials (AMAT) reported strong Q2 earnings, driven by high demand for semiconductor equipment. Profit rose to $2.14 billion and adjusted earnings per share of $2.39 beat estimates.

Revenue grew 7% to $7.1 billion, slightly missing the forecast of $7.13 billion. Semiconductor systems generated $5.26 billion, global services brought in $1.57 billion, and display sales surged 45% to $259 million.

For Q3, the company expects earnings per share between $2.15–$2.55 (Below estimates of$2.31) and revenue between $6.7–$7.7 billion, aligning with the $7.22 billion estimate.

Technically, AMAT has reacted to the descending trendline. If the price remains below 100-day MA, there is a possibility of consolidation or further correction. However, a breakout above the trendline could open the door for an upward move toward $200.

Indices

Indices’ Weekly Performance:

The S&P 500 climbed last week, returning to positive territory for the year. It’s now up 7% for the month and 1.3% for 2025.

Markets rallied after the U.S. and China struck a 90-day tariff truce, following a similar deal with the UK. Stocks held onto gains as Trump announced plans for new tariffs on other countries and corporate deals boosted the tech sector during his Middle East tour.

Last week, the S&P 500 gained 5.3%, the Dow rose 3.4%, and the Nasdaq surged 7%. Tech stocks rallied, with Nvidia jumping 16%, Meta up 8%, Apple rising 6%, and Microsoft gaining 3%.

Technically, SPX is moving strongly toward its all-time high. The index’s reaction to this resistance level is crucial. if it successfully breaks above, further gains could be expected. However, failure to overcome this barrier may result in a downward correction.

Stocks

Sector’s Weekly Performance:

All sectors saw gains, with Technology and Consumer Discretionary leading the way.

- Tech surged 7.8%, driven by chipmakers benefiting from a U.S.-China tariff cut and AI deals in Saudi Arabia. Super Micro (SMCI) jumped 44% last week, while AMD (AMD) announced a $6B stock buyback. Semiconductor stocks rallied, pushing the SOX index up 10%.

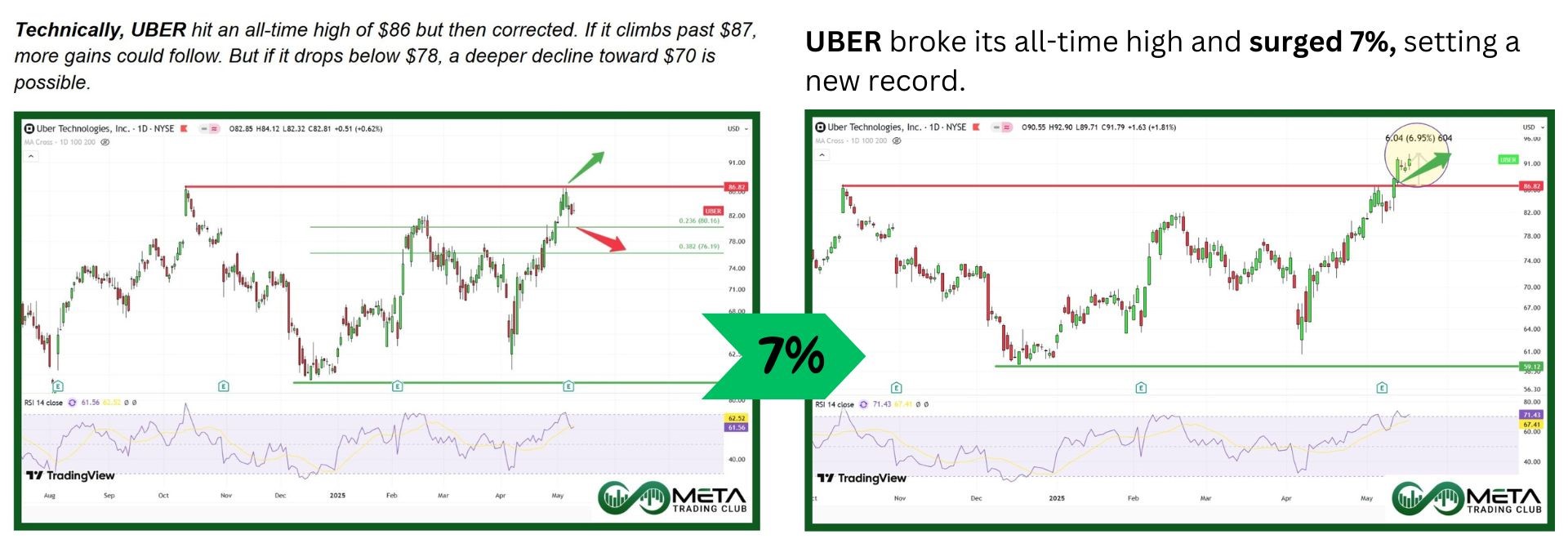

- Communication Services climbed 6%, as Charter acquired Cox Communications for $21.9B, expanding its broadband reach.

- Industrials rose 5.3%, with Deere (DE) hitting a record high after strong Q2 results and strategic cost-saving moves.

- Utilities gained 2%, as NRG Energy surged 33% following its $12B acquisition of LS Power assets.

- Consumer Staples edged up 1.5%, with Walmart (WMT) dipping after warning of price hikes, though analysts see it as a strong tariff hedge.

- Healthcare up 0.85%, but UnitedHealth (UNH) plunged 23% after leadership changes and a criminal probe into Medicare fraud.

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- Super Micro Computer (SMCI): Soared 44% after the company secured major deals with Saudi Arabia for AI server deployment, boosting investor confidence.

- Dell Technologies (DELL): Jumped 19% after strong earnings and rising optimism about AI adoption.

- Arm Holdings (ARM): Climbed 17% as investors bet on growing demand for its semiconductor designs in AI and mobile computing, backed by potential expansion deals with major tech firms.

- Tesla (TSLA): Gained 17% following bullish comments from Elon Musk on production expansion.

- NVIDIA (NVDA): Surged 16% after striking a $10 billion AI chip deal with Saudi Arabia’s Humain startup.

- Carnival Corporation (CCL): Rose 15% as positive booking trends and strong revenue forecasts signaled growing consumer demand for leisure and travel post-pandemic.

- Vistra Corp. (VST): Advanced 15% after announcing expansion projects and securing contracts for renewable energy development.

- Lululemon Athletica (LULU): Increased 14% on solid earnings and strong demand in athleisure.

- Micron Technology (MU): Gained 14% on rising demand for memory chips and improved revenue forecasts, driven by AI-powered data processing needs.

- Advanced Micro Devices (AMD): Jumped 13% as investors welcomed its $6 billion stock buyback plan and continued advancements in AI processing chips.

Commodity

Weekly Performance of Commodities:

Gold (XAUUSD) has dropped 10% from its record $3,500 high, hitting a five-week low last week as optimism grows around the trade agreements. Investors are shifting funds into risk assets like tech and AI stocks, fueling a market rally.

The Trump administration announced a 90-day tariff truce, reducing levies on U.S. imports to 10% and on Chinese imports to 30%. More trade deals with India, Japan, and South Korea are also in the works.

Technically, XAUUSD is currently holding its upward trendline. However, since the bullish momentum has weakened, further upside beyond $3,300 is not expected despite maintaining the up-trendline. On the other hand, if the trendline is broken and a bearish structure forms, a decline toward the $2,900 zone could be anticipated.

WTI Crude oil remained steady, aiming for a second straight weekly gain as easing trade tensions supported prices earlier last week.

U.S.-Iran nuclear talks caused market fluctuations, with President Trump alternating between pressure tactics and optimism for a deal, while the Treasury sanctioned more Iranian oil firms.

Global crude inventories rose, including a 3.5M-barrel build in the U.S. and OPEC maintained its 1.3M-barrel daily demand growth estimate, while the IEA increased its supply forecast, signaling a potential looser market balance ahead.

Forex

Weekly Performance of Major Foreign Exchange Pairs:

DXY: The dollar strengthened last week, driven by the U.S. China trade deal and a rebound in import prices despite weak consumer sentiment due to tariff concerns. It’s on track for a fourth straight weekly gain but is still down 3% since April 2, when Trump announced global tariffs.

USD/JPY: Against the Japanese yen, the dollar rose as Japan’s economy contracted for the first time in a year. The dollar is up 0.4% for the week vs. the yen. Also, Japan’s Finance Minister Katsunobu Kato plans to discuss currency volatility with the U.S. Treasury Secretary Scott Bessent next week.

Crypto

Crypto Market Weekly Performance:

Bitcoin has been stuck in a tight range above $103,000 for over a week, facing resistance near $107,000.

Technically, daily close above $107K could signal a breakout, while failure to clear it may lead to a drop toward $98,000. Despite reaching an all-time high of $108,786 in January, Bitcoin has yet to close above $107,000, making it a key level to watch for future movement.

Ethereum has surged 50% in two weeks, reclaiming the $2,700 mark and pushing its market cap above $320 billion. This resurgence comes as Bitcoin holds steady at $103,000–$104,000, despite posting a 40% gain over the past five weeks.

As the leading altcoin, Ethereum tends to absorb significant inflows when traders seek alternative assets with strong growth potential. Its recent surge signals renewed confidence in the crypto space.

Technically, ETH reacted to a key Fibonacci level around $2,700 last week. If it successfully breaks above this resistance and maintains its bullish formation, further upside potential could be expected. However, failure to do so may lead to a pullback toward lower levels.

Next Week’s Outlook

Economic Events

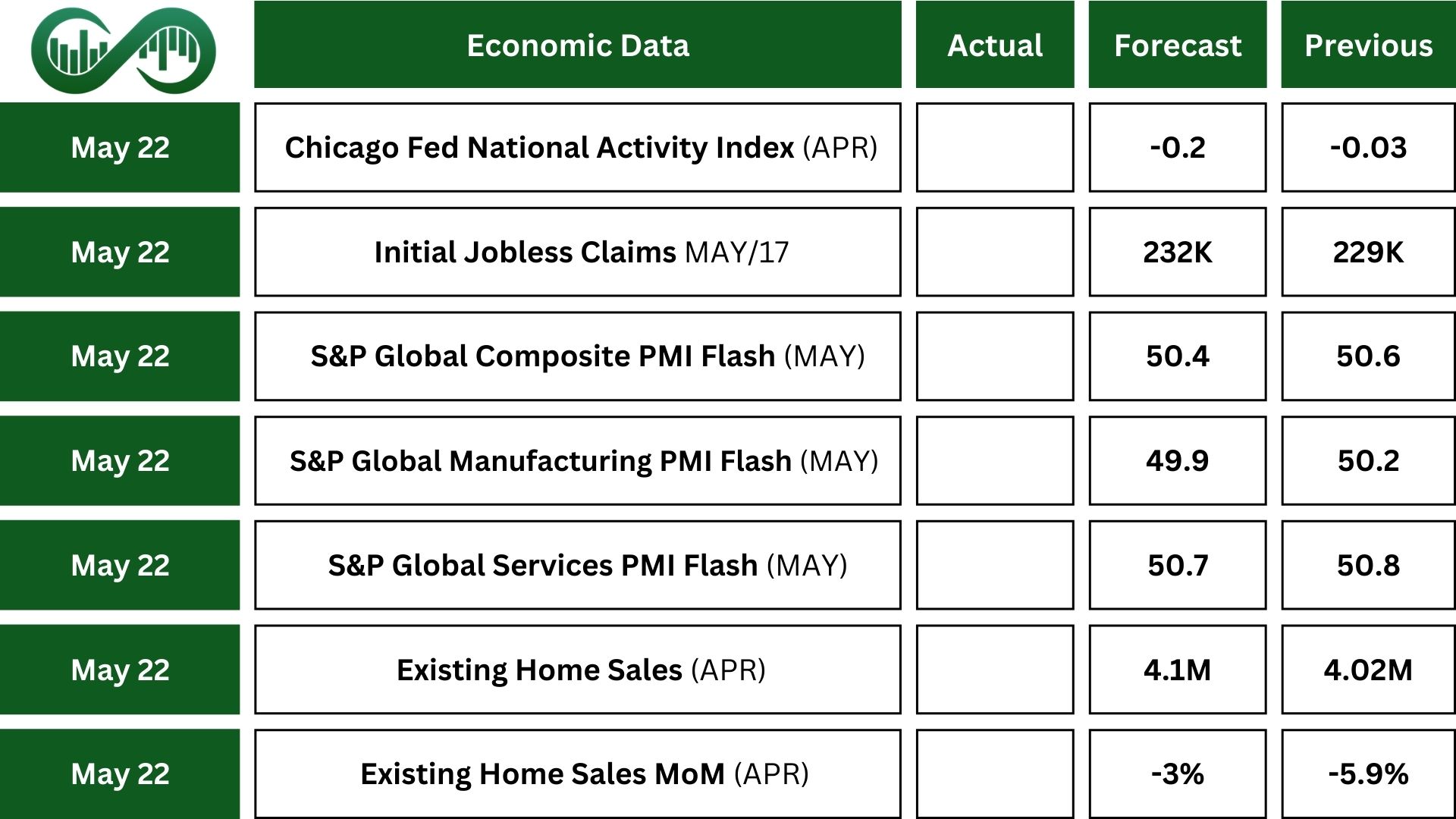

It’ll be a fairly quiet week in the U.S., with focus on tariffs and speeches from Federal Reserve officials.

Trade talks remain key after President Trump announced plans to send letters to certain trading partners about new tariff rates. He noted it’s “not possible” to meet with everyone wanting discussions. Traders will also pay attention to multiple Federal Reserve speeches for clues on the central bank’s policy direction for the rest of the year.

The economic calendar is light. Manufacturing growth is expected to stall, services may slow further, and new home sales likely dropped. Meanwhile, existing home sales are expected to stay steady.

Earnings Events

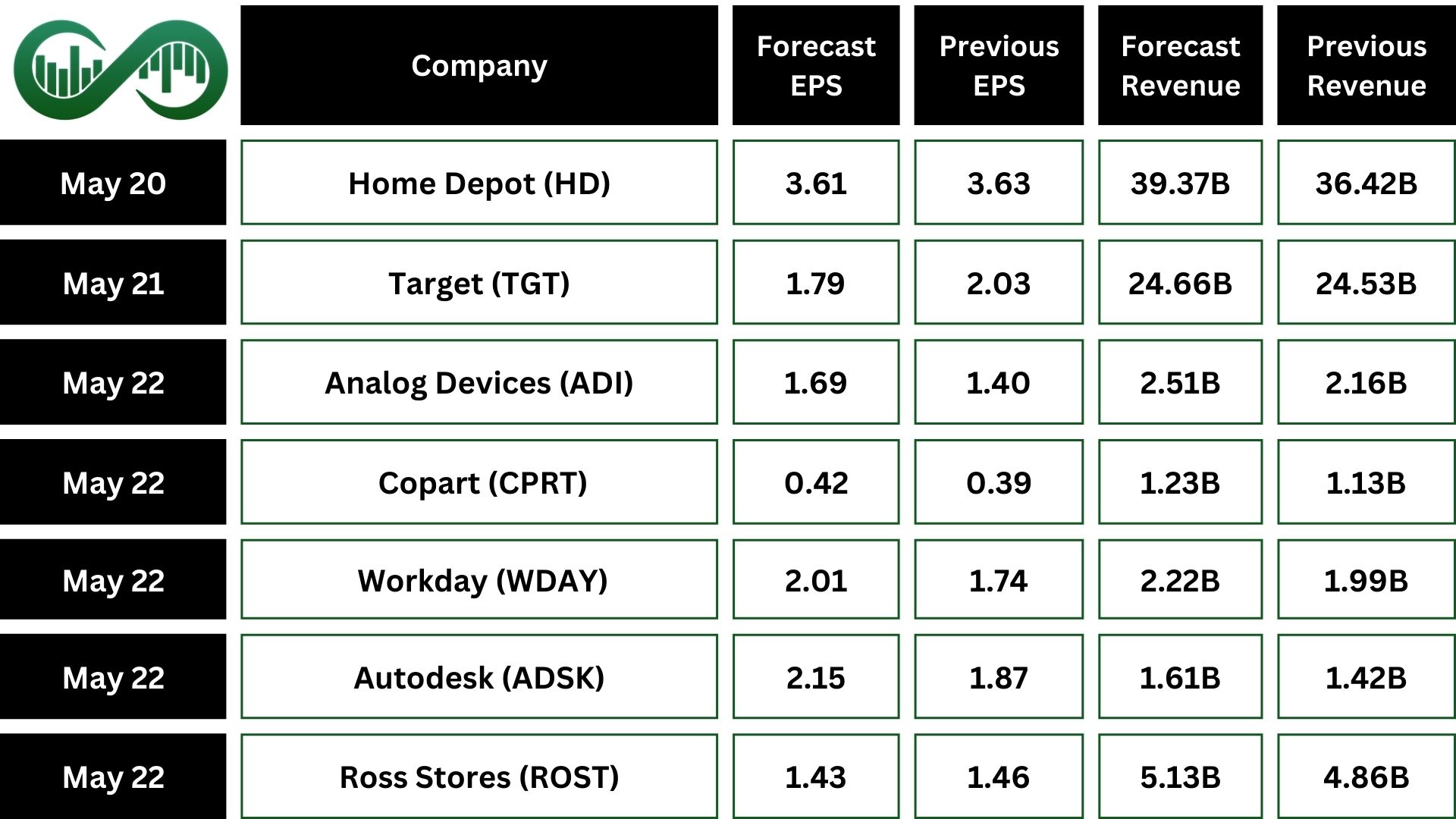

On the earnings side, major retail players like Home Depot (HD), TJX Companies (TJX), Lowe’s (LOW), Target (TGT) and Ross Stores (ROST) will release their earnings reports, alongside tech firms Palo Alto Networks (PANW), Intuit (INUT) and Analog devices (ADI).

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.