The Personal Consumption Expenditures (PCE) Price Index is a key inflation gauge used by the Federal Reserve to assess the prices of goods and services consumed by households. Unlike the Consumer Price Index (CPI), the PCE adjusts for changing consumer behavior, reflecting how people shift spending as prices change.

Core PCE excludes food and energy prices. Policymakers closely monitor it to understand inflation trends. It is considered a comprehensive measure of inflation. This helps guide decisions on interest rates and monetary policy.

By focusing on core PCE, the Federal Reserve can assess economic stability and inflation risks more effectively.

April PCE Price Index

The Bureau of Economic Analysis reported the April 2025 estimates for personal income, disposable income, and personal consumption expenditures, indicating steady economic activity.

In April 2025, U.S. consumer prices edged up 0.1%, aligning with expectations, following a flat reading in March.

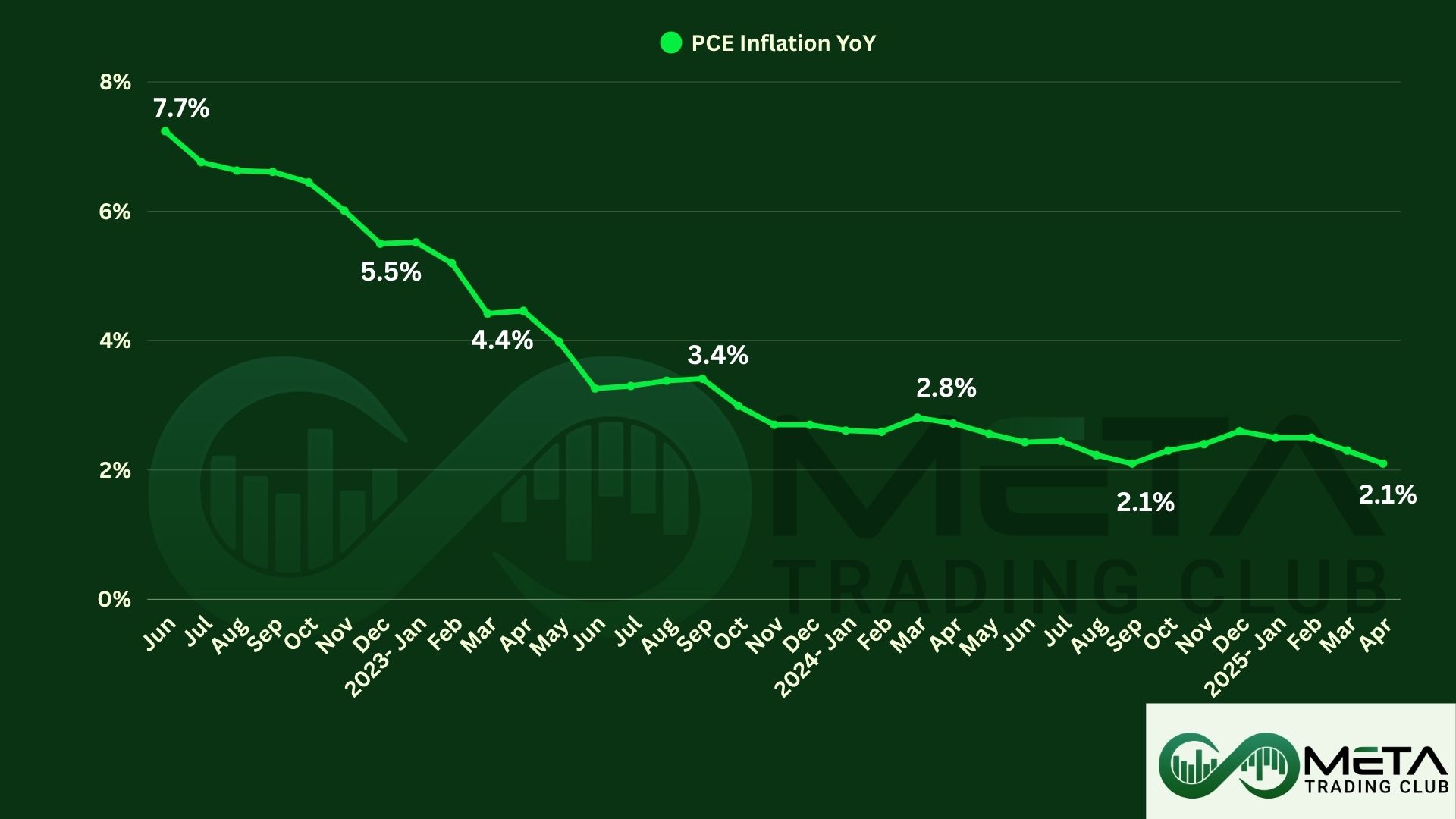

Also, annual PCE inflation in the U.S. continued to decline for the second consecutive month, reaching 2.1% in April, the lowest level in seven months. This represents a drop from 2.3% in March and came in below the projected 2.2%.

Meanwhile, core PCE inflation fell to 2.5%, its lowest since March 2021, reinforcing a trend of easing inflationary pressures. The PCE index remains the Federal Reserve’s key measure of inflation, guiding monetary policy decisions.

Income and Outlays Overview

In April 2025, personal income in the U.S. grew 0.8%, also disposable personal income (DPI) rose 0.8%. Personal consumption expenditures (PCE) saw a modest increase of 0.2%.

Total personal outlays, including spending and interest payments, increased, while personal savings reached $1.12 trillion, with a savings rate of 4.9%.

The rise in personal income was largely driven by increases in government social benefits and compensation. Spending on services climbed by $55.8 billion, while spending on goods decreased by $8 billion.

Price Index Trends

- Month-to-Month Changes: The PCE price index rose 0.1% from the previous month, with core inflation (excluding food and energy) also up 0.1%.

- Year-over-Year Changes: headline PCE inflation eased to 2.1%, its lowest level in seven months, while core PCE inflation declined to 2.5%, its lowest since March 2021.

Impacts of April PCE Data

The PCE index showed inflation easing, with annual PCE inflation at 2.1%, its lowest in seven months, and core PCE inflation at 2.5%, the lowest since March 2021. This reinforced expectations that inflationary pressures are cooling.

These data correspond to the first month in which Trump’s tariffs were implemented, but there is currently no sign of inflation rising due to the tariffs.

The decline in inflation could give the Federal Reserve room to consider interest rate cuts in upcoming meetings.

While today’s data provides a reassuring signal, it is not enough to prompt a policy change by the Federal Reserve. Markets need stronger signs of declining inflation before considering a shift in interest rates.