Last week’s market and economic data key points:

- U.S. May NFP rise to 139k, beating expectations

- S&P 500 kicks off June with gains as payrolls beat forecasts

- Walmart says consumers are holding steady

- Apple gears up for iOS 26 reveal at WWDC 2025

- Meta eyes $10 billion scale AI investment

- Microsoft stock hits new record at $3.5 trillion

- Tesla sheds record value after Trump-Musk fallout

- Circle stock rockets 168% as crypto goes mainstream

- Gold choppy after u.s. jobs report

- Silver hits highest level in nearly 15 years

- Euro slips as strong U.S. jobs data boosts dollar

- Bank of Canada holds rates steady at 2.75%

- Bitcoin at a crossroads: double top or $150k breakout

- Top U.S.-China trade officials set to meet Monday in London

Table of Contents

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

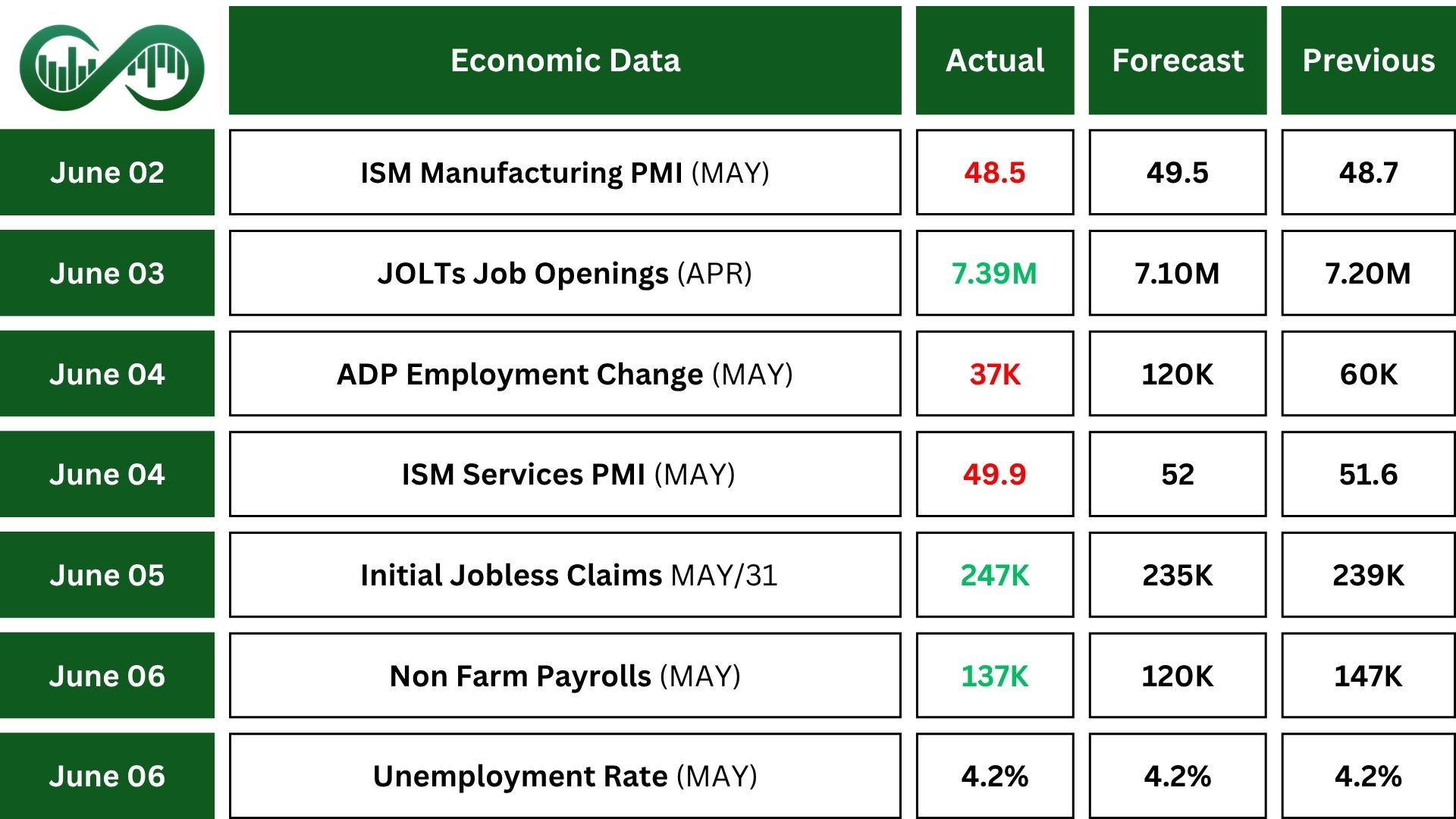

Economic Reports

The ISM Manufacturing PMI dropped to 48.5, indicating continued contraction in the sector. Trade uncertainty remains a significant concern, with companies adjusting their inventory strategies due to tariff-related costs.

Retailers fear inventory shortages if a trade deal isn’t secured soon, drawing comparisons to the supply chain disruptions seen during COVID-19. Despite these challenges, short-term inventory buildup has likely supported certain industries.

The U.S. services sector shrank slightly in May, with the Services PMI at 49.9, its first decline since June 2024. Business activity remained flat, but new orders fell, signaling weaker demand. However, employment rebounded, returning to growth after two months of decline. Supplier deliveries slowed, indicating increased economic activity, but prices surged, partly due to tariffs.

Job openings in the U.S. jumped to 7.391M in April, beating expectations. This indicates a steady labor market which may lead the Federal Reserve to hold rates, keeping borrowing costs high. Inflation concerns remain, as hiring strength suggests economic resilience.

Also, U.S. jobless claims rose to 247K, the highest since October 2024, surpassing forecasts, hinting at potential labor market softening. Meanwhile, continuing claims dipped to 1.904M, slightly below expectations. Federal government jobless claims also declined after recent dismissals by the Department of Government Efficiency (DOGE).

Challenger job cuts totaled 93,816 in May, the lowest in four months but still reflecting economic strain. Services sector layoffs hit their highest since May 2020.

Tariffs, funding cuts, and weaker consumer spending are driving cost reductions. Year-to-date layoffs surged 80% to 696,309, mostly due to federal workforce cuts leading the trend.

The U.S. non-farm payrolls added 139,000 jobs in May, slightly above expectations, while the unemployment rate stayed at 4.2%. Growth was strong in health care, leisure, and social assistance, but federal jobs declined.

Despite concerns about labor force participation and government cuts, steady job trends boosted investor confidence, lifting markets slightly.

Earnings Reports

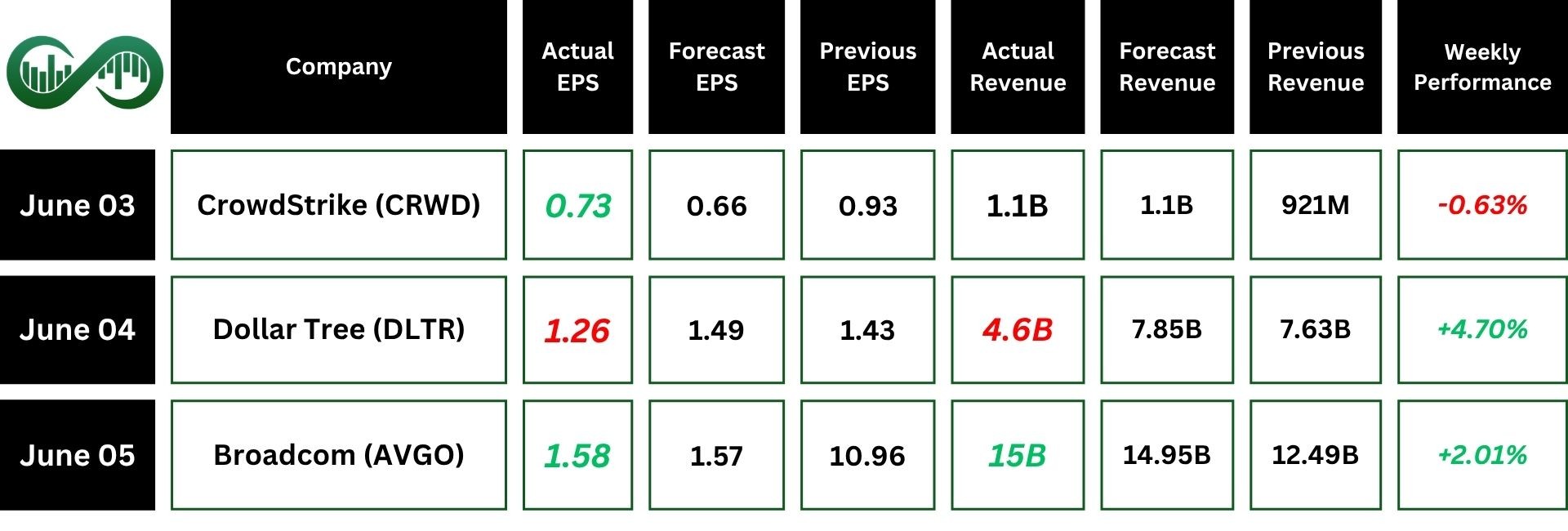

CrowdStrike

CrowdStrike (CRWD) reported $1.1 billion in Q1 revenue, up 20% year-over-year, with subscription revenue reaching $1.05 billion. Despite strong deal momentum, net income slightly down from last year.

However, the stock dropped 7% after earnings, driven by weaker guidance, customer retention concerns, and lingering effects of a prior Windows outage. Analysts downgraded the stock, citing valuation risks and soft margins.

Technically, If CRWD gains momentum and successfully breaks its all-time high resistance, confirming above that level, further upside potential could follow.

Dollar Tree

Dollar Tree (DLTR) reported strong Q1 results, with same-store sales up 5.4% and net sales rising 11.3% to $4.6B, though EPS of $1.47 missed estimates. The company reaffirmed its full-year revenue outlook.

Despite economic challenges, Dollar Tree opened 148 new stores and converted 500 locations to its multi-price format. However, tariff concerns pressured the stock.

Broadcom

Broadcom (AVGO) reported $15 billion in Q2 revenue, up 20% year-over-year. AI semiconductor revenue surging 46% to $4.4 billion, but non-AI segments declined 5%.

Despite beating estimates, AVGO stock fell 5% after earnings were released, likely due to high investor expectations and valuation concerns.

The company remains optimistic due to AI-driven growth, expecting long-term stock appreciation despite potential short-term volatility.

Technically, AVGO posted strong earnings, and if the stock breaks through its all-time high resistance, it has a high potential for further gains. However, if the decline persists and falls below the $236 support level, a deeper downturn may follow.

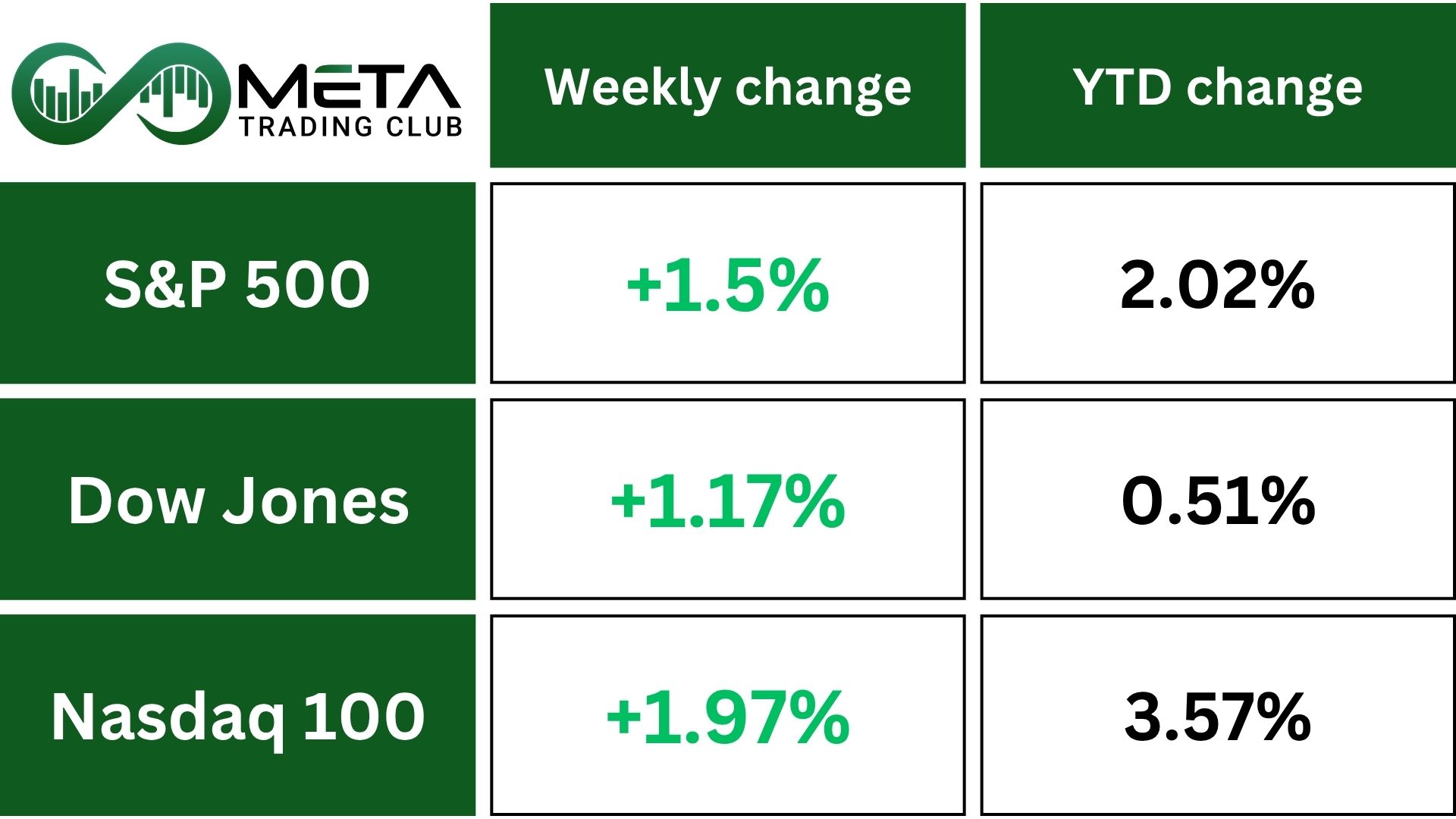

Indices

Indices’ Weekly Performance:

The S&P 500 rose 1.5% past week, surpassing 6,000, as better than expected U.S. job growth boosted the market. The index has gained 2% so far in 2025, continuing its strong momentum after a 6.2% jump in May (its biggest monthly gain since November 2023).

The U.S. added 137,000 jobs in May, surpassing forecasts, while the unemployment rate remained at 4.2% and wage growth exceeded expectations.

The positive jobs data helped offset concerns about political tensions, including a public dispute between President Trump and Tesla CEO Elon Musk.

Technically, if SPX surpasses its all-time high resistance, it may gain momentum for further upside. However, failure to break through this level could lead to a deeper pullback.

Stocks

Sector’s Weekly Performance:

Past week saw gains across various sectors:

- Technology: Rose 3.2%, driven by strong gains in Micron (MU) jumping 15% following positive analyst upgrades ahead of its earnings report.

- Communication Services: Increased 3.1%, with Meta (META) leading the charge. Meta 7.8% surge after securing a long-term energy deal and announcing nuclear investment plans.

- Basic Materials: Gained 2.4%, benefiting from stable commodity prices.

- Energy: Up 2.3%, as the sector benefited from rising oil prices and strong refining margins.

- Industrials: Rose 1.6%, led by General Electric (GE).

- Consumer Cyclical: Decreased 0.26%, dragged down by Tesla (TSLA) 15% decline amid ongoing controversies.

- Utilities: Fell slightly over 1%, facing pressure from higher interest rates.

- Consumer Defensive: Dropped 1.3%, led by Brown-Forman (BF) 16% decline after disappointing Q4 earnings and sales.

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- Micron Technology (MU): Surged 15% following positive analyst upgrades ahead of its earnings report.

- Marvell Technology, (MRVL): Gained 13.5% following the announcement of a strategic partnership with a major cloud provider.

- Arista Networks (ANET): Rose 12% after its high-performance networking solutions in cloud computing and AI-driven infrastructure.

- Airbnb (ABNB): Increased 9% as strong recovery in travel demand and increased consumer spending on accommodations.

- NXP Semiconductors N.V. (NXPI): Climbed 8.6% after unveiling a new line of automotive chips, expected to drive growth in its automotive segment.

- Vistra (VST): Gained 8% following the announcement of a major renewable energy project, boosting investor confidence in its long-term growth prospects.

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

Gold (XAU/USD) ended the week up about 1%, marking the second weekly gain in three weeks. It was a turbulent week, which included a call between President Trump and President Xi to ease trade tensions. Trump mentioned that Xi invited him to China, and he extended a similar invitation in return.

Gold expected to remain mostly flat for the month as tariff uncertainty, which usually boosts safe-haven demand, was balanced by investor withdrawals from ETFs.

Also, gold declined as the dollar and yields surged following stronger than expected U.S. job gains last month.

Technically, gold is consolidating following its April high. If the precious metal fails to stay above its upward trend line and breaks below it, a potential decline could follow.

Silver (XAG/USD) has reached its highest level since September 2011, trading above 36$ per troy ounce, up 9%.

Silver has performed similarly to gold, with both metals doubling in value since September 2022. While gold remains the preferred hedge against economic and political instability, rising gold prices have led investors to explore other precious metals like silver for protection.

WTI Crude Oil prices hit multi week highs as optimism grows over potential U.S.-China trade agreements. Summer demand is expected to absorb increased OPEC+ production, supporting prices.

WTI rose around $65 a barrel, gaining 6.2% for the week, while Brent climbed to $66.5, up 5.9% weekly.

Technically, WTI has experienced a sharp rise, reaching a key resistance zone. If oil successfully breaks above the $65 resistance level and sustains its position, further gains could follow. However, if momentum weakens, a rejection from this zone is possible.

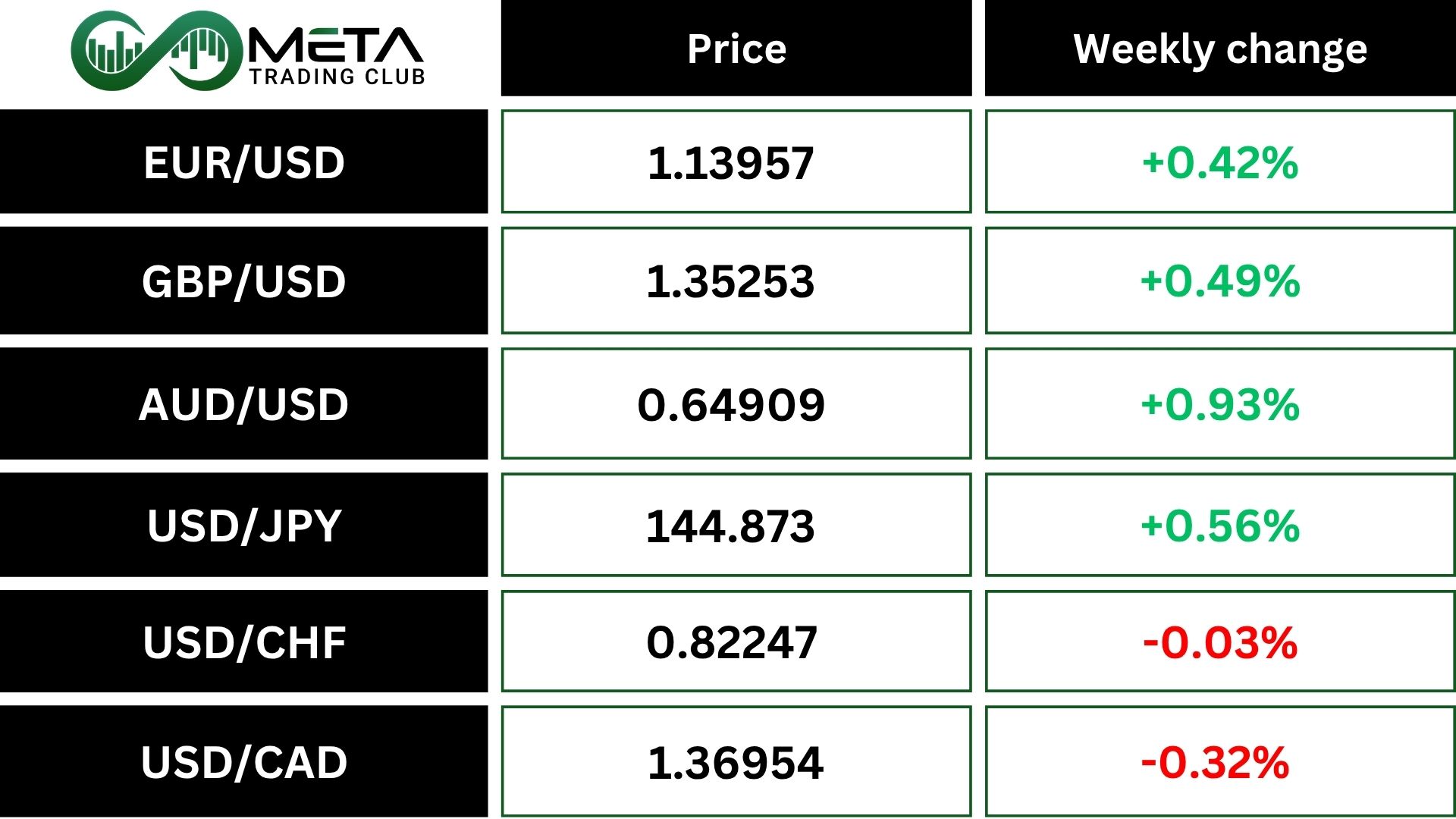

Forex

Weekly Performance of Major Foreign Exchange Pairs:

The Bank of Canada kept its interest rate at 2.75%, noting the economy has slowed but not worsened, while inflation has increased.

The euro fell below $1.14, retreating from its six-week high of $1.149, as a stronger than expected U.S. jobs report boosted the dollar.

Meanwhile, European investors reacted to the ECB’s 25-basis-point rate cut and President Lagarde’s remarks suggesting the easing cycle may be ending. The ECB also lowered its inflation forecasts for 2025 and 2026, citing softer energy prices and a stronger euro. The eurozone might achieve a soft landing, with most rate cuts likely behind, though uncertainty remains over potential new tariffs.

Crypto

Crypto Market Weekly Performance:

Bitcoin is trading near $105,500, gaining 1.1% after a turbulent week where prices fluctuated between $100,400 and $106,500.

Technically, if Bitcoin falls below $100,000, it could trigger another wave of sell-offs, especially after Friday’s $988 million in long liquidations following a public dispute between President Trump and Elon Musk. However, a break above $111K may trigger further gains, while a drop below $102K could lead to a decline toward $98K.

Next Week’s Outlook

Economic Events

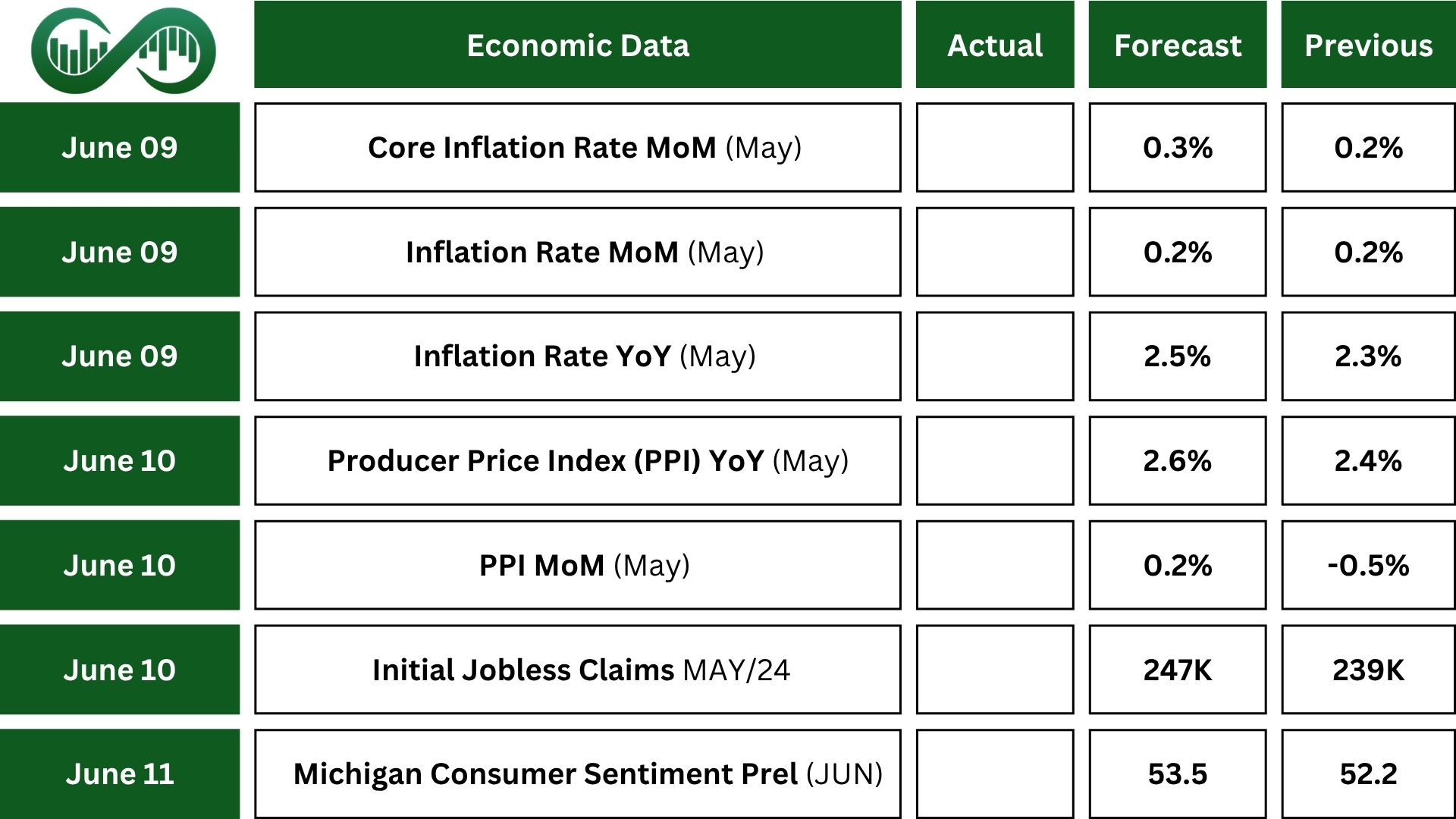

Coming week’s economic updates will focus on US inflation data, including consumer and producer price indexes, and the University of Michigan’s consumer sentiment reading.

Headline inflation is expected to stay at 2.3%, its lowest since February 2021. Monthly CPI increases are projected at 0.2% for overall inflation and 0.3% for core inflation.

Traders will also watch the government’s budget report and weekly jobless claims for signs of a weakening labor market.

Earnings Events

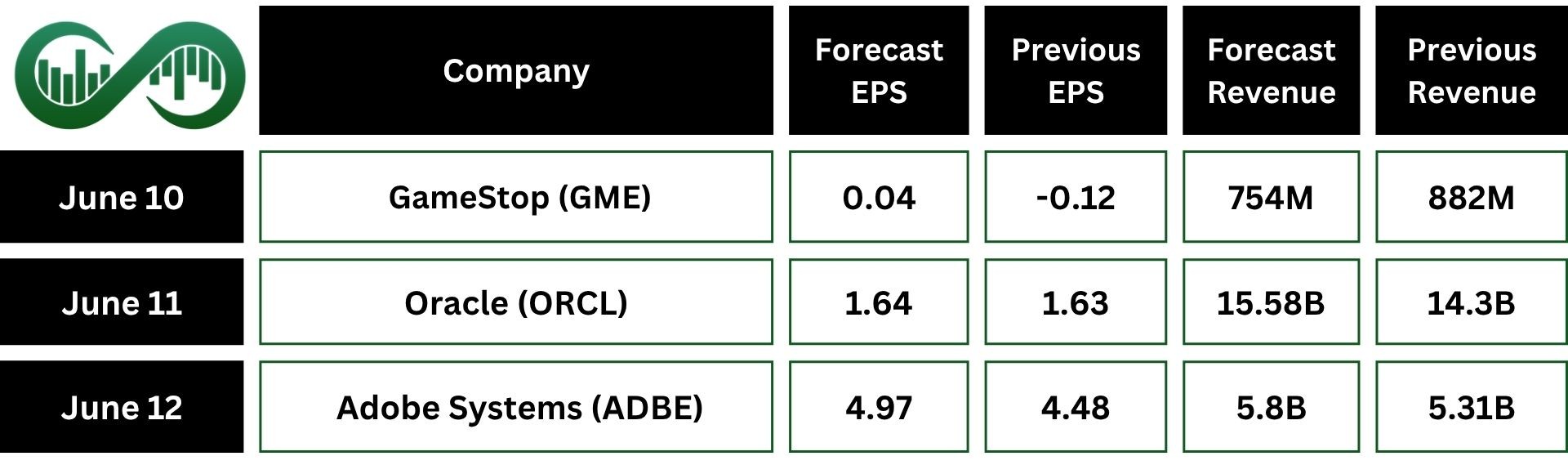

Earnings coming week are expected from companies including Oracle (ORCL), Adobe (ADBE) and GameStop (GME).

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.