An inflation report is published by the government, typically by the central bank, and provides detailed information on current inflation rates. It includes data on price changes for various expenditure categories like housing, food, and transportation, and identifies factors driving inflation.

A Consumer Price Index (CPI) report measures the average change in prices paid by urban consumers for a market basket of goods and services, providing a key indicator of inflation. Published monthly by national statistical agencies, it includes data on categories like food, housing, and transportation. The CPI report helps policymakers, economists, and investors understand economic trends and make informed decisions.

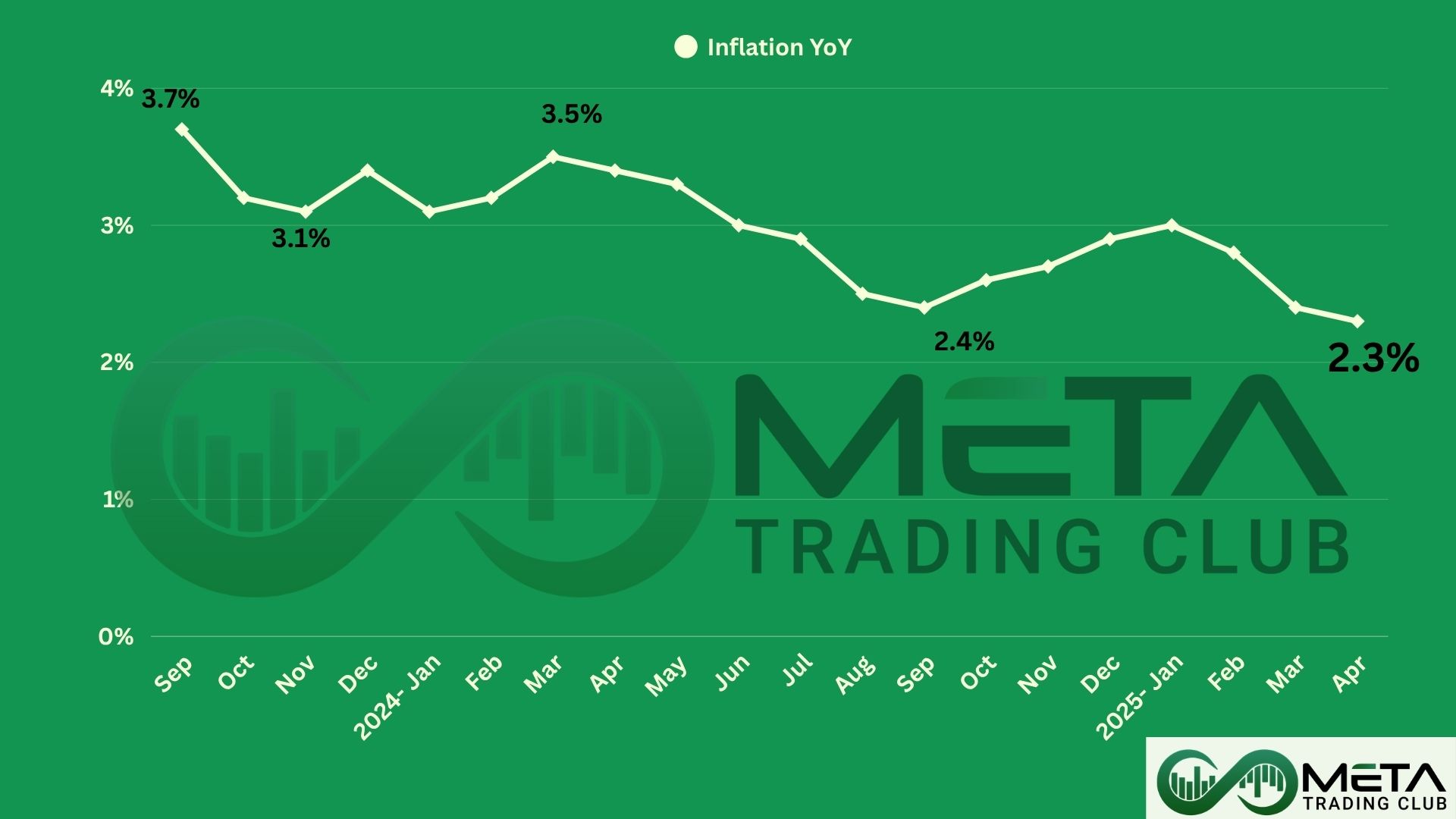

Inflation April 2025

The U.S. Bureau of Labor Statistics has reported a 0.2% increase in the Consumer Price Index for All Urban Consumers (CPI-U) for April, following a 0.1% decline in March. Over the last 12 months, the all-items index rose 2.3%, falling from 3% in January.

Shelter and Energy: The shelter index increased by 0.3% in April, contributing to more than half of the overall CPI rise. Meanwhile, the energy index rose 0.7% due to an uptick in natural gas and electricity prices, despite a decline in the gasoline index.

Food Index: The food index declined by 0.1% decrease in egg prices, while the food away from home index rose 0.4%. Over the last 12 months, the food index increased 2.8%, with notable gains in the meats, poultry, fish, and eggs category.

Core Inflation (All Items Less Food and Energy): This category saw a 0.2% increase in April, with household furnishings, medical care, motor vehicle insurance, education, and personal care experiencing price hikes. However, airline fares, used cars and trucks, and apparel recorded price declines. Over the past year, the index for all items less food and energy rose 2.8%, with shelter contributing a 4% increase.

Annual Trends: The all-items index increased 2.3% over the past 12 months, marking the smallest annual rise since February 2021. The energy index recorded a 3.7% decline, with gasoline prices dropping 11.8% year-over-year, while the food index rose 2.8%.

Impacts of April Inflation Data on Market

The April inflation report indicates that U.S. prices for goods and services increased slightly, though less than expected. This follows a small decline in March, suggesting inflation is rising gradually but may be stabilizing rather than accelerating.

If inflation drops below 2% in the coming months, the Federal Reserve could consider cutting interest rates more aggressively to prevent economic slowdown.

Despite signs of slowing inflation, the report does not provide a clear direction for Fed policy, leaving investors and businesses uncertain about future rate cuts. As a result, SPY showed little movement in pre-market trading, as the inflation data aligned closely with expectations and offered no strong signal on monetary policy changes.