Last week’s market and economic data key points:

- U.S. May PPI rose 0.1%, softer than expectations

- CPI inflation rose but stays below expectations

- June Consumer Sentiment jumps 16%, beats forecasts

- S&P 500 drops for the week amid middle east tensions

- Oracle stock logs best weekly run in 24 years on strong earnings

- Tesla set to gain from musk-trump reconciliation ahead of robotaxi launch

- Oil jumps as Israel Iran conflict escalates

- Gold hits record high as war drives safe-haven demand

- Swiss franc nears 2011 highs as investors seek safety

- Bitcoin volatile as risk-off sentiment grips markets amid war jitters

Table of Contents

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

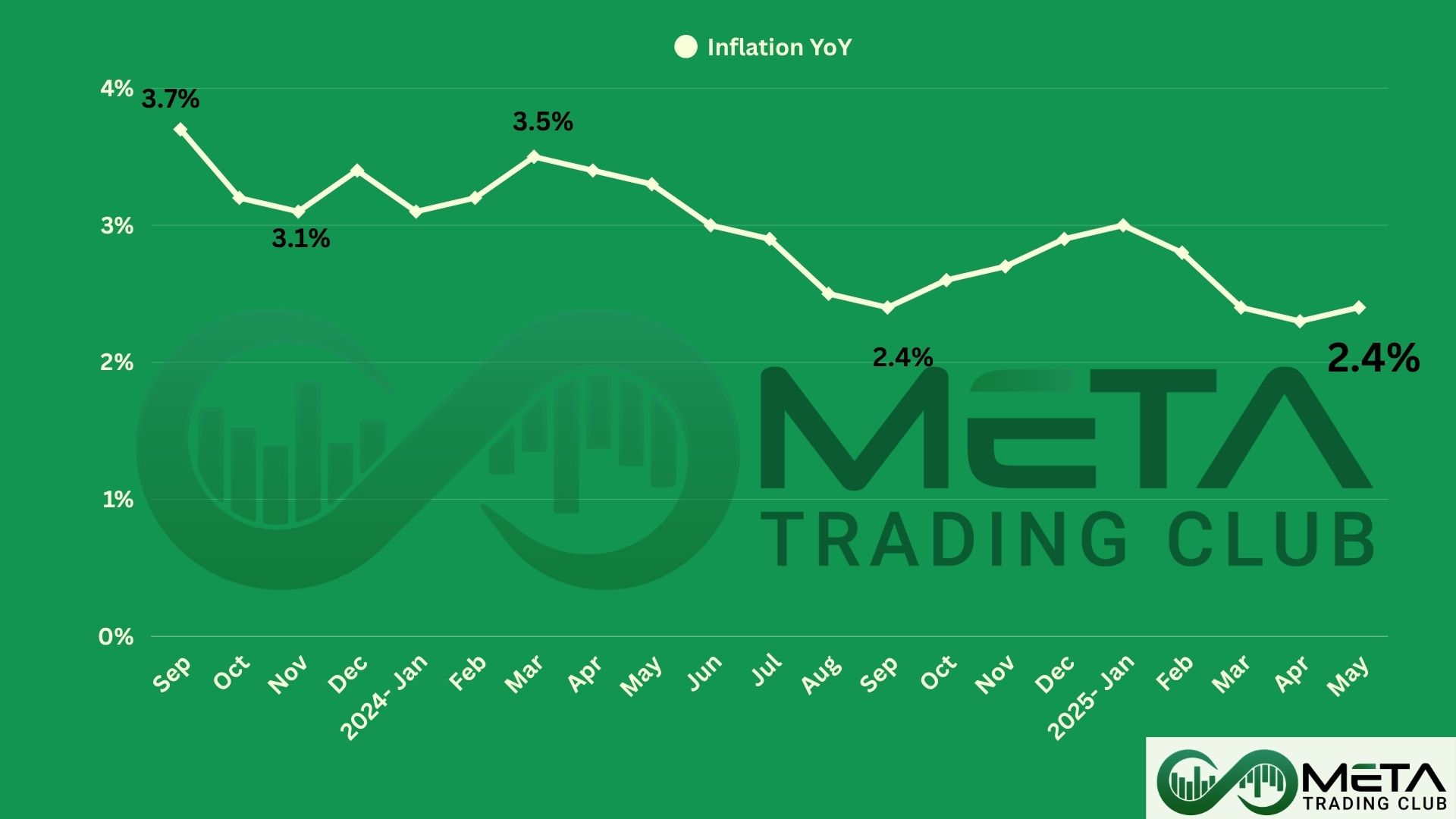

U.S. Inflation in May rose 2.4% year-over-year, slightly below expectations, showing slower price growth than predicted. Monthly inflation increased by 0.1%, mainly due to higher housing costs. Core inflation (excluding food and energy) also went up by 0.1%, while annual Core CPI climbed 2.8%. Energy costs dropped by 3.5%, helping balance overall inflation. The low inflation report has raised hopes for interest rate cuts, as investors look forward to possible Federal Reserve action.

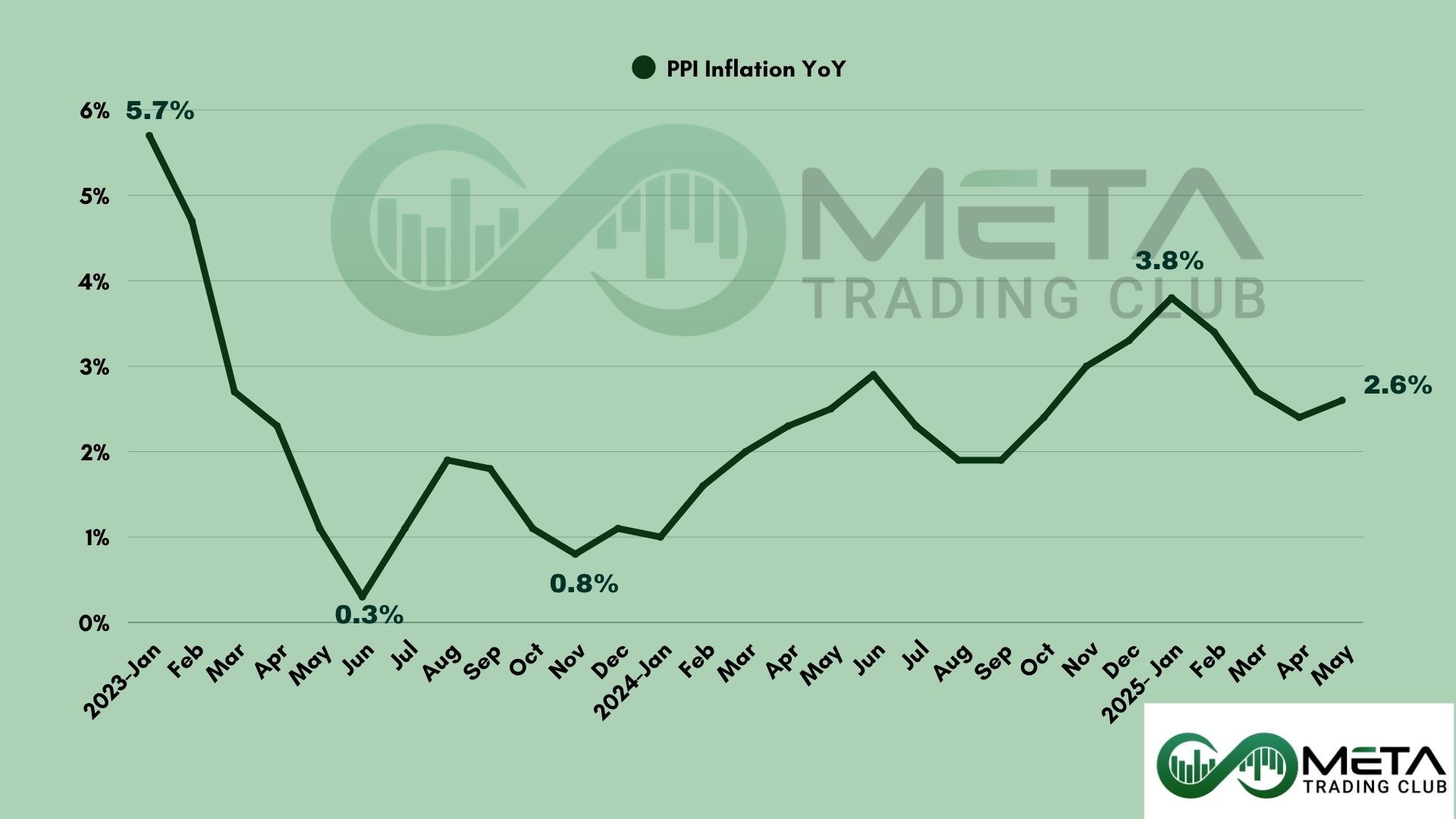

The May Producer Price Index (PPI) rose 0.1%, marking a modest increase after previous declines. Producer prices grew 2.6% year-over-year, signaling steady inflation in the production sector. The rise was mainly driven by higher service costs and non-energy goods. Overall, inflation remains moderate, reducing concerns about sharp price increases.

U.S. initial jobless claims remained at 248K in early June, defying expectations for a decline. The four-week moving average rose, its highest since August 2023, while continuing claims surged to 1.96 million, the highest since November 2021. These figures suggest early signs of the labor market weakening amid ongoing economic uncertainty.

In June, Michigan Consumer Sentiment rose for the first time in six months, increasing 16% to 60.5, surpassing market expectations. While optimism about business conditions improved, concerns about personal finances, jobs, and big purchases remain.

Inflation expectations also declined, with year-ahead projections dropping to 5.1% and long-term expectations falling to 4.1%. A rise in sentiment can boost optimism and drive stock purchases. Also, lower inflation expectations in the report may ease fears of future inflation pressures.

However, rising uncertainty from escalating Israel-Iran tensions is overshadowing the impact of cooler inflation data and stronger-than-expected consumer confidence.

Earnings Reports

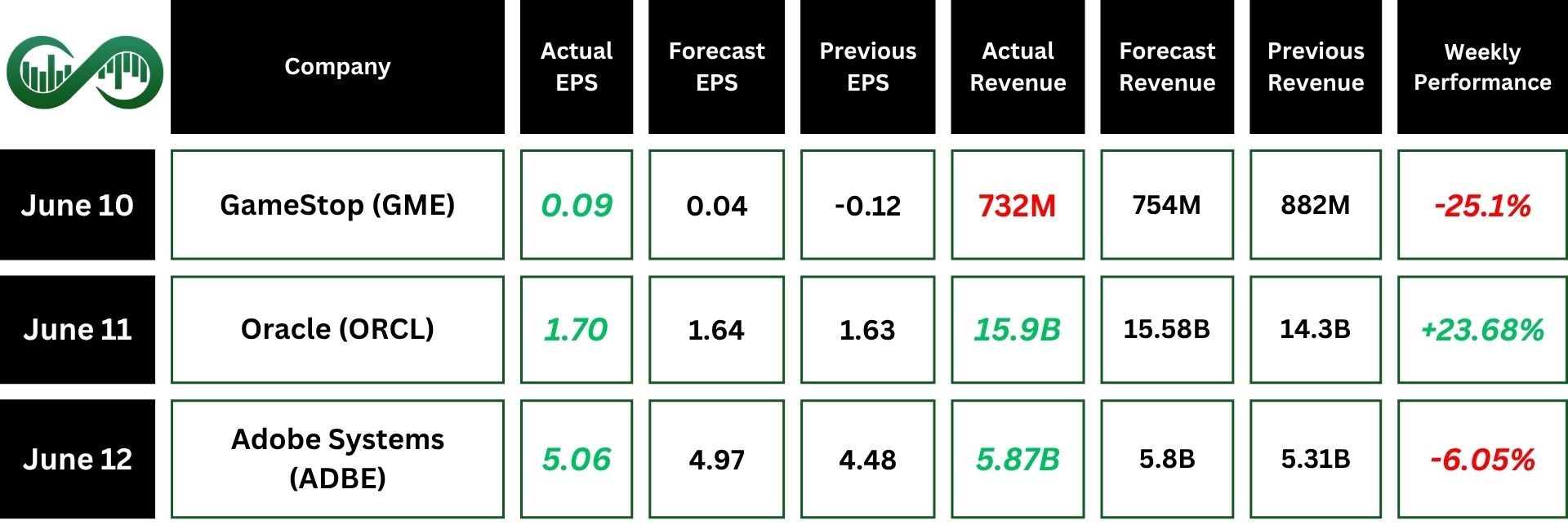

GameStop

GameStop (GME) posted $27.5 million in profit, bouncing back from a $55 million loss last year. Sales dropped to $732.4 million, reflecting challenges as gaming moves digital.

Hardware and software sales declined, while collectibles saw growth. GameStop closed its Canadian operations on May 4 and bought 4,710 Bitcoins in recent weeks, though there’s little sign it’s shifting toward crypto.

GameStop’s stock fell over 25% after its earnings report.

Oracle

Oracle (ORCL) reported impressive Q4 and fiscal 2025 results, driven by cloud growth and rising revenues. Total revenue increased 11% to $15.9 billion, while cloud revenue surged 27% to $6.7 billion. Cloud Infrastructure saw a 52% jump to $3 billion.

Earnings also beat expectations, with GAAP EPS at $1.19 and non-GAAP EPS at $1.70. Remaining Performance Obligations (RPO) expanded 41% to $138 billion, reflecting strong future demand.

Oracle’s cloud expansion, especially in IaaS and ERP solutions, continues to boost market confidence. Following the earnings report, ORCL stock soared 23%, signaling investor optimism about its cloud strategy and multi-cloud partnerships.

Adobe

Adobe Systems (ADBE) reported record revenue of $5.87 billion in Q2 2025, growing 11% year-over-year.

Earnings per share reached $5.06 (non-GAAP), while net income totaled $2.17 billion (non-GAAP). The company generated $2.19 billion in cash flow and repurchased 8.6 million shares.

The Digital Media segment grew 11%, and the Digital Experience segment saw 10% growth to $1.46 billion, with subscription revenue up 11%.

Adobe’s stock declined 6% after its earnings report due to disappointing future revenue guidance, which fell short of estimates.

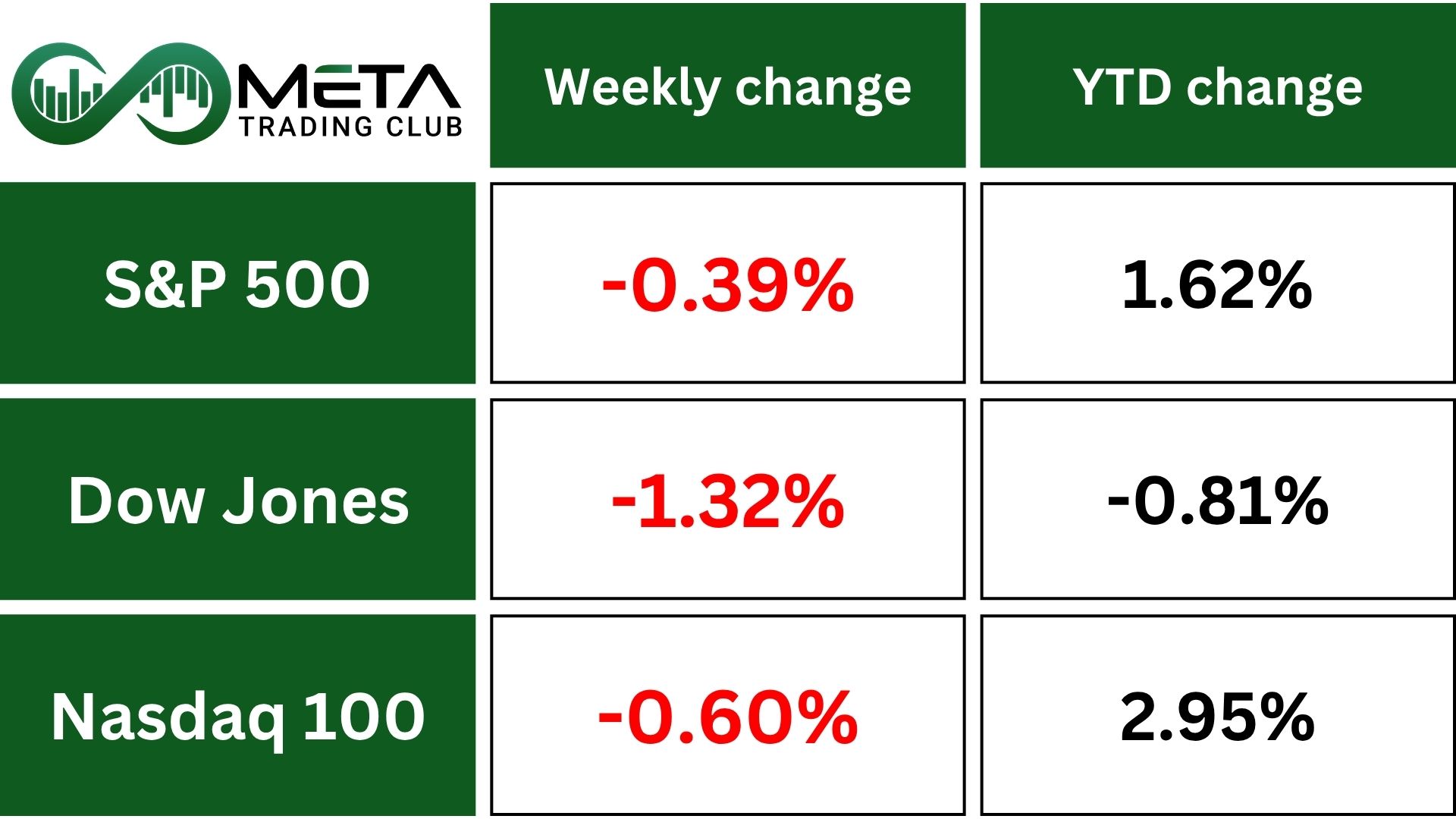

Indices

Indices’ Weekly Performance:

U.S. stocks dropped past week as Israel’s strike on Iran caused uncertainty in global markets, overshadowing earlier gains from soft inflation data, which raised hopes for interest rate cuts.

The S&P 500 closed below 6,000 and Nasdaq fell 0.6%, while the Dow dropped 1.3%.

Israel and Iran’s long-standing tensions have turned into open conflict, as both nations launched direct attacks over the weekend. The situation has raised global concerns and led to a halt in nuclear negotiations.

On the economic front, May’s producer price index rebounded less than expected, following a slower-than-anticipated consumer inflation report last month. This fueled speculation about possible Federal Reserve rate cuts.

Prediction shows a 23% chance of a June rate cut, up from 16% the previous week. The probability of a September cut rose to 57% from 52%.

Also, President Trump criticized Fed Chair Jerome Powell, arguing that a 2% rate cut could save the U.S. $600 billion annually, but said Powell has not acted.

Meanwhile, U.S.-China negotiators agreed on a framework to implement their Geneva trade agreement, though Trump still plans to impose tariffs on non-compliant countries.

Technically, if SPX surpasses its all-time high resistance, it could gain momentum for further upside. However, if it fails to break through, a deeper pullback may occur. Additionally, if the index drops below the 5770-support level, it could signal further declines.

Stocks

Sector’s Weekly Performance:

Past week energy and healthcare leading gains while financials and industrials struggled.

- Energy: Surged 5.7%, led by APA, Halliburton, and ConocoPhillips, all gaining over 10%. Halliburton secured a contract with Repsol Resources to support its North Sea assets.

- Healthcare: Gained 1%, with Eli Lilly rising 6.4% after confirming it will only partner with telehealth firms that stop selling unauthorized copies of its weight-loss drug Zepbound.

- Industrials: Fell 1.3%, reflecting weaker performance in manufacturing and production-related stocks.

- Financials: Declined 2.6%. Visa (-4.7%) and Mastercard (-4.8%) dropped as reports surfaced about Walmart, Amazon, Expedia, and airlines considering launching stablecoins in the U.S.

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- Oracle (ORCL): Surged 23.7% following strong earnings and positive analyst upgrades, fueled by increased demand for cloud computing and AI solutions.

- Halliburton Company (HAL): Gained 13% as oil prices surged, boosting oilfield service stocks amid rising global demand.

- ConocoPhillips (COP): Jumped 11% due to higher crude oil prices, benefiting from increased production outlook and Middle East tensions.

- Newmont (NEM): Climbed 10.6% on rising gold prices, as investors sought safe-haven assets amid geopolitical uncertainty.

- Tesla (TSLA): Rose 10.2% after Elon Musk and Donald Trump’s reconciliation. The company is set to launch its Robotaxi service later this month, and improved relations boost investor confidence and support Tesla’s strategic initiatives.

- Diamondback Energy (FANG): Boosted 10.2% by higher oil prices, strengthening the outlook for energy sector profitability.

- EOG Resources (EOG): Up 10% as rising crude prices supported exploration and production stocks.

- Archer-Daniels-Midland (ADM): Increased 9.6% due to strong agricultural commodity demand, benefiting food supply chains.

Commodity

Weekly Performance of Commodities:

Gold (XAU/USD) prices continue to rise as investors seek safe-haven assets following Israel’s strike on Iran, and Iran in response launched ballistic missiles at Israel. President Trump’s warning of harsher attacks without a nuclear deal has added to market uncertainty.

Gold climbed 1.5%, marking the third consecutive positive session and a 3.3% gain for the week.

While the upward trend may continue, further gains will likely depend on a worsening economic outlook and lower funding costs.

Technically, as the Middle East rises, gold by passing the $3,430 resistance level, potentially could rise to an all-time high of $3,500 if momentum continues.

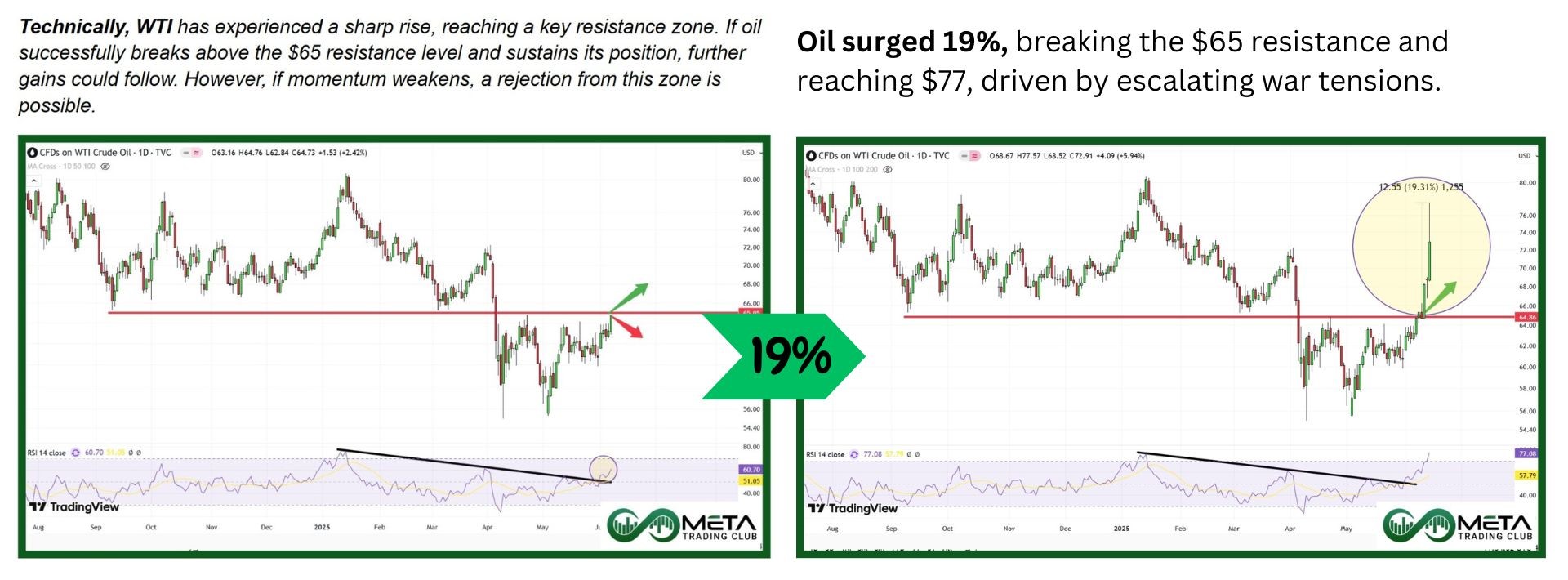

WTI Crude Oil surged to a four-month high as Israel started attacks on Iran, fueled concerns of a broader conflict in the oil-rich Middle East.

Israel’s attack on Iran’s South Pars Gas Field has significantly escalated tensions, marking the first direct strike on Iran’s energy infrastructure. The attack targeted Phase 14 refineries, causing fires and leading to a partial suspension of gas production.

Additionally, Israel struck Iran’s oil reserves, including major fuel depots and refineries in Tehran, further intensifying the conflict, sparking massive fires and raising concerns about potential fuel shortages.

These attacks have heightened concerns about a wider Persian Gulf conflict, raising the risk of oil supply disruptions in a region that provides over 20% of the world’s oil demand.

Technically, if WTI crude oil surpasses $73 and holds above it on the hourly time frame, it could gain momentum toward $75 and beyond, especially with rising Middle East tensions over the weekend.

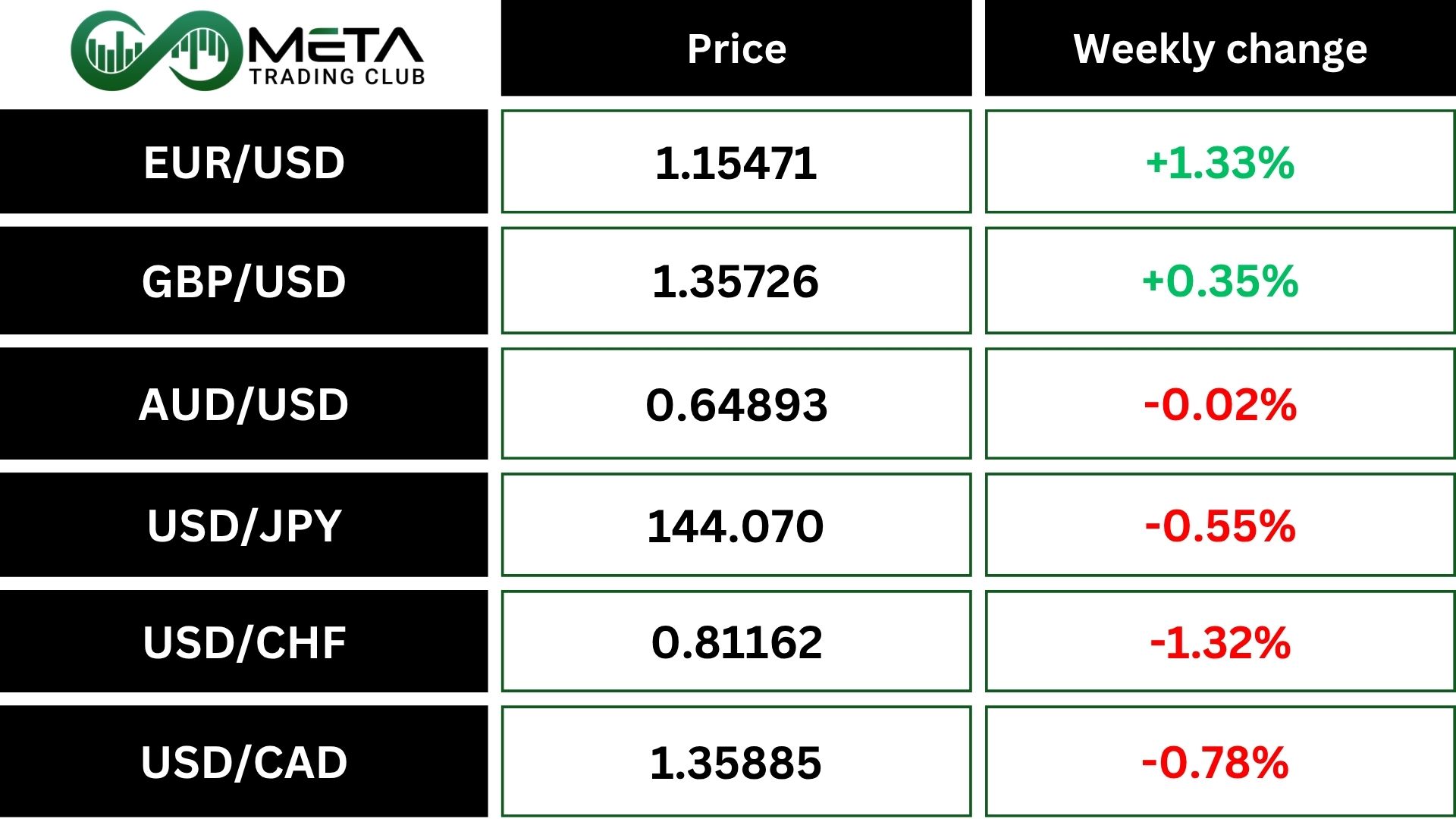

Forex

Weekly Performance of Major Foreign Exchange Pairs:

- EUR/USD: The euro gained 1.3% against the U.S. dollar, and the euro has now been up for two consecutive weeks, rising 1.79% over the last two weeks. Investors turn to strong reserve currencies amid geopolitical tensions.

- USD/JPY: The U.S. dollar fell 0.55% against the Japanese yen, ending its two-week winning streak. Rising geopolitical tensions, including the Israel-Iran conflict, have led investors to seek safer assets like the yen.

- GBP/USD: The British pound gained 0.35% against the U.S. dollar, marking its second consecutive week of gains. The U.S. dollar softened due to lower inflation expectations and geopolitical uncertainty, making the pound more attractive.

- DXY: The Dollar Index declined last week, reflecting weaker demand for the dollar amid shifting market conditions. The index fell, extending its monthly decline to 3.84%. The drop was influenced by growing expectations of Federal Reserve rate cuts, geopolitical tensions, and stronger performance of other major currencies like the euro.

- USD/CHF: The Swiss franc surged to its highest level since 2011, as investors sought safe-haven assets amid rising Middle East tensions. Beyond geopolitical risks, the franc’s 10% rise this year has also been fueled by uncertainty over U.S. trade policies, dollar weakness due to cooling inflation, and concerns over the U.S. economic and fiscal outlook.

Crypto

Crypto Market Weekly Performance:

Bitcoin briefly rose above $106,000, but escalating Middle East tensions and Trump’s threats against Iran caused a sharp pullback. After hitting $110,000 midweek, BTC faced multiple rejections, eventually dropping below $103,000 before recovering some ground.

Despite a slight rebound, BTC slipped again after Trump’s latest warning, now hovering above $105,000 with a market cap below $2.1 trillion.

Most alternative cryptocurrencies are in the red, posted minor declines while, HYPE up 15%.

The total crypto market cap dropped $20 billion, standing at $3.38 trillion as global uncertainty weighs on investor sentiment.

Technically, if BTC falls below $100,000, it could trigger another wave of sell-offs. A break above $111,000 may lead to further gains, while dropping below $102,000 could push BTC toward $98,000.

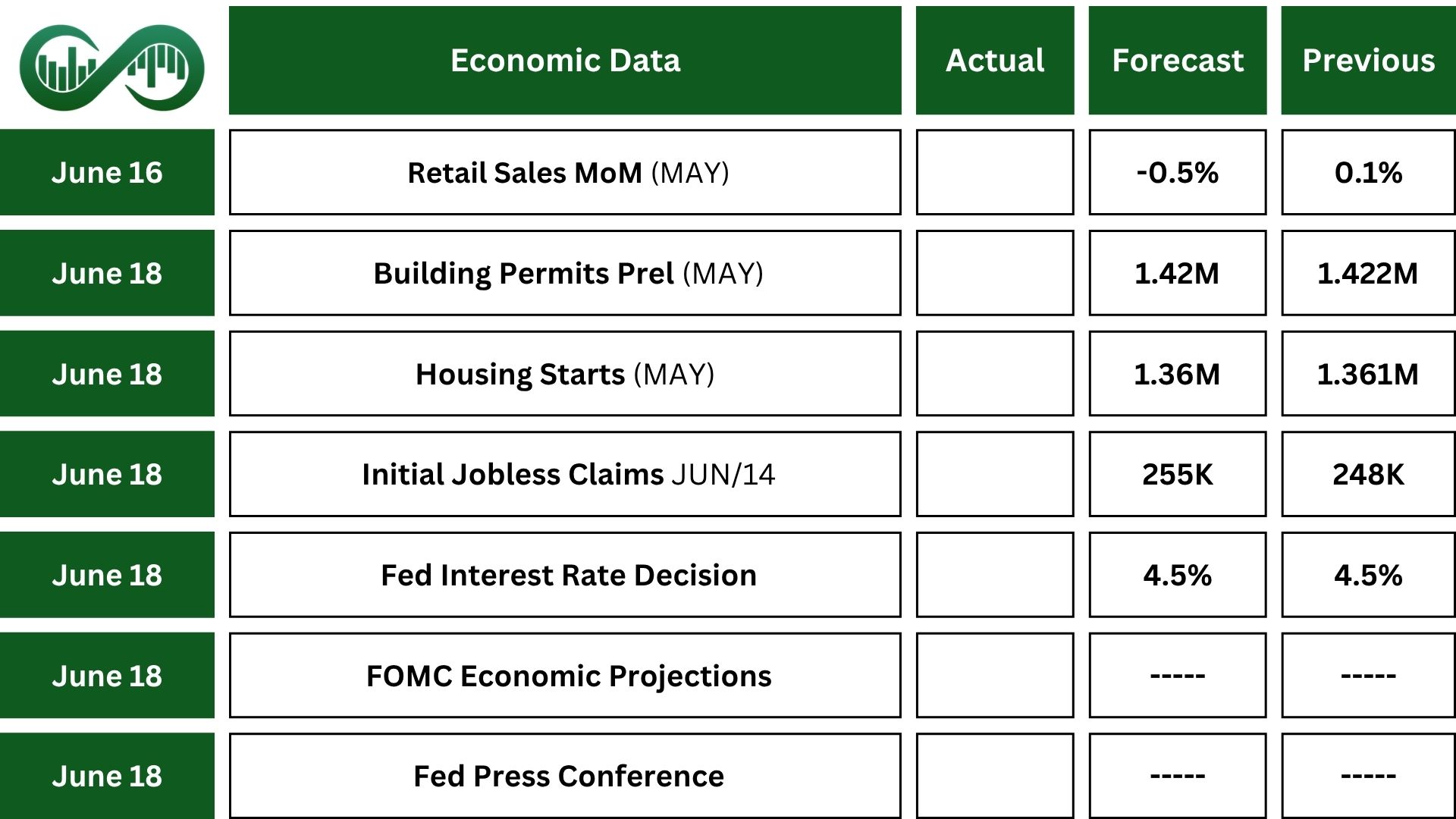

Next Week’s Outlook

Economic Events

Geopolitical tensions in the Middle East will stay in the spotlight coming week after Israel’s strike on Iran’s nuclear facilities, raising concerns about a wider regional conflict. Also, markets will closely follow trade negotiations between the U.S. and its key partners, looking for progress.

Meanwhile, global attention turns to the G7 Summit in Canada, where leaders from major economies will discuss key international challenges. It’s also a significant week for monetary policy, with the Federal Reserve, People’s Bank of China, Bank of Japan, and Bank of England all expected to maintain current interest rates.

The U.S. Federal Reserve is expected to keep interest rates unchanged, with traders focusing on its economic projections for signs of how policymakers view recent economic softness amid trade uncertainties.

Retail sales are anticipated to decline 0.5% in May, marking the first drop in four months, possibly due to tariff concerns, while industrial production is forecasted to inch up 0.1% following a flat reading last month.

Key upcoming data releases include building permits, housing starts, the NAHB housing market index, import/export prices, business inventories, capital flows, and regional manufacturing indicators like the New York Empire State and Philadelphia Fed indexes.

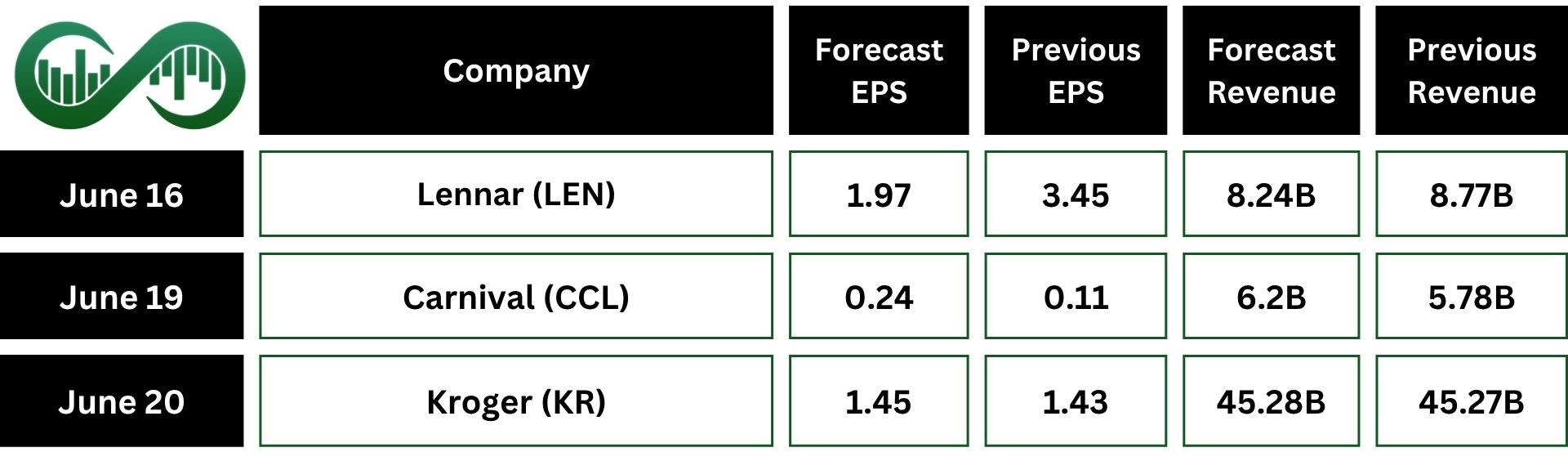

Earnings Events

Earnings season has come to a close, with Kroger (KR) set to release its report coming week.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.