The Producer Price Index (PPI) measures the average change over time in the prices that domestic producers receive for their goods and services. Also, it’s a key indicator of inflation at the wholesale level, reflecting price changes from the perspective of the seller rather than the consumer.

The Bureau of Labor Statistics (BLS) releases the Producer Price Index (PPI) report monthly, providing crucial insights into the average change over time in the selling prices received by domestic producers for their goods and services. The report is typically released around the 12th of each month at 8:30 AM Eastern Time. It includes data on various industry classifications, commodity classifications, and the Final Demand-Intermediate Demand system. These offer a comprehensive view of price changes across different sectors. This data is essential for economists, policymakers, and businesses to understand inflationary trends and make informed decisions.

May Producer Price Index

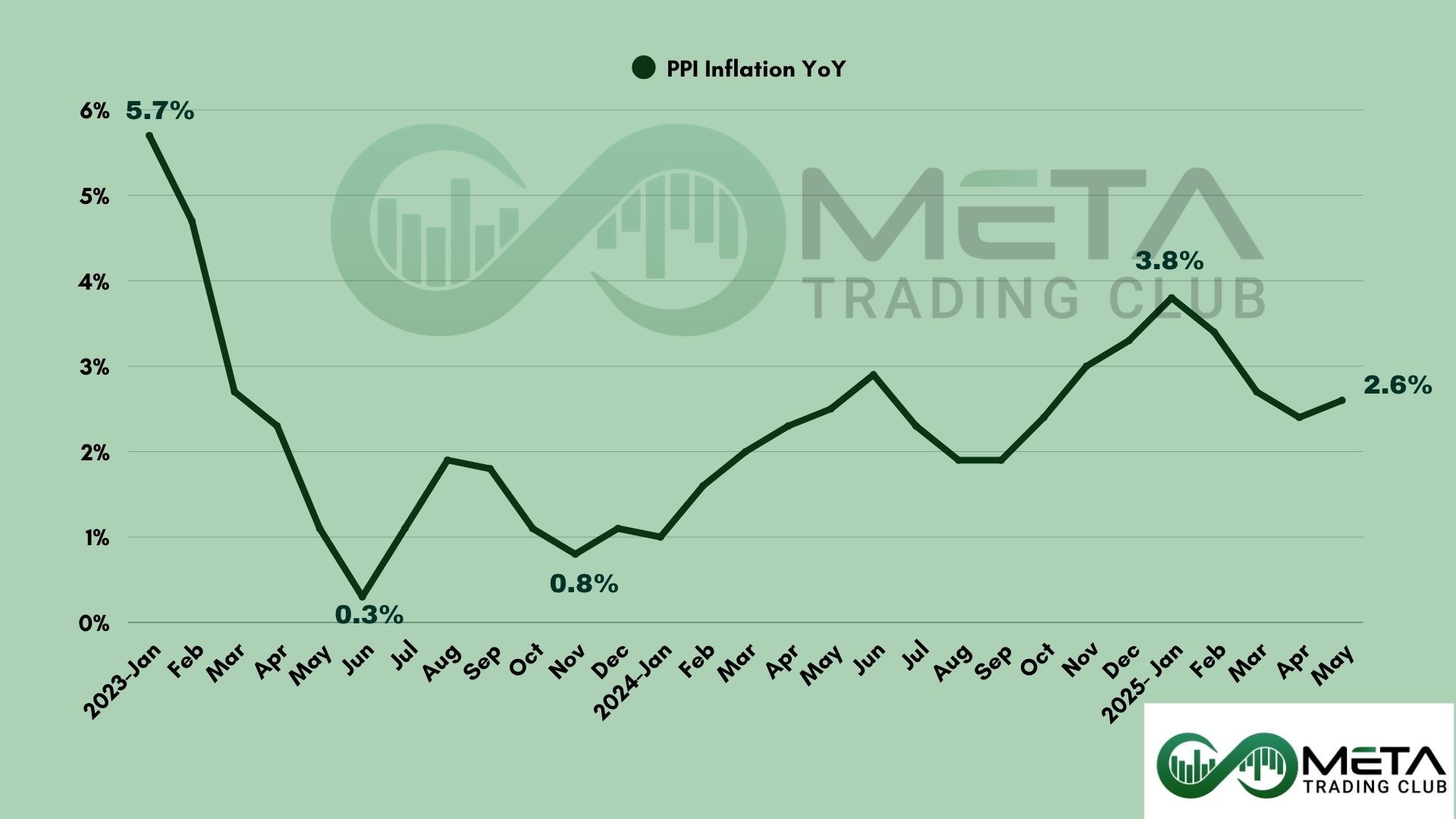

The May 2025 Producer Price Index (PPI) report shows a modest 0.1% increase in final demand prices, following declines in April (-0.2%) and March (-0.1%). On a year-over-year basis, producer prices have risen 2.6%, signaling steady inflation in the production sector. The May increase was driven by a slight rise in service costs and final demand goods.

Within the service sector, trade services saw the largest price increase, rising 0.4%, indicating higher margins for wholesalers and retailers. In contrast, transportation and warehousing costs dropped 0.2%, while prices for other services remained stable. Specific industries experienced more pronounced changes; machinery and vehicle wholesalers saw a 2.9% rise, while traveler accommodations, apparel, alcohol retail, and software publishing also saw price increases. Meanwhile, airline passenger services declined by 1.1%, as did prices in securities brokerage, investment advisory, and portfolio management.

On the goods side, most of the 0.2% increase came from non-food and non-energy goods, which also rose 0.2%. Food prices edged up 0.1%, while energy remained flat. Within the goods category, tobacco products saw a 0.9% price increase, while gasoline, processed poultry, roasted coffee, and residential natural gas experienced price gains. However, jet fuel prices plummeted 8.2%, alongside declines in pork and carbon steel scrap prices.

Intermediate demand also showed mixed trends. Processed goods for intermediate demand increased 0.1%, largely due to higher prices for nonferrous metals, gasoline, processed poultry, and fabricated structural metal. Unprocessed goods for intermediate demand declined 1.6%, with energy materials falling 3.5% and nonfood materials slipping 1.4%. Services for intermediate demand edged up 0.1%, led by metals, minerals, and ores wholesaling.

Impacts of May PPI Data on Market

Overall, the May PPI report suggests moderate inflation within the production sector. While energy prices remained flat, trade services and non-energy goods pushed prices higher. The year-over-year increase of 2.6% points to steady pricing pressures, though certain commodity and wholesale markets are seeing stronger fluctuations.

The May 2025 Producer Price Index (PPI) report had a muted impact on financial markets, as inflation pressures remained softer than expected. The Federal Reserve is likely to maintain its cautious stance, as the cooler-than-expected inflation data supports the case for holding off.