Last week’s market and economic data key points:

- U.S. GDP shrank in the first quarter, economy slowed

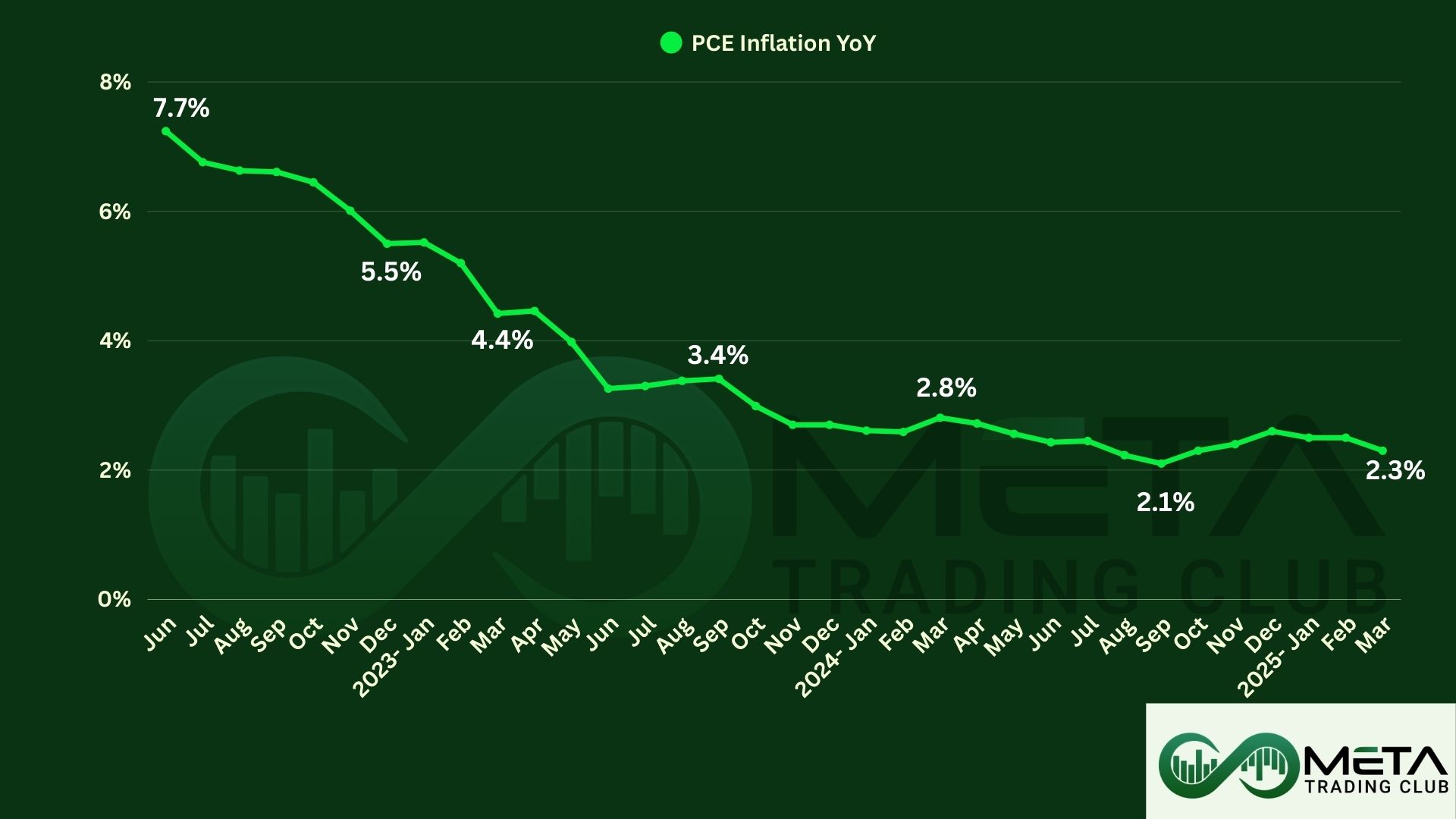

- PCE inflation slowed but everyday prices still feel high

- Manufacturing struggles as activity contracted

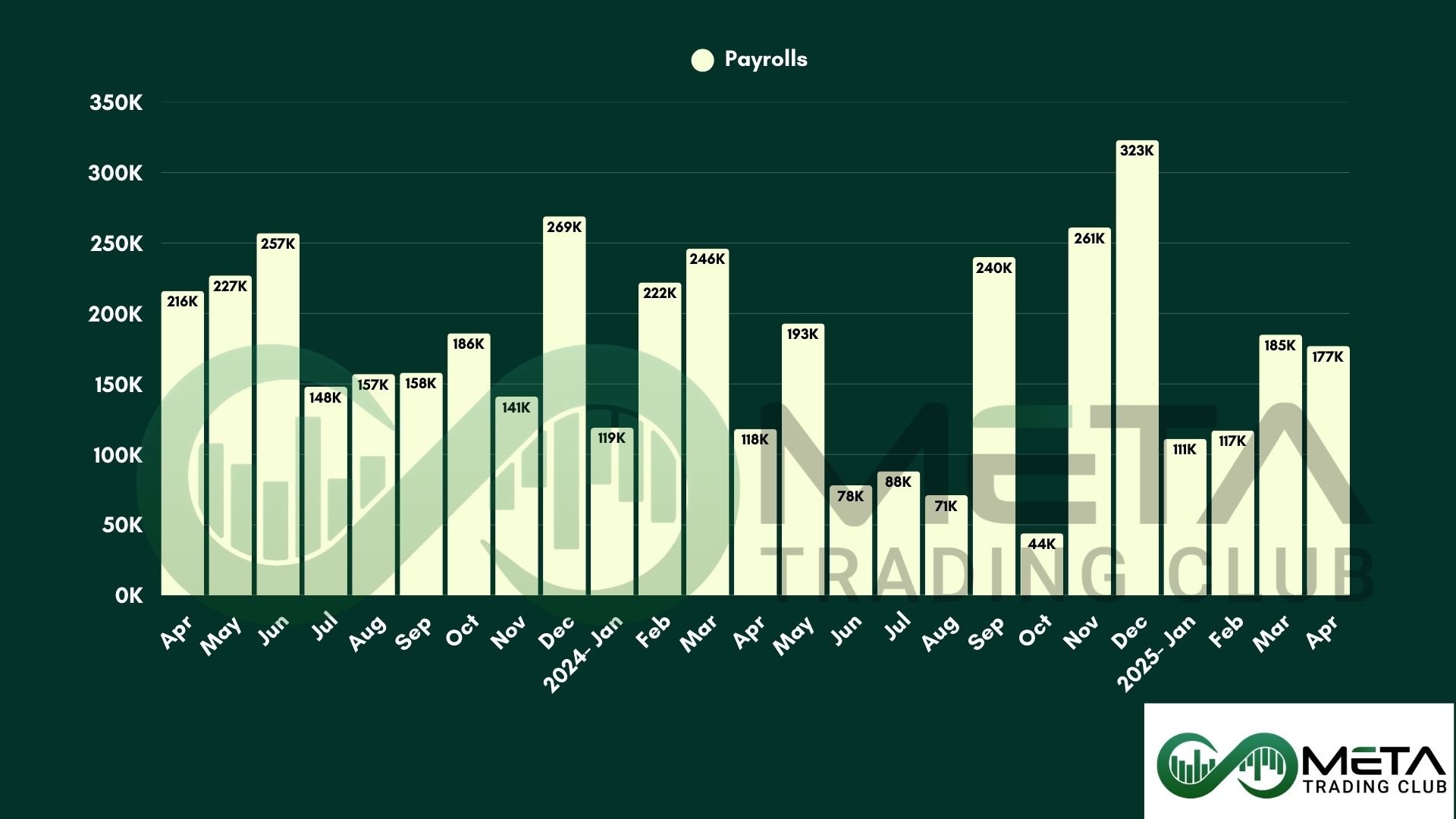

- U.S. job market adds 177k jobs in April

- Unemployment holds at 4.2%

- Strong AI bets lifted Meta and Microsoft

- Tariffs hit Apple and Amazon

- MSTR boosted bitcoin holdings, but losses widen

- Roblox sees strong growth as engagement surged

- Gold fell 2% as trump touts trade progress

- BoJ holds rates at 0.5%, citing Trump tariffs

- Supply surge weighs on oil despite trade optimism

- Bitcoin eyes retest of $95k, watch fed decision

Table of Contents

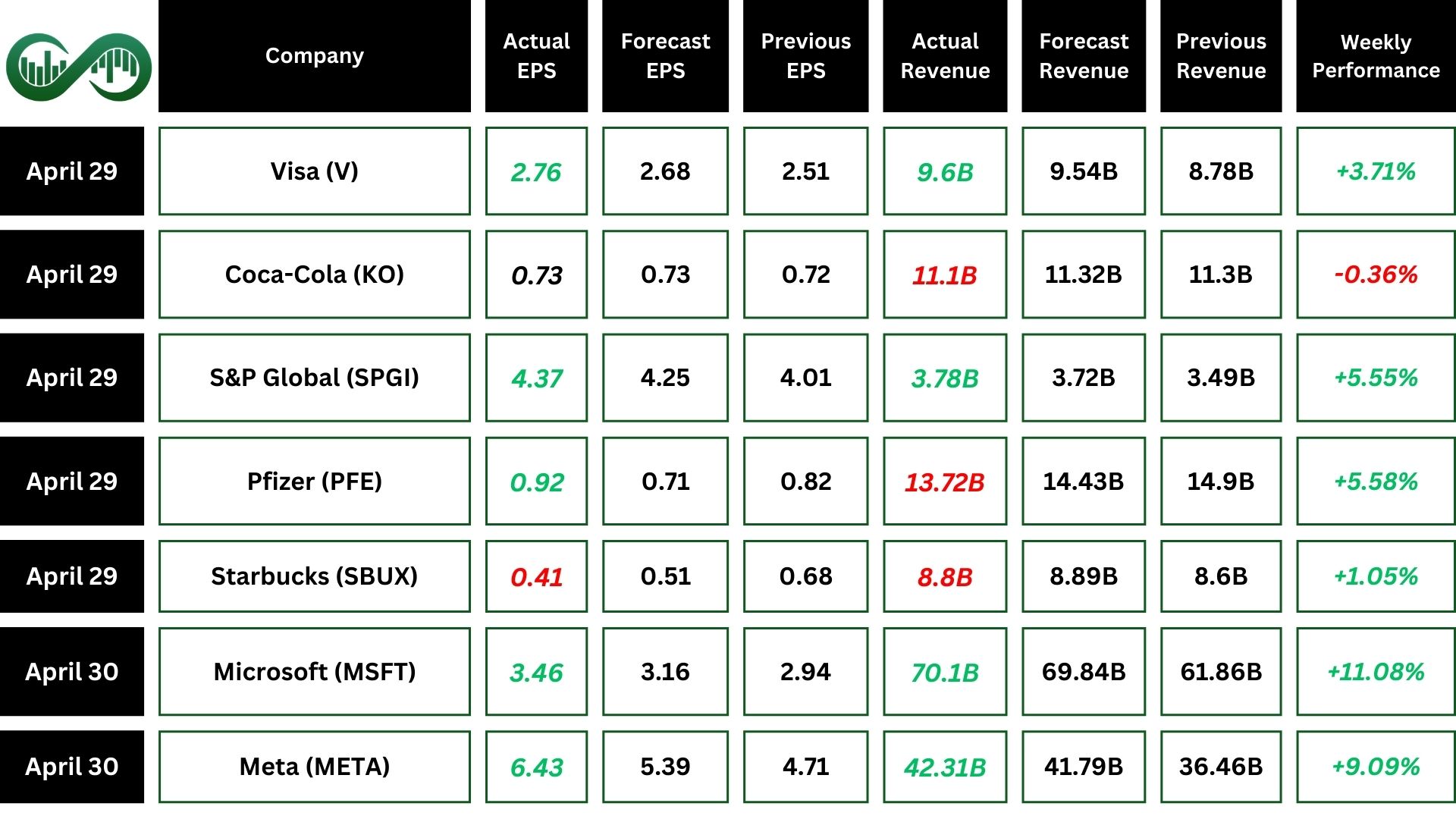

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

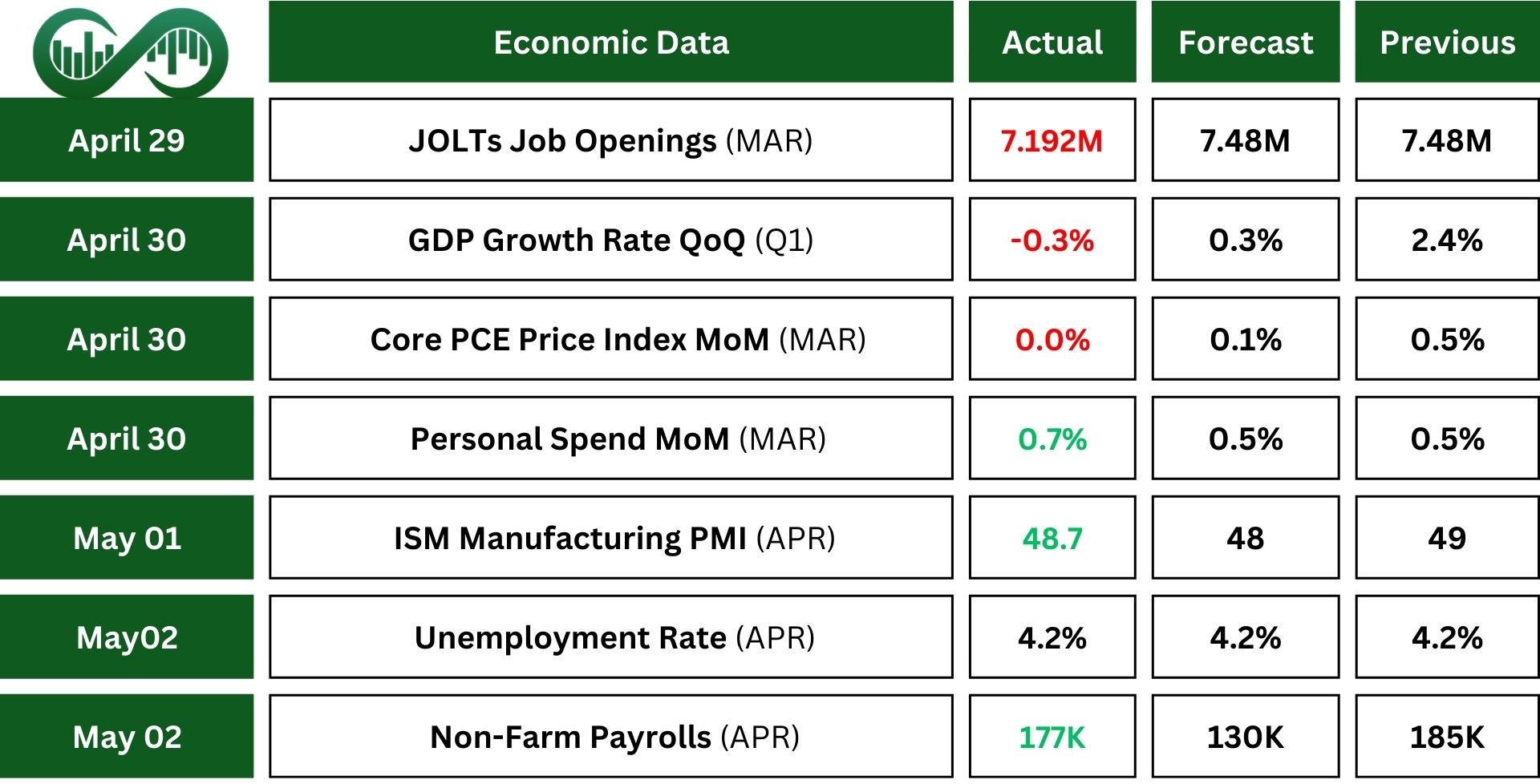

Job openings held steady at 7.2M, though they dropped compared to last year, with federal government openings down. Hiring and separations remained unchanged at 3.2%. The economy remains strong, but fewer openings could signal slower wage growth or economic momentum.

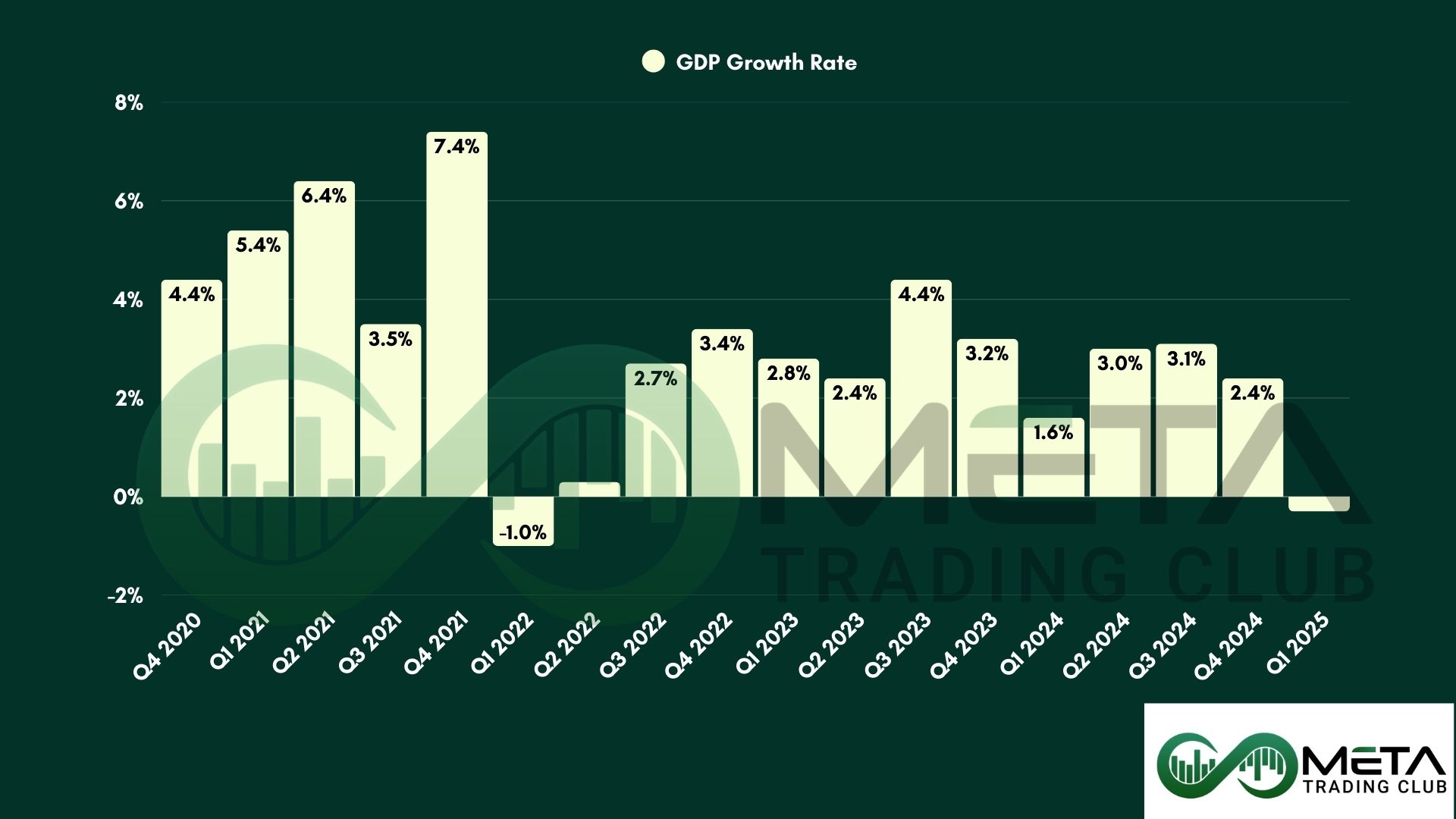

In Q1 2025, the U.S. economy shrank by 0.3%, reversing the 2.4% GDP Growth from the previous quarter. This decline happened due to higher imports and less government spending, though investment, consumer spending, and exports helped offset some of the drop. Businesses might have stocked up on goods ahead of rising costs, which could slow future demand.

In March, U.S. PCE Price Index remained unchanged from February, marking the smallest shift in ten months. While goods prices fell by 0.5%, services rose by 0.2%, and food costs increased by 0.5%. Energy prices dropped 2.7%, contributing to annual inflation easing to 2.3%, with core inflation at 2.6%. The PCE data reflected steady economic activity as personal income grew by 0.5%. Minimal month-to-month price changes indicate controlled inflation, supporting overall economic stability.

U.S. jobless claims rose by 18K to 241K for the week ending April 26, the highest since February and above forecasts of 224K. Ongoing claims climbed 83K to 1.91M, marking the highest level since November 2021. While federal government claims fell slightly, some workers face delays in receiving benefits due to severance packages.

The Manufacturing PMI fell to 48.7 in April, marking the second straight month of contraction after a brief two-month expansion. New orders, backlogs, production, and employment all declined, while supplier deliveries slowed and raw material inventories increased. Customer inventories remained low, prices rose, and both exports and imports contracted, highlighting ongoing challenges in the sector.

The U.S. job market saw moderate growth in April, with Non-Farm Payrolls increasing by 177,000, while the Unemployment Rate stayed at 4.2%.

Job gains in key industries balanced government employment declines and stable wage growth at 0.2%. The steady labor market signals economic stability, which could boost investor confidence, though slower wage growth may affect consumer spending.

Earnings Reports

Meta

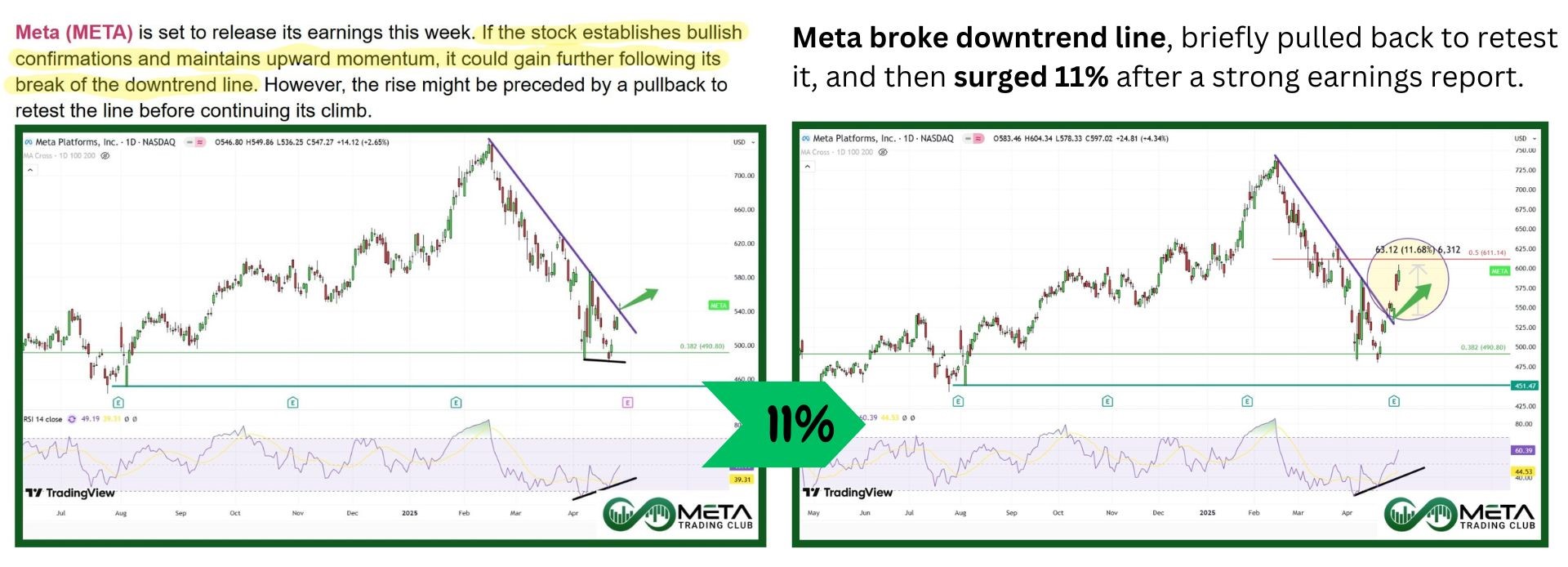

Meta (META) had a strong Q1 2025, with revenue up 16% to $42.31 billion and profit exceeding expectations at $6.43 per share.

User growth continued, reaching 3.43 billion daily active users. Ad revenue improved as impressions grew 5%, and ad prices rose 10%. Also, the company paid $1.33 billion in dividends.

Meta forecasts $44 billion in revenue for Q2, aligning with expectations. Following the earnings report, its stock jumped 10%, reflecting strong investor confidence fueled by AI investments and solid growth.

Technically, META broke its downtrend and surpassed a key resistance level, signaling possible upward movement. However, if it fails to reclaim 640, the stock may enter a sideways consolidation phase.

Microsoft

Microsoft (MSFT) had a strong Q3 2025, with revenue rising 13% to $70 billion and net income up 18% to $25.8 billion.

Also, cloud services drove growth, with Azure revenue surging 33%. While Microsoft 365, LinkedIn, and Dynamics boosted business segment revenue by 10%. Also, personal computing revenue grew 6%.

The company returned $9.7 billion to investors through dividends and stock buybacks. Following the earnings report, Microsoft shares jumped 11%, as cloud and AI expansion fueled strong market optimism.

Technically, MSFT has moved out of its bearish phase and is now overbought on the daily timeframe. It could be corrected slightly or consolidated to ease this condition.

Amazon

Amazon (AMZN) posted Q1 2025 results, with net sales rising 9% to $155.7B and AWS revenue up 17% to $29.3B.

Also, operating income increased to $18.4B, and net income surged to $17.1B ($1.59 per share), beating estimates.

However, Q2 2025 guidance fell short, with projected operating income of $13B–$17.5B, disappointing investors.

Amazon’s stock dipped as concerns over economic uncertainty and consumer spending weighed on sentiment. Despite near-term challenges, cloud and AI growth remain key drivers for its long-term prospects.

Technically, AMZN broke its downtrend, and if it holds above $192, further gains toward $210 or higher could follow. However, if it stays below $192, the stock may enter a sideways consolidation phase between $162 and $192.

Apple

Apple (AAPL) Q2 2025 results showed adjusted EPS of $1.65, slightly below expectations, and revenue of $95.4B, missing forecasts.

China revenue fell short, while Mac and iPad sales exceeded estimates, but services and wearables lagged.

Apple’s stock dropped 23% amid trade war concerns, losing $773B in value, but rebounded as Trump temporarily exempted iPhones from tariffs.

Following its earnings report, Apple’s stock fell 3%, with investors wary of tariff risks, economic uncertainty, and supply chain challenges.

Technically, AAPL broke its downtrend and pulled back for a retest. If it rises above $215 and holds, further gains toward $225 or higher could follow. Otherwise, the stock may enter a sideways consolidation phase or experience a price correction.

MicroStrategy

MicroStrategy (MSTR) Q1 2025 results showed Bitcoin holdings growing by 61,497 BTC, now valued at $5.8 billion. The company announced a $21 billion stock offering. Also, subscription revenue surged 61.6%.

However, total revenue dropped 3.6% to $111.1M, missing expectations. Operating losses hit $5.921B, and net losses were far worse than last year.

Despite financial setbacks, MSTR stock rose as investors remained optimistic about its Bitcoin accumulation strategy and ongoing crypto enthusiasm.

Technically, MSTR stock has hit a crucial level at $404. If it breaks above and holds, further gains toward $440 could follow. Otherwise, the stock might enter a correction phase.

Roblox

Roblox (RBLX) had a strong Q1 2025, with bookings up 31% to $1.21 billion and revenue rising 29% to $1.04 billion, showing steady expansion.

Despite a net loss of $0.32 per share, results were better than expected. User engagement remained high, with daily active users up 26%, and total engagement hours increasing 30%.

Strong earnings and user growth helped Roblox’s stock climb 11%.

Technically, RBLX stock is approaching $76, its highest level ever. If it breaks above, further growth could follow. However, failing to surpass this resistance may lead to a correction toward $66.

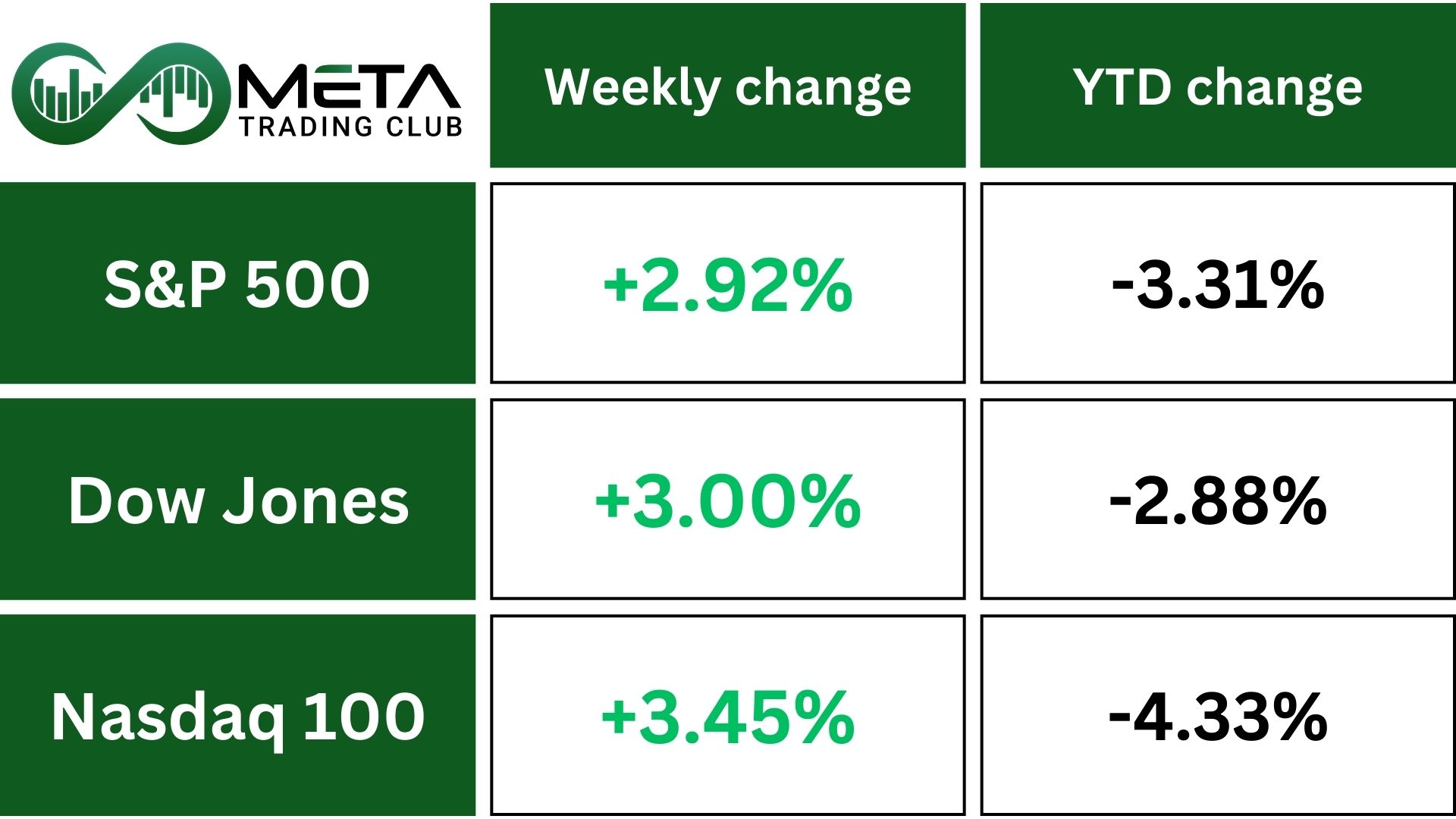

Indices

Indices’ Weekly Performance:

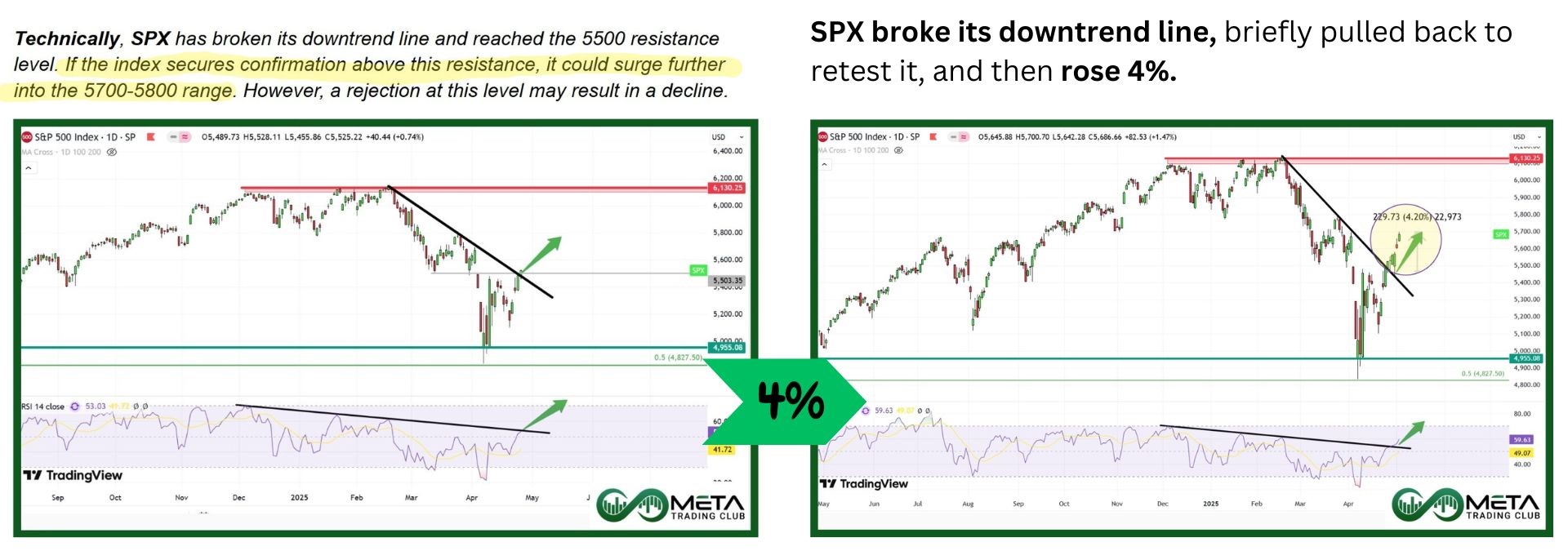

Wall Street gained for a second straight week, supported by strong economic data and trade optimism between the U.S. and China. The U.S. jobs added in April, surpassing expectations and unemployment remained at 4.2%. These helped ease slowdown fears, following a report showing the first GDP contraction in three years, driven by tariff-related import surges.

The S&P 500 recorded nine straight gains, matching a 2004 streak, while the Dow hit a nine-day run, its longest since December 2023. For the week, the S&P 500 rose 2.9%, the Dow climbed 3%, and the Nasdaq gained 3.43%, reflecting strong market momentum.

Tech earnings shake up markets, Meta and Microsoft surged on strong earnings, Meanwhile, Amazon and Apple fell, as tariff concerns weighed on their outlooks. Markets responded sharply to earnings and policy uncertainties.

Technically, SPX has broken its downtrend and now sits at a critical resistance zone. If it surpasses this level, the next important target to watch is around 5800.

Stocks

Sector’s Weekly Performance:

Most sectors saw gains, with Industrials, Communication Services, and Technology leading.

- Tech up 4.3%: Microsoft (MSFT) surged on a strong Azure growth outlook, while Super Micro (SMCI) fell after cutting its forecast, pulling down Nvidia (NVDA) and AMD (AMD). Semiconductors rallied 3.4%.

- Industrials up 4.2%: Carrier (CARR) jumped 19% weekly after beating profit expectations and raising its forecast.

- Communication Services up 4%: Meta (META) rose as strong Q1 results eased tariff concerns, supported by AI-powered ad growth.

- Consumer Discretionary up 2%: Amazon (AMZN) dipped after disappointing Q1 cloud revenue and income projections.

- Healthcare edged up 1.4%: Eli Lilly (LLY) fell after CVS (CVS) dropped its obesity drug from reimbursement.

- Energy retreated 0.4%: Oil prices slid amid global trade war concerns, affecting Chevron (CVX) and Exxon Mobil (XOM).

Despite strong gains in tech and industrials, tariff fears, earnings misses, and oil declines weighed on parts of the market.

Top Performers

Last week saw impressive gains across several major stocks, with technology, cloud computing, and AI investments leading the surge.

- Arista Networks (ANET): Jumped 17% on a strong earnings report that beat expectations, driven by higher demand for cloud networking amid AI growth.

- Applovin (APP): Climbed 11% as mobile app monetization and digital advertising gained momentum..

- Microsoft (MSFT): Rose 11% following Azure’s 33% revenue surge and strong cloud expansion, fueling investor optimism.

- Palantir (PLTR): Gained 10% after securing major government contracts, reinforcing demand for data analytics and AI solutions.

- Meta Platforms (META): Added 9% as earnings exceeded expectations, with ad revenue growth supported by AI-driven advertising.

- Oracle (ORCL): Up 9% due to cloud infrastructure growth, strengthening its position in enterprise software.

- Arm Holdings (ARM): Increased 9%, benefiting from positive sentiment.

- Sherwin-Williams (SHW): Grew 8%, supported by higher sales positive earnings.

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Gold (XAUUSD) dropped above 2% last week, hitting its lowest level since mid-April as traders took profits and momentum faded.

The decline came amid cooling geopolitical tensions and a stronger dollar. President Trump’s trade talks with India, South Korea, and Japan and minerals deal with Ukraine shifted market sentiment toward cautious optimism.

Technically, gold pulled back from its all-time high, now hovering around $3,150. If it holds above this level, another upward moves toward $3,300 could follow. However, falling below $3,150 may signal a deeper correction.

Crude oil fell around 7% as OPEC+ increased supply, unwinding 2.2M barrels per day in production cuts.

Oil prices have fallen 18% this month amid new U.S. tariffs, including a 145% tariff on Chinese imports. While China is reviewing U.S. trade talks, it insists that tariffs must be removed first, adding uncertainty to global markets.

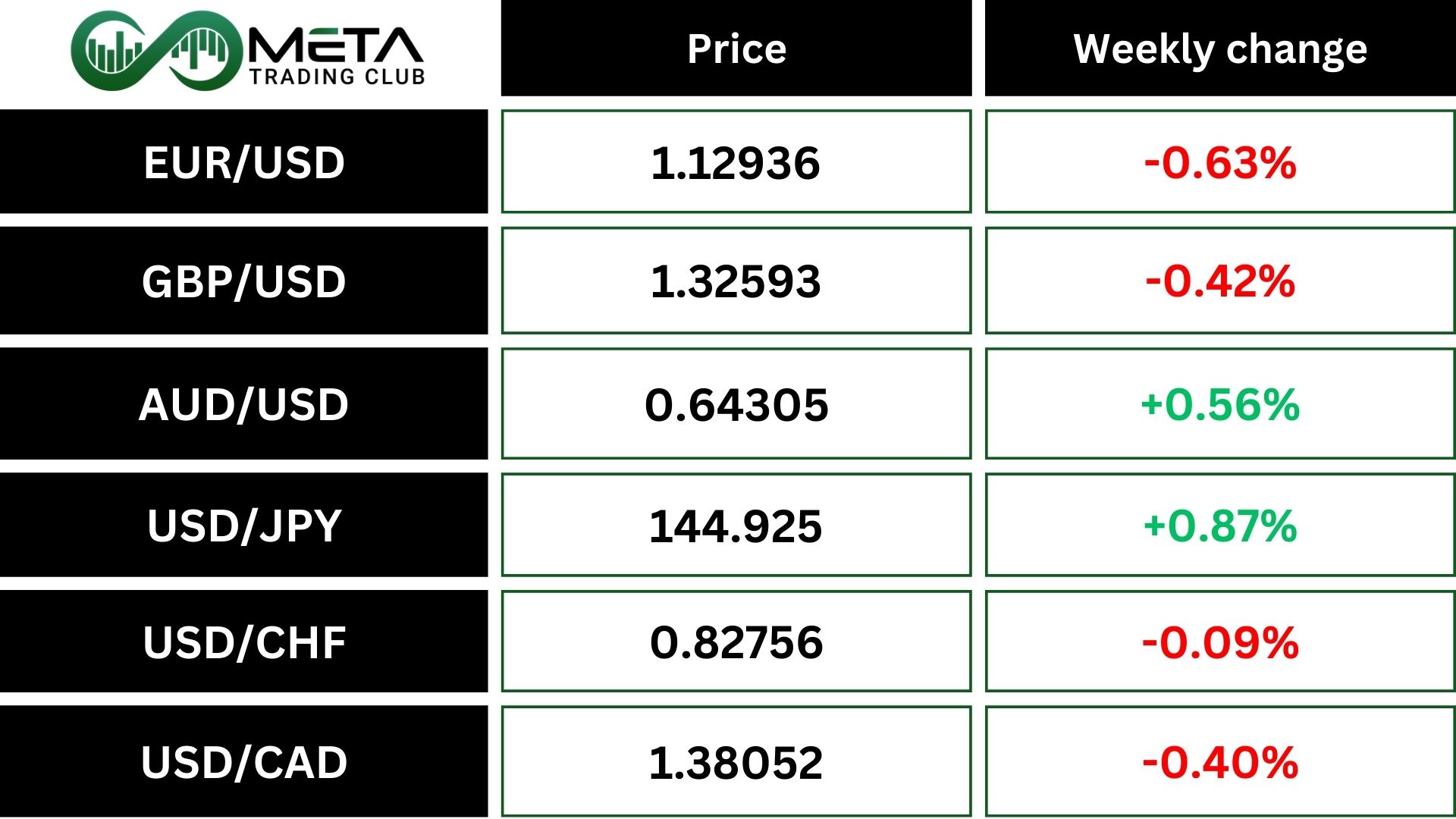

Forex

Weekly Performance of Major Foreign Exchange Pairs:

DXY: The dollar was rising because of optimism about trade deals with China and other countries. Dollar gained against the euro and yen after the U.S. added 177,000 new jobs, showing the economy is still strong. This means the Federal Reserve will likely keep interest rates the same for now.

EUR/USD: The inflation in the Eurozone stayed high, instead of slowing down as expected. Prices are still rising at 2.2%, and core inflation rose to 2.7%. This could make the European Central Bank rethink lowering interest rates.

USD/CAD: The Canadian dollar was trading at its highest level since October. It’s benefiting from less recession worry in Canada and a weaker U.S. dollar, alongside gains in other G10 currencies.

GBP/USD: The U.K. local elections might be affecting the British pound. If Labour wins big, it could make the pound stronger because it signals stability. But before results are clear, investors might be cautious, causing short-term ups and downs in the pound’s value.

Crypto

Crypto Market Weekly Performance:

Bitcoin dropped ahead of the Fed interest rate decision. The crypto fell to $95K as traders prepared for high volatility before the Federal Reserve’s rate announcement.

Bitcoin fell below $96K after failing to break $98K. It had been rising from $90K, staying between $93K–$95K for a week before jumping to $97.5K on Thursday. However, sellers pushed it down, despite positive market signals hinting at another rally.

Now, BTC struggles below $96K, with a market cap of $1.9 trillion and 61.7% dominance over altcoins.

Technically, BTC broke its downtrend, gaining upward momentum and reaching $96,000. With RSI slightly overbought, the price may consolidate before continuing higher. However, if Bitcoin drops below $90,000, further upside weakens, and a lower consolidation phase could follow.

Next Week’s Outlook

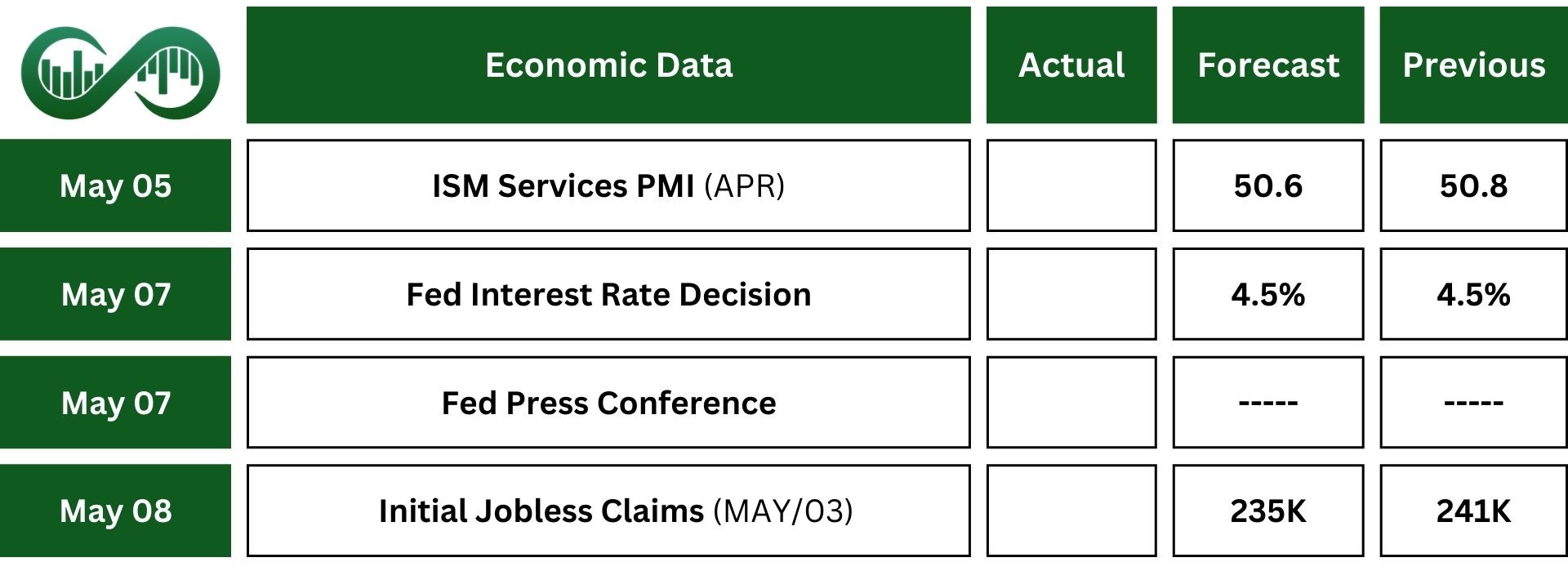

Economic Events

U.S.-China tariff talks in focus, as China reviews U.S. proposals while Trump signals a tariff cut.

The Federal Reserve meets Tuesday and Wednesday, expected to keep interest rates unchanged amid economic slowdown concerns.

ISM PMI survey may show modest services sector growth, slowing from March.

Final trade data expected to confirm a growing trade deficit, with record-high March imports driven by businesses stockpiling goods ahead of tariffs.

Earnings Events

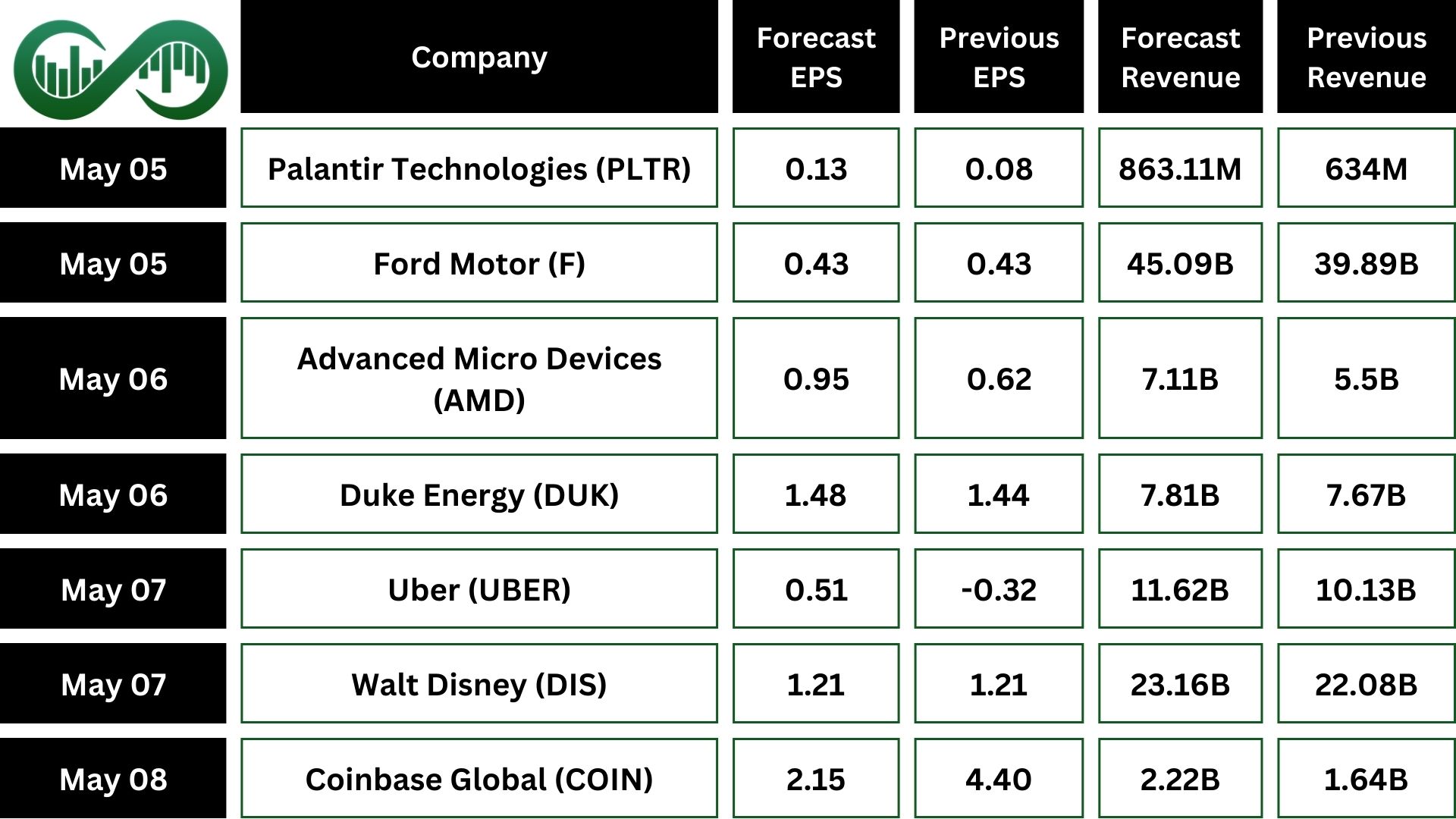

This week, several major companies, including Ford (F), Uber (UBER), Walt Disney (DIS), Palantir (PLTR), Advanced Micro Devices (AMD), Novo Nordisk, Shopify, and Pinterest, will report their earnings, keeping the busy earnings season going.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.