Last week’s market and economic data key points:

- Durable goods orders drop 6.3% in April

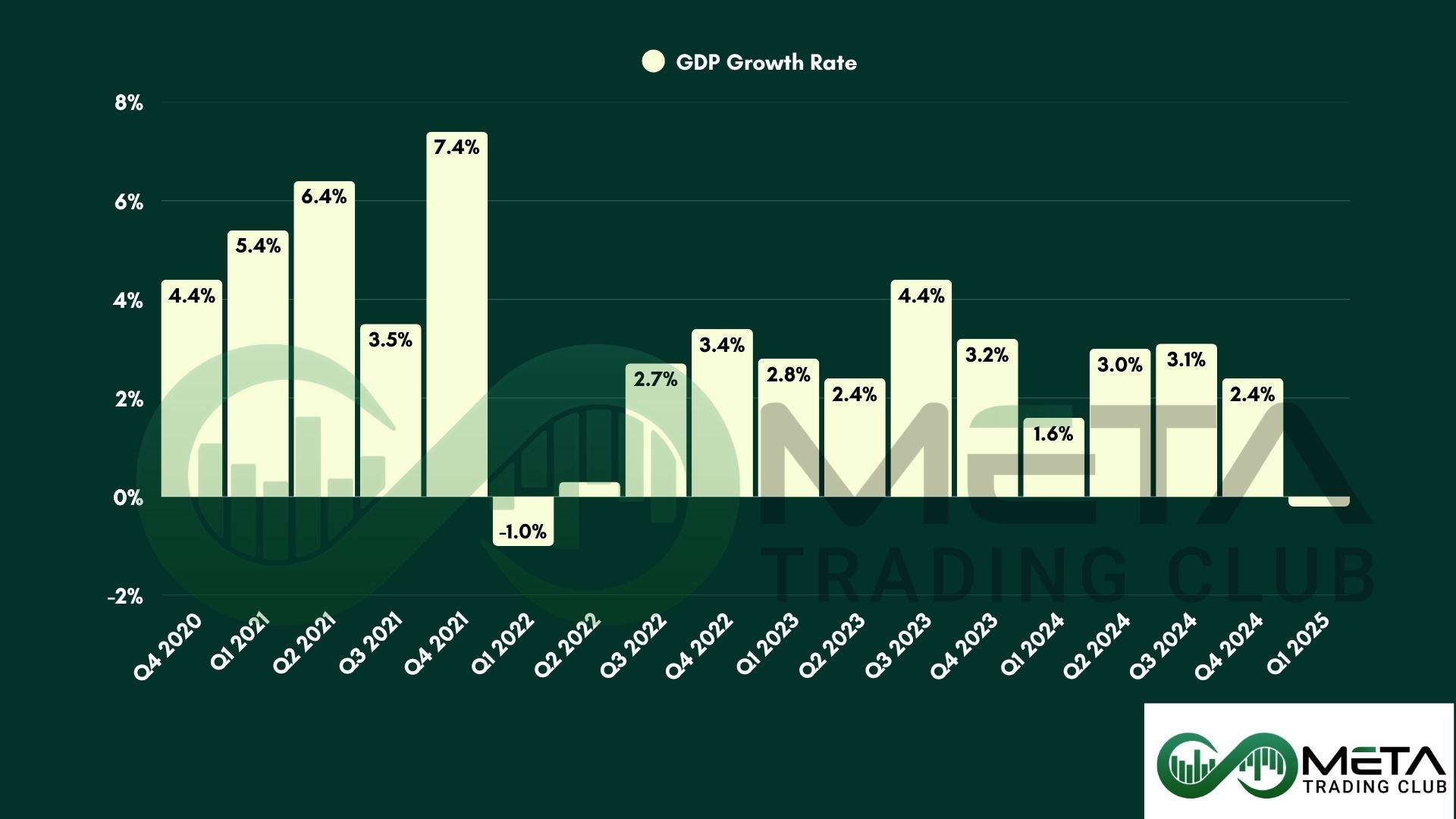

- U.S. GDP shrinks 0.2% in q1 after strong 2024 growth

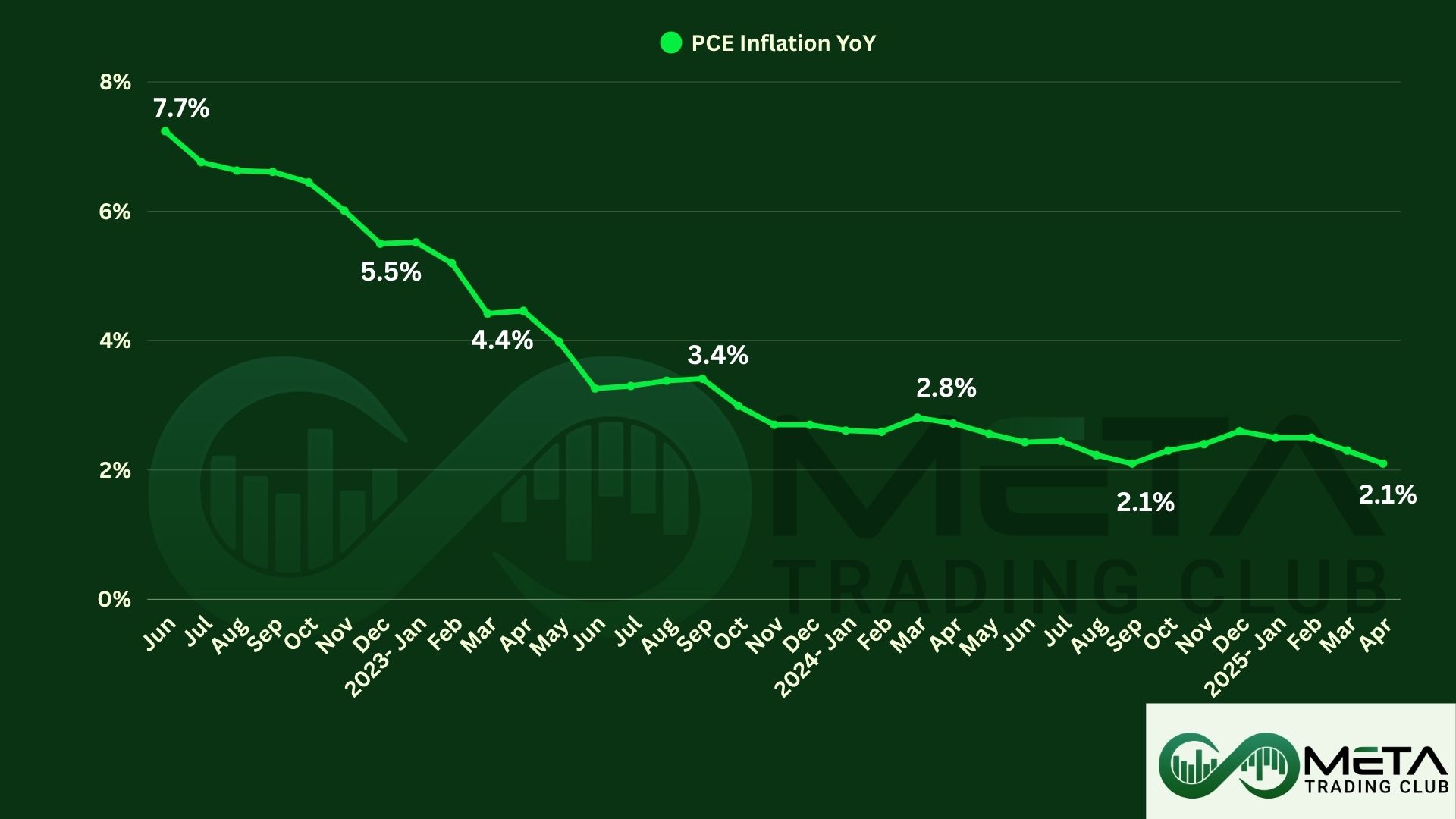

- Annual PCE inflation fell to 2.1%, lowest in 7-months

- Consumer Sentiment holds steady in May

- Nvidia’s CEO plans to sell $800 million in stock

- Costco posted higher sales despite consumer concerns

- Tesla set a winning week as musk’s white house exit

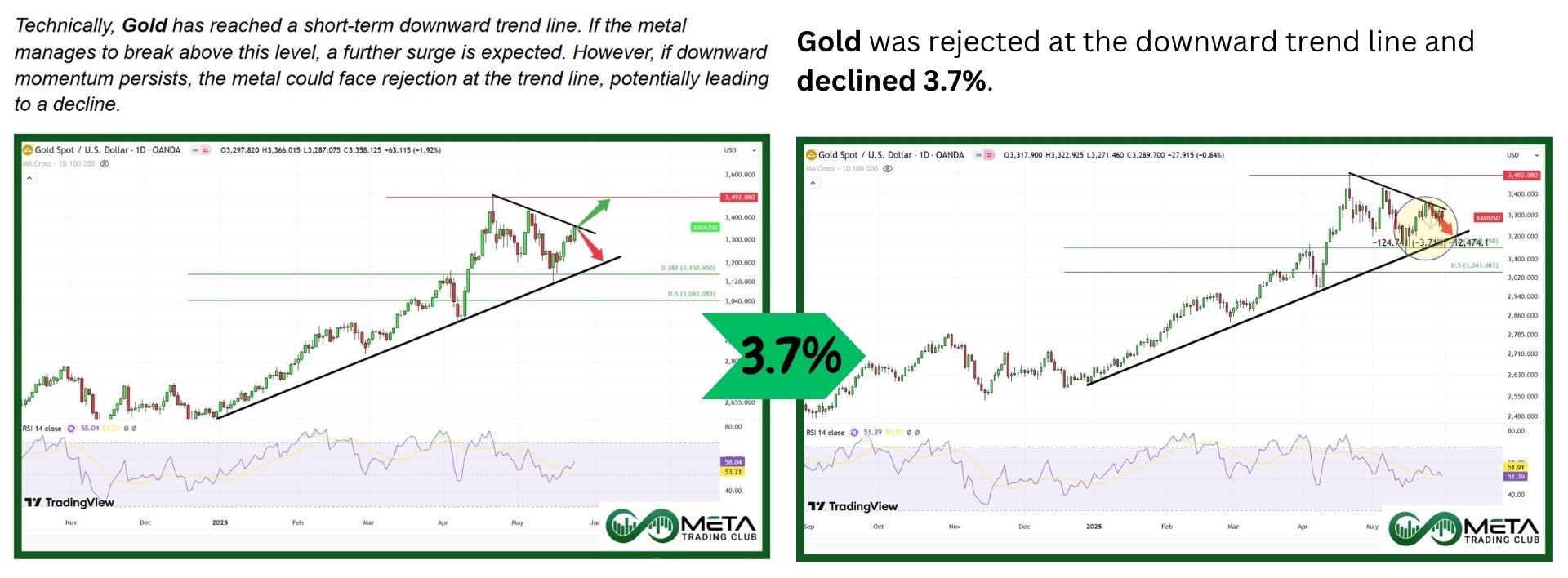

- Gold Dropped in May, ending 4-month winning streak

- Oil settles lower as Opec output decision looms

- White house jitters fuel dollar rally

- Bitcoin ETF smash records, pulling in $9 billion in 5-weeks

- Blackrock’s IBIT surpasses $71 billion in Bitcoin holdings

Table of Contents

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

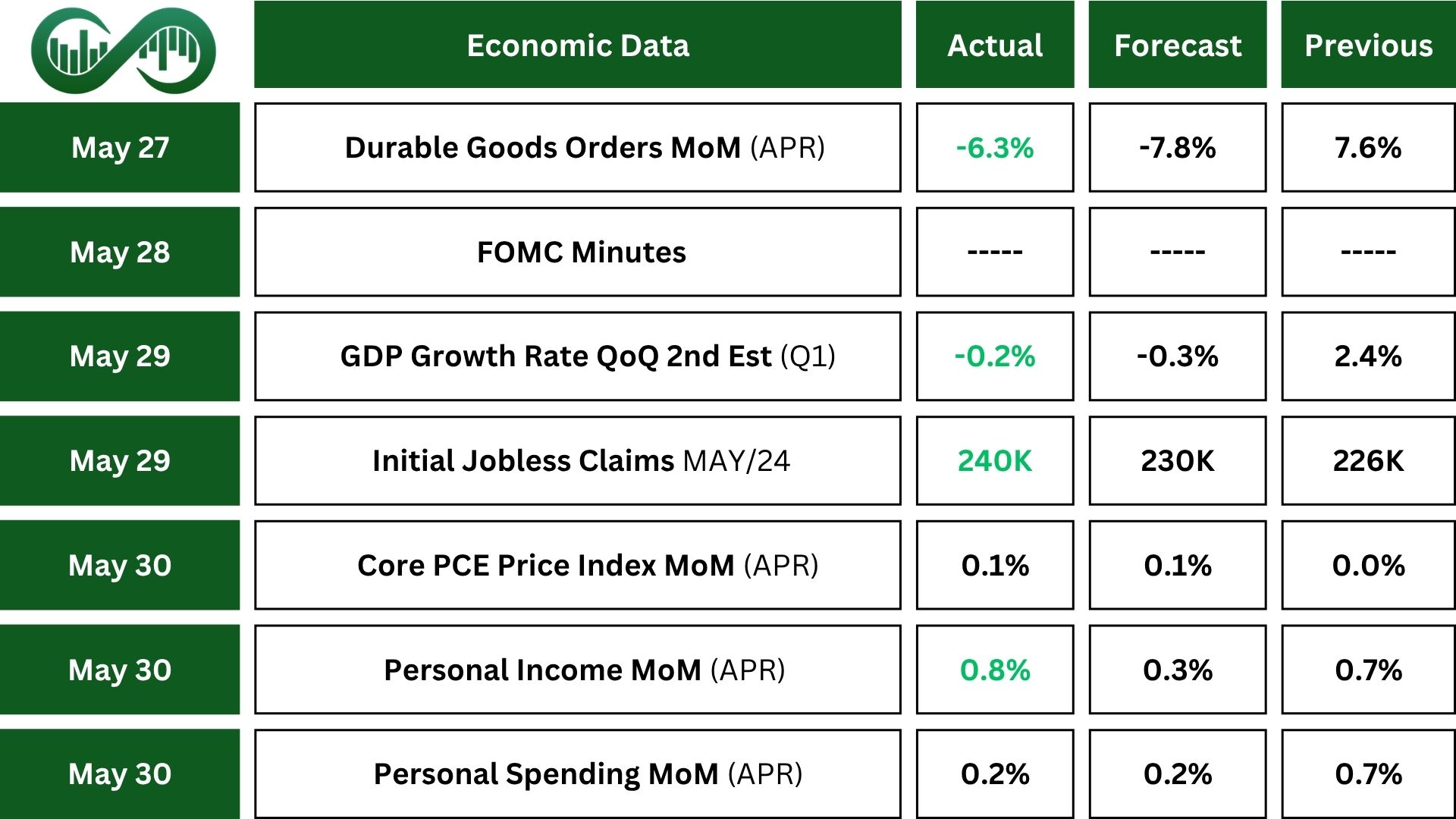

In April, U.S. Manufactured Durable Goods Orders dropped by 6.3%, marking the steepest decline since early 2024. While the fall was less severe than anticipated, it followed a strong rise in the previous month. The decrease was driven by new 10% tariffs and weaker demand, as many businesses had already stocked up, reflecting ongoing trade tensions.

In Q1 2025, the U.S. economy contracted by 0.2%, following 2.4% GDP Growth in late 2024. The decline was primarily driven by increased imports and reduced government spending, though investment, consumer spending, and exports helped limit losses.

Consumer Sentiment remained steady in May after months of decline. While it dipped at first, optimism grew later due to a pause on some tariffs, improving business expectations. However, inflation expectations barely changed in the short term, but long-term expectations dropped slightly, the first decline in months. Consumers expect tariffs to affect prices, but discussions on tax and spending policies haven’t significantly shaped their outlook.

Annual PCE Inflation in the U.S. fell to 2.1% in April, marking its second consecutive monthly decline and the lowest level in seven months. Core PCE inflation also dropped to 2.5%, the lowest since March 2021. On a monthly basis, the PCE price index rose by 0.1% in April, aligning with expectations after remaining unchanged in March. The PCE index remains the Federal Reserve’s primary inflation gauge.

President Donald Trump postponed a planned 50% tariff on EU imports from June 1 to July 9 at the request of European Commission President Ursula von der Leyen, fueling optimism for an agreement.

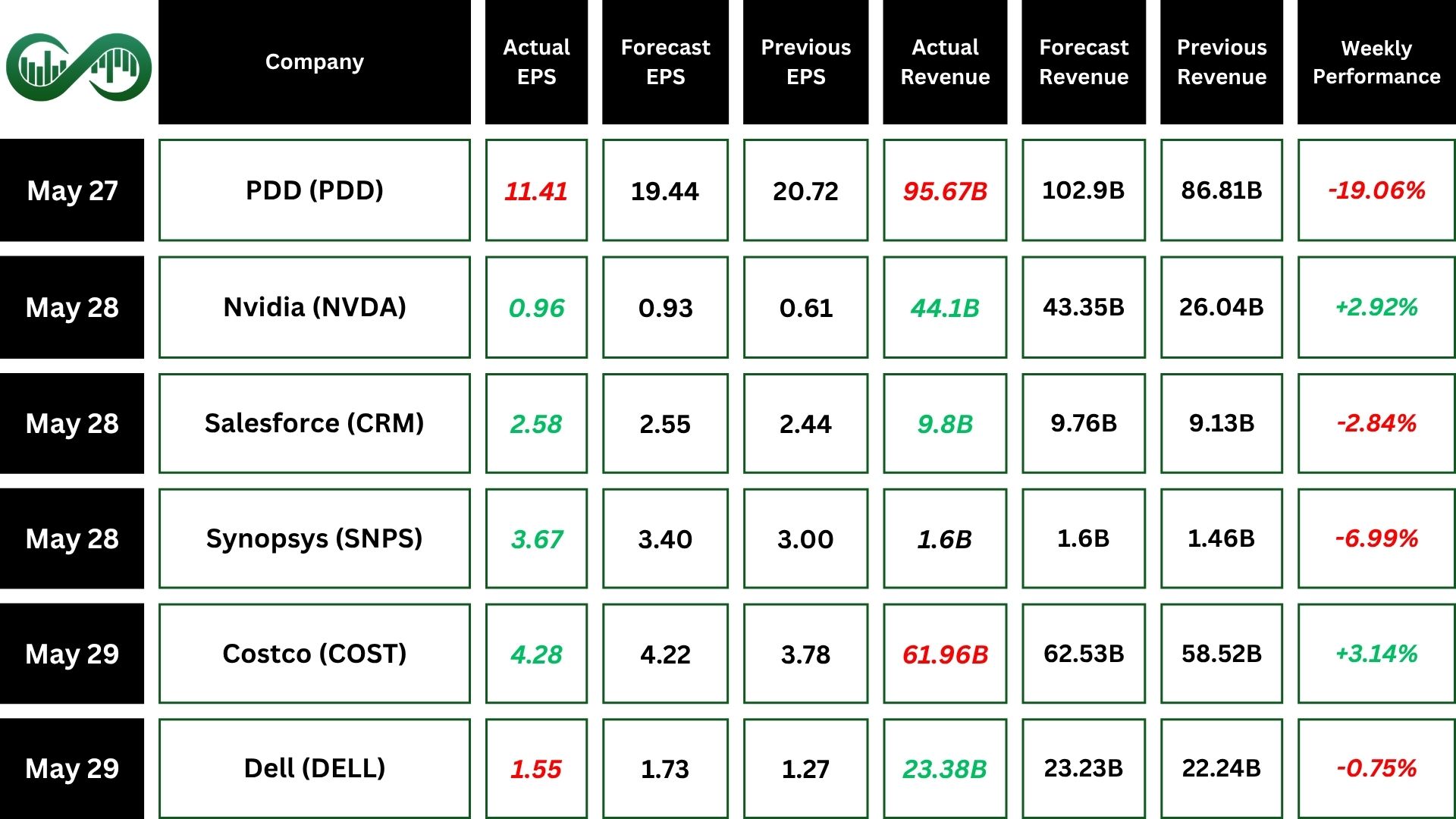

Earnings Reports

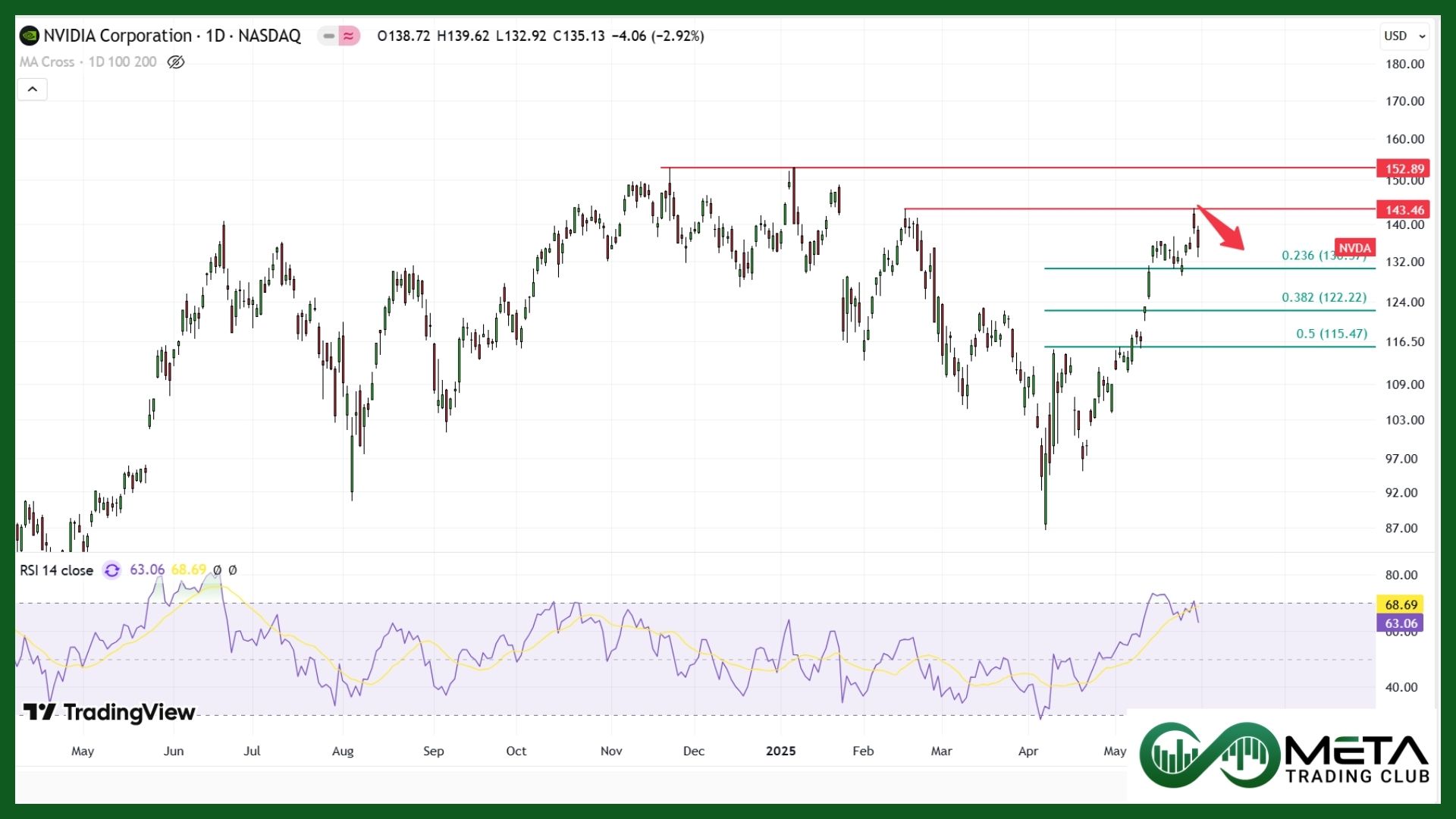

Nvidia

Nvidia (NVDA) reported strong Q1 earnings, with revenue reaching $44.1 billion, up 69% year-over-year.

The Data Center segment led by 73% growth, contributing $39.1 billion, reinforcing NVIDIA’s AI and cloud computing dominance. Also, gaming revenue hit a record $3.8 billion.

Although, new U.S. export restrictions on H20 chips to China led to a $4.5 billion charge from excess inventory and purchase commitments, with $2.5 billion in shipments unable to be completed.

Meanwhile, NVIDIA’s Blackwell NVL72 AI supercomputer is now in full-scale production, and the company is partnering with Alphabet, Open AI, Google, Oracle, Foxconn, Saudi Arabia, and Taiwan to advance AI supercomputers and factories.

Salesforce

Salesforce (CRM) reported strong Q1 FY26 earnings, with revenue reaching $9.8 billion, up 8% year-over-year, exceeding expectations.

Subscription and support revenue grew 8%-9%, while profit margins improved, with GAAP at 19.8% and non-GAAP at 32.3%.

Operating and free cash flow increased by 4%, and $3.1 billion was returned to shareholders through buybacks and dividends.

Despite solid results, the stock dipped as investors reacted to cautious Q2 guidance, potential cloud spending slowdown, and uncertainty surrounding the Informatica acquisition.

CRM declined and entered the Fibonacci zone, where it could potentially rebound from the 0.5 Fibonacci support level. However, if it drops further and breaks below the 0.618 Fibonacci zone, a continued decline is expected.

Costco

Costco (COST) reported strong Q3 earnings, with earnings per share of $4.28, surpassing expectations, though revenue slightly missed at $63.21 billion.

Same-store sales grew 8%, exceeding forecasts, with solid performance across the U.S., Canada, and international markets.

Net income rose to $1.90 billion, up from $1.68 billion. Stock rose 3%last week, it has gained 12% year-to-date, outperforming the S&P 500, which has stayed level.

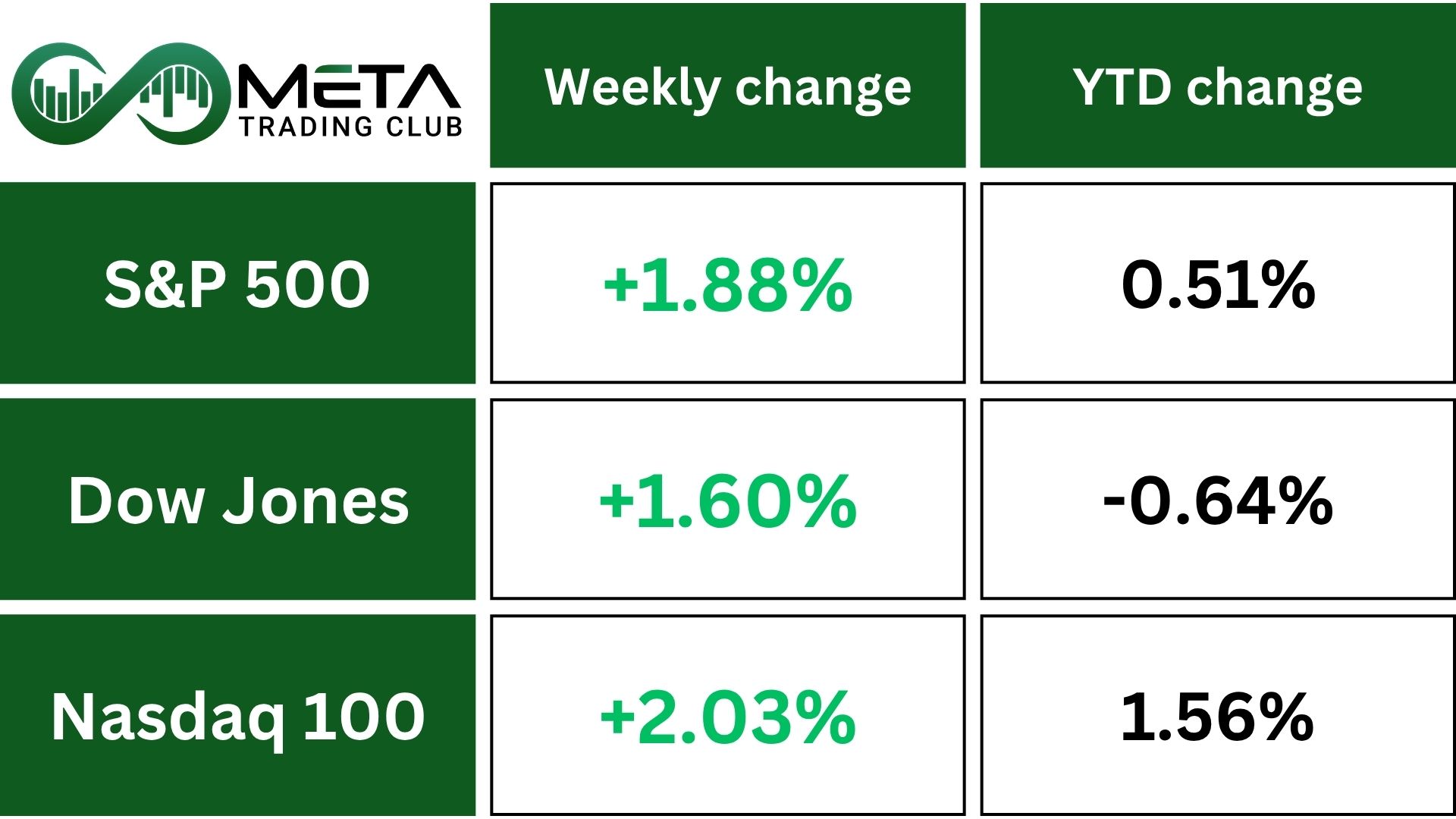

Indices

Indices’ Weekly Performance:

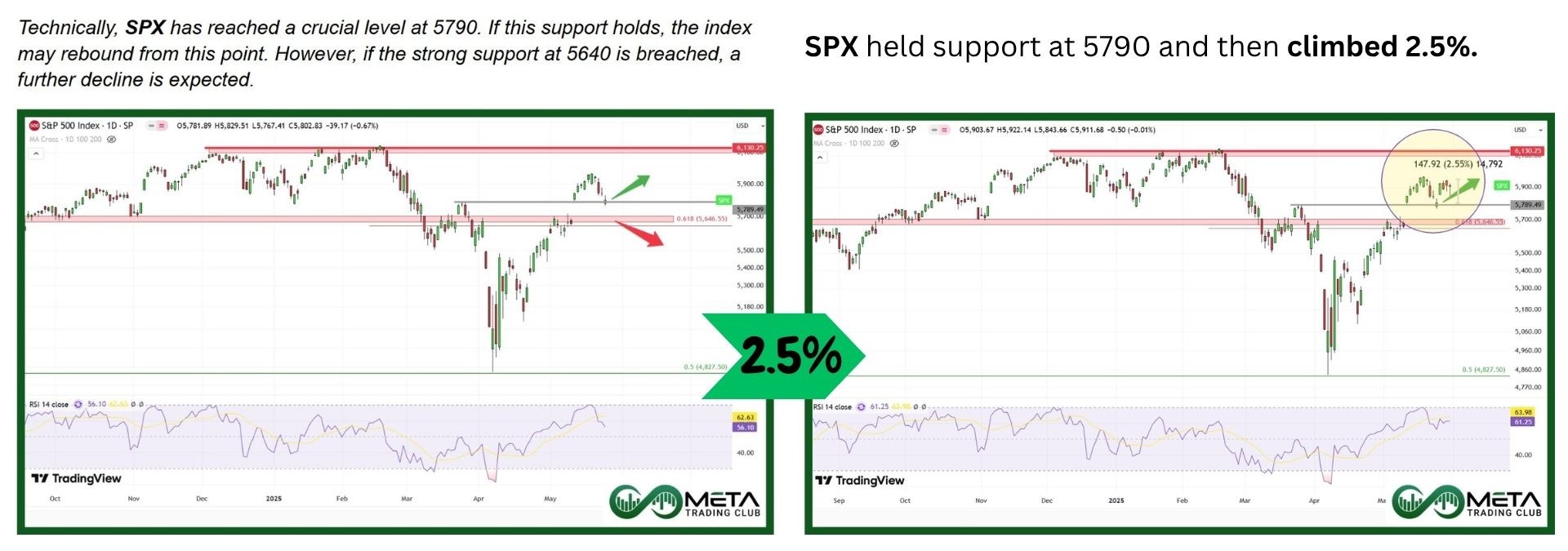

The Nasdaq surged 7.8% this month, while the S&P 500 added 5%, both posting their biggest monthly gains since November 2023. Dow climbed 3.9%. All three benchmarks posted weekly gains.

Earlier this month, Washington and Beijing agreed to suspend most tariffs on each other’s imports for 90 days. However, US President Donald Trump on Friday accused China of violating the pact, without providing details. “China, perhaps not surprisingly to some, has totally violated its agreement with us,” Trump said in a social media post.

In response, China criticized the US for “discriminatory restrictions” in its use of export controls in the semiconductor industry, CNBC reported.

Last week, a federal appeals court granted the Trump administration’s request to temporarily pause a ruling that struck down a series of tariffs announced by the White House. The US Court of International Trade on Wednesday ruled that Trump overstepped his authority by imposing duties under the International Emergency Economic Powers Act.

Technically, if SPX breaks above its trend line on lower time frames, it could gain momentum for further upside. However, the 5790 support level remains a key threshold, if the index falls below it, a deeper decline may follow.

Stocks

Sector’s Weekly Performance:

This week saw strong gains across various sectors, with Real Estate leading and followed by Consumer Defensive and Utilities.

- Real Estate: Increased 2.5%, driven by rising demand and strong first-quarter earnings. Welltower (WELL) surged 5% amid growth in healthcare real estate.

- Consumer Defensive: Rose 2% as stable consumer spending on essential goods supported the sector. Costco (COST) surged after its strong Q3 earnings report.

- Utilities: Gained 2%, fueled by positive developments in renewable energy investments, including NextEra Energy (NEE).

- Healthcare: Surged 1.7%, largely influenced by acquisition speculation surrounding Hologic (HOLX).

- Financial: Advanced 1.26%, supported by interest rate stability and strong banking sector earnings.

- Industrials: Rose 1.25%, led by Viatris (VTRS), which surged after reporting strong Q2 revenue.

- Technology: Posted a 0.71% gain, despite Palantir Technologies (PLTR) surging 7%.

Stock Market Weekly Performance:

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- Ulta Beauty (ULTA): Led the top performers, surging 19% after the beauty retailer reported strong quarterly earnings and net sales that exceeded expectations.

- Applovin (APP): Surged 11%, driven by strong earnings and growing demand for its AI-powered digital advertising solutions. Increased adoption by mobile developers boosted revenue and investor confidence.

- Warner Bros (WBD): Climbed 10.8% as streaming growth and restructuring efforts fueled optimism. Strong subscriber additions and improved revenue forecasts reassured investors.

- Nordson (NDSN): Gained 9.6% following better-than-expected earnings and strong demand for industrial automation. Expansion into high-margin segments strengthened investor sentiment.

- Royal Caribbean Cruises (RCL): Increased 7% as record bookings and cruise industry optimism fueled gains. Strong revenue growth and positive guidance drove investor enthusiasm.

- Palantir (PLTR): Added 6.9% as AI-powered government contracts boosted confidence. The company’s role in defense and commercial AI applications attracted bullish investors.

- United Airlines (UAL): Rose 6.4% with strong travel demand and upbeat revenue guidance. Cost-cutting measures improved its profit outlook.

- Oracle (ORCL): Gained 6.1% as enthusiasm for AI and cloud growth drove momentum. Increased investment in AI infrastructure and partnerships strengthened confidence.

Commodity

Weekly Performance of Commodities:

Gold (XAUUSD) ended May with its biggest monthly drop since December, falling 0.5% in May and breaking a four-month winning streak.

Despite the decline, gold remains up 25.1% this year, far outperforming the S&P 500’s 0.5% gain.

The retreat in gold prices coincided with a stock market rally, as investors who had bought gold amid U.S. trade war concerns in April took profits as tensions eased.

Technically, if gold breaks its short-term downtrend line, it could gain momentum for further upside. However, if the metal gets rejected at this resistance, it may decline toward the longer-term uptrend line. A break below up trend line could signal a deeper drop ahead.

WTI Crude Oil ended the week with a loss of over 1%, pressured by trade tensions and supply concerns.

President Trump’s accusation that China violated a recent tariff truce added to uncertainty ahead of the OPEC+ meeting, where key producers like Saudi Arabia and Russia are pushing for a larger output increase.

Kazakhstan’s refusal to curb production has further strained group unity, while fears of oversupply continue to weigh on prices.

Forex

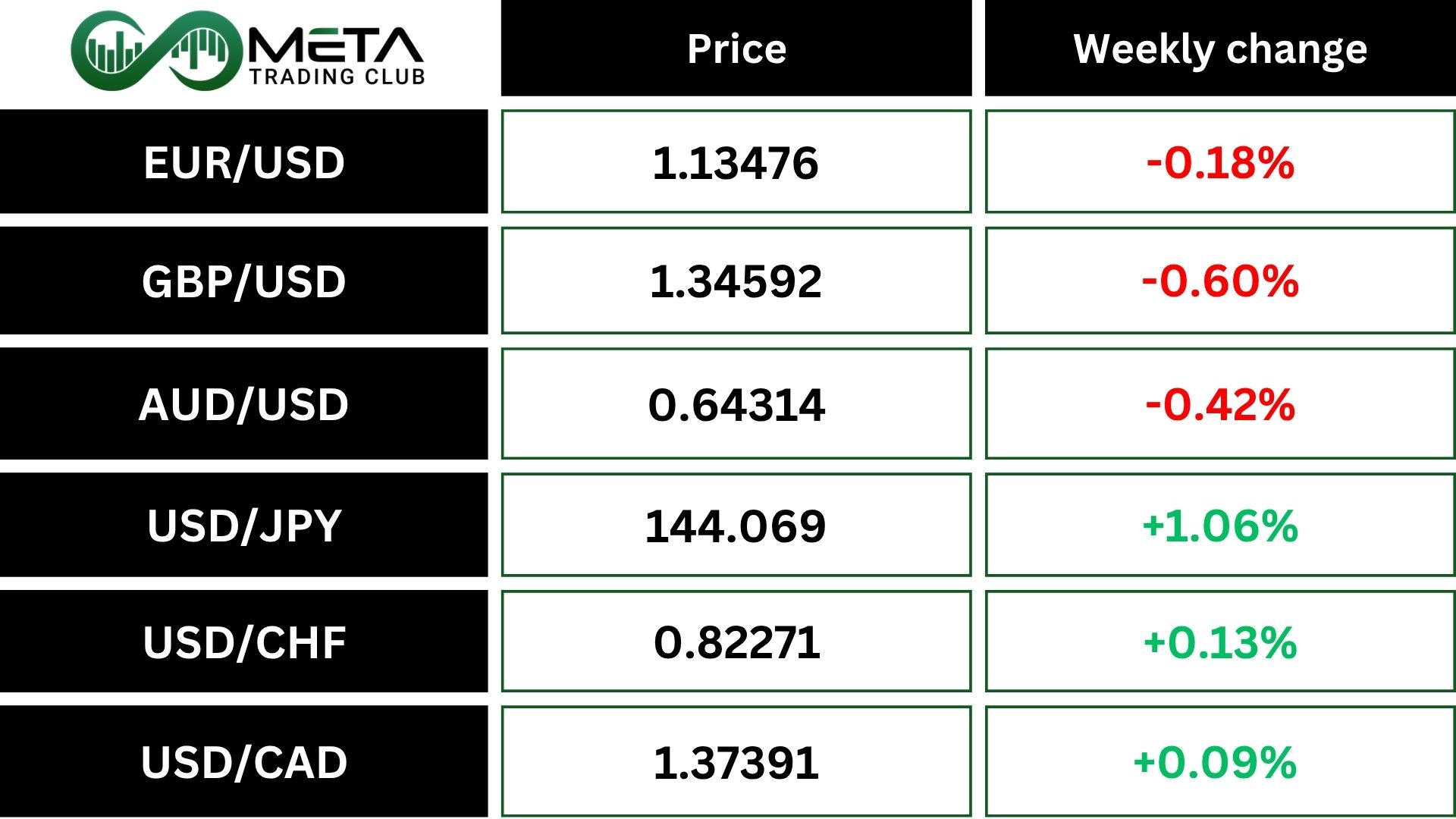

Weekly Performance of Major Foreign Exchange Pairs:

The EUR/USD lost momentum, dropping back toward $1.13 after briefly touching $1.1390, despite reaching a one-month high of $1.1418 earlier in the week.

Meanwhile, the U.S. dollar regained strength as political and legal developments in Washington drove demand. A federal appeals court upheld Trump’s tariffs, reversing a lower court ruling that deemed them illegal, boosting the dollar against most major currencies.

USD/JPY traded near flat after a brief dip, while GBP/USD hovered around $1.3470.

Crypto

Crypto Market Weekly Performance:

Bitcoin has pulled back after peaking above $111,000 in May, now trading below $105,000. Some see this as a weakening trend, while others view it as a bullish correction.

$88,888.88 as a key retracement level aligning with the 0.618 Fibonacci level. Despite short-term fluctuations, the broader trend remains strong, with predictions that Bitcoin will not fall below $80,000 again.

Technically, if BTC stays above $100K–$102K, it could maintain bullish momentum. A break above $111K may trigger further gains, while a drop below $102K could lead to a decline toward $98K.

Next Week’s Outlook

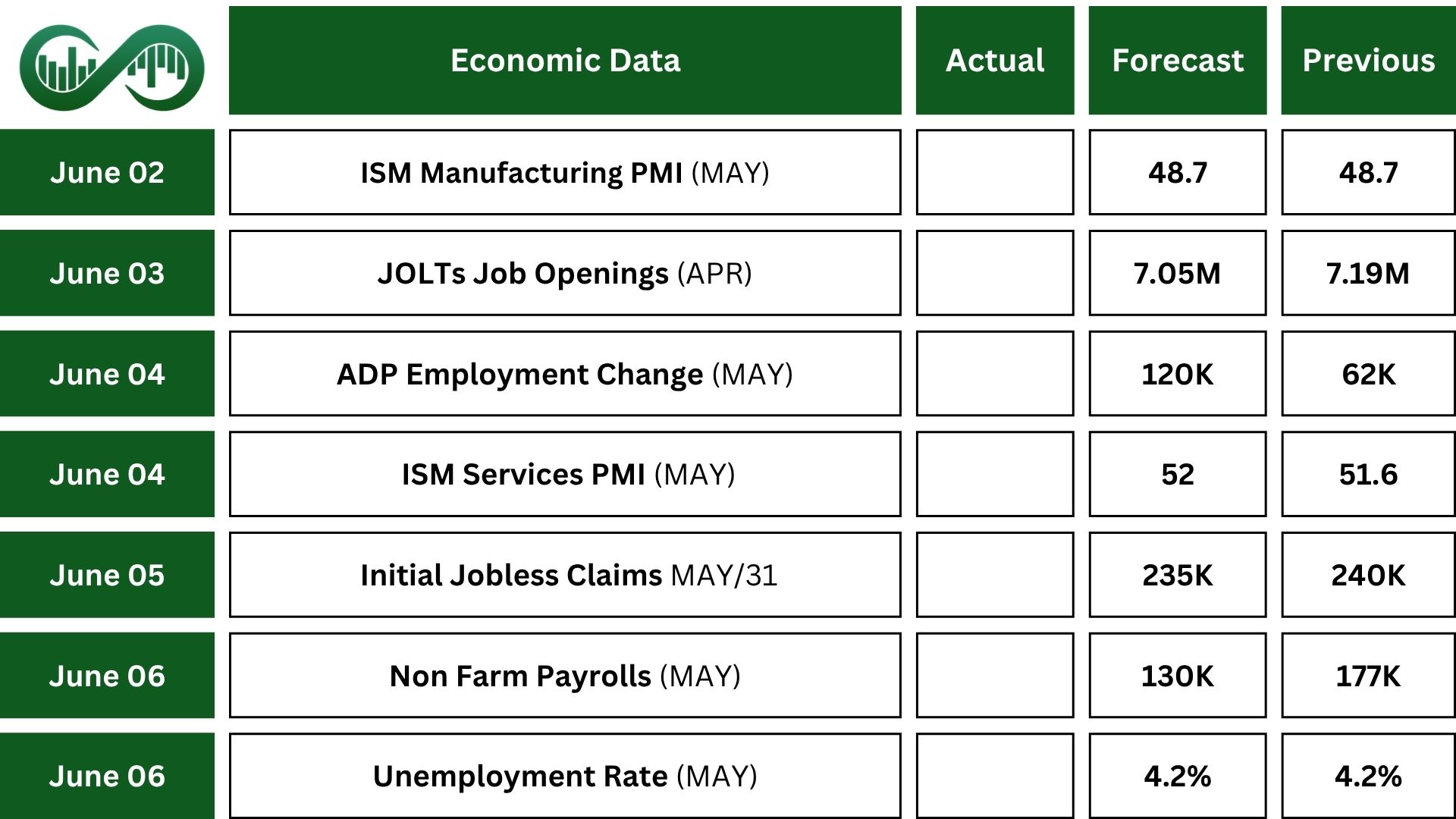

Economic Events

Trade tensions remain high as President Trump accused China of breaking a tariff truce, while US Trade Secretary Scott Bessent said negotiations were stalled.

Investors are watching Federal Reserve speeches for insights on economic policy.

The first week of June will bring important economic data, including the US jobs report and ISM PMI surveys for manufacturing and services.

Job growth for Non-Farm Payrolls is expected to slow to 130K in May, the weakest in three months, while the Unemployment Rate should stay at 4.2%. Also, annual wage growth may dip to 3.7%.

The US manufacturing sector is expected to keep shrinking, while the service sector may see modest gains.

Other key reports include job openings, private employment data, trade figures, and factory orders.

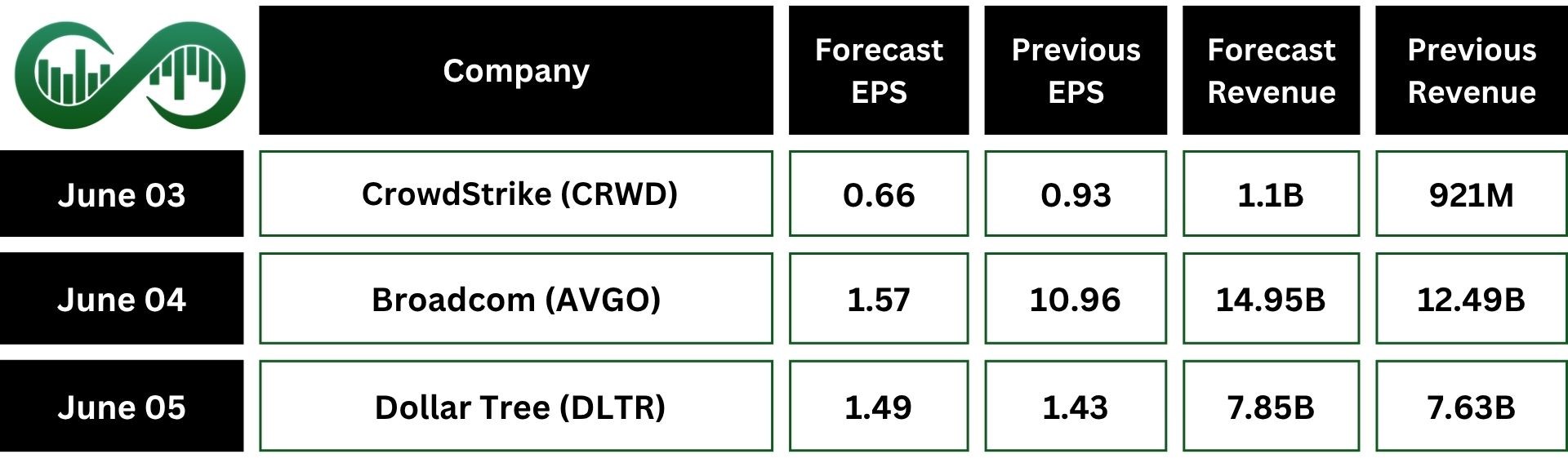

Earnings Events

On the earnings front, CrowdStrike (CRWD) and Broadcom (AVGO) will release their earnings.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.