Last week’s market and economic data key points:

- Trump proposes 50% tariff on EU, set for June

- S&P 500 dips for the week amid tariff concerns

- Wall street’s ‘fear gauge’ spikes to a two-week high

- Apple hits two-week low after tariff threat

- Gold climbs as markets weigh fresh risks

- Crude oil slip to modest weekly losses

- Dollar set biggest weekly fall since April

- Yen gets safe-haven boost as dollar index drops

- BTC shows weakness after hitting new all-time high

Table of Contents

What You Gained by Reading Last Week’s Market Mornings and What You Missed If You Didn’t!

Last Week’s report

Economic Reports

Last week in the U.S. was relatively calm, with no significant economic developments.

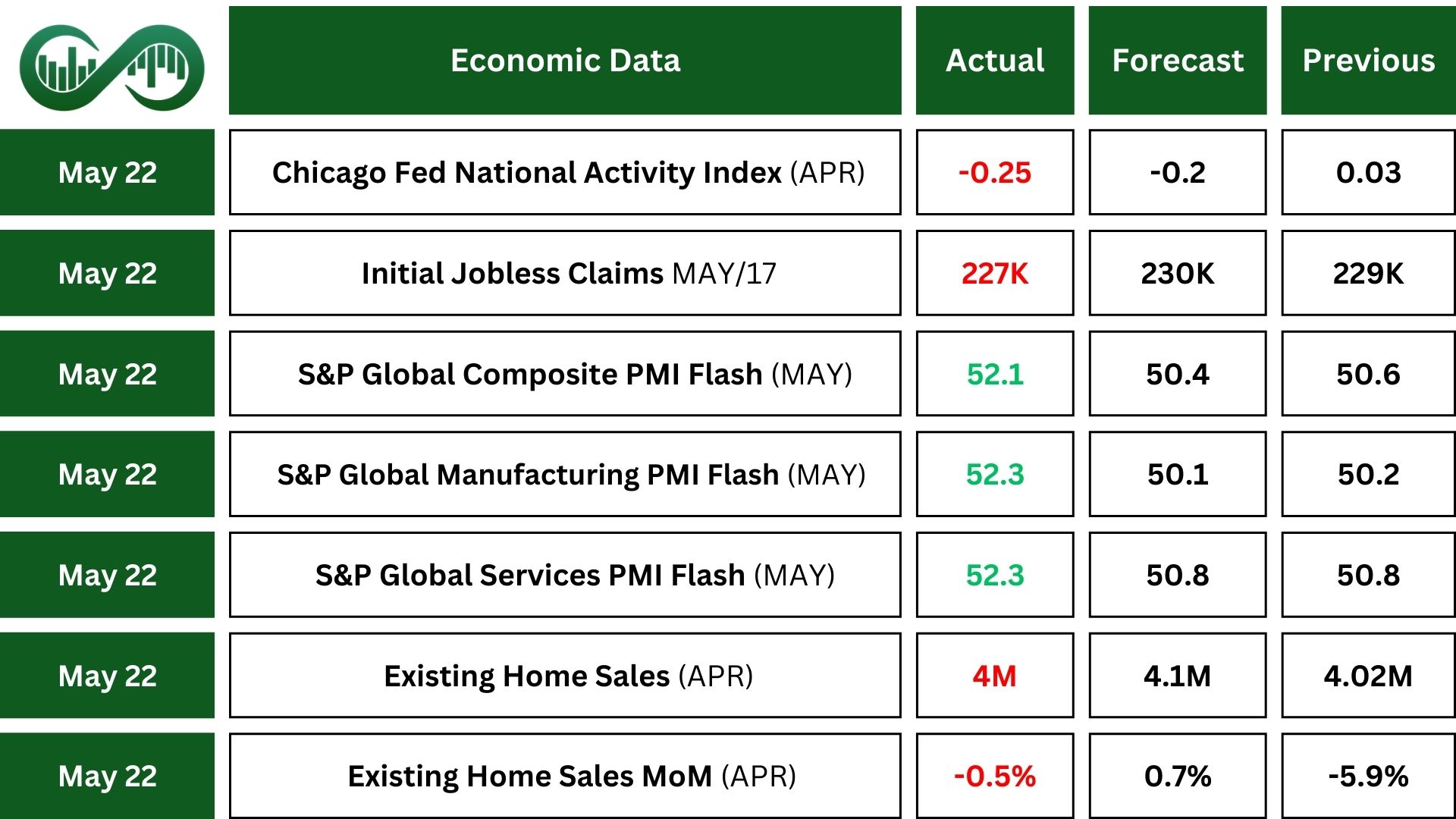

The Chicago Fed National Activity Index (CFNAI) fell in April, indicating a slowdown in economic activity. The decline was driven by weakness in lower production, declining sales, orders, and inventories, and a drop in personal consumption and housing. However, employment showed improvement, offering a small positive sign amid broader economic weakness. This dip in the CFNAI suggests that economic momentum is slowing, raising concerns about future growth.

U.S. initial jobless claims dipped slightly, falling by 2K to 227K for the week ending May 17, coming in below expectations. This suggests that the labor market remains stable despite high interest rates and economic uncertainty.

However, continuing claims rose by 36K to 1,903K, exceeding forecasts, indicating that some job seekers are struggling to find work.

The S&P Global Flash US Manufacturing PMI rose in May, its highest level in three months, and exceeding forecasts. This indicates factory production rebounded after two months of decline and new order growth reached a 15-month high.

The S&P Global US Services PMI climbed in May, marking a recovery from 17-month low and exceeding market expectations. Businesses saw a rise in new domestic orders, but orders from foreign markets dropped sharply, one of the largest declines on record outside of the pandemic. This suggests that tariffs and unpredictable government policies continue to disrupt international trade and business operations.

US existing home sales fell 0.5% month-over-month in April, reaching 4 million, the lowest in seven months. This was down in March and below forecasts, with high mortgage rates continuing to limit demand.

Earnings Reports

Target

Target (TGT) Q1 earnings fell short of expectations, with adjusted EPS at $1.30, reflecting weak retail conditions and slower sales growth.

Net sales dropped to $23.8 billion, missing forecasts, despite a 4.7% sales increase and a 35% rise in same-day deliveries through Target Circle 360.

Valentine’s Day and Easter sales performed better than usual, and the Kate Spade partnership became Target’s most successful collaboration in over a decade.

Also, the company cut its full-year sales forecast, raising concerns about weak consumer spending and stiff competition.

After missing revenue and profit estimates, Target’s stock fell 5%.

Indices

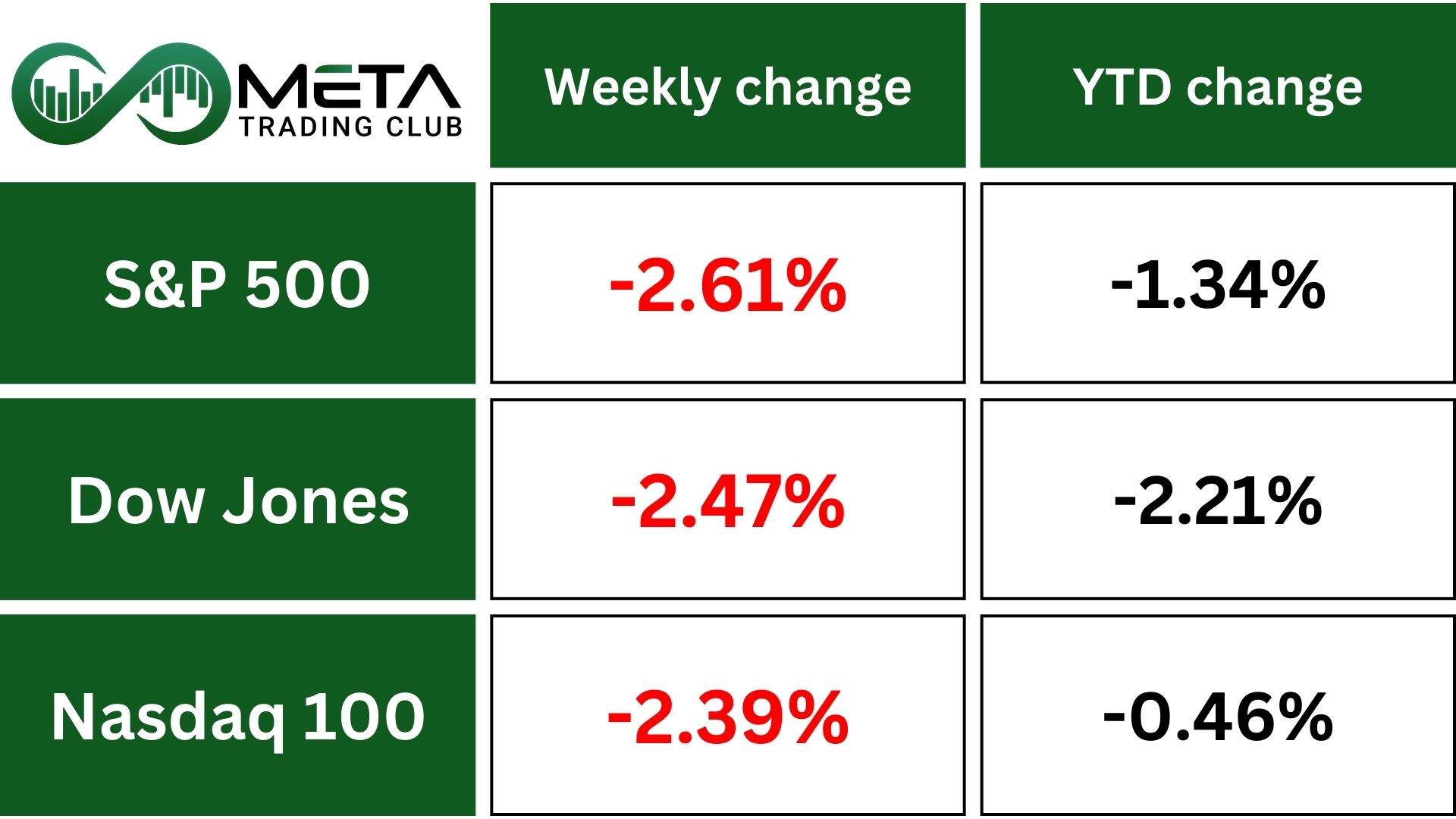

Indices’ Weekly Performance:

Last week, U.S. equity indexes fell as investors reacted to economic uncertainty triggered by the White House’s budget bill and trade tensions. The S&P 500, Nasdaq, and Dow Jones all dropped by approximately 2.5%, reflecting widespread concerns about fiscal policy and tariff threats.

A key driver of market jitters was the House of Representatives’ passage of a $2.3 trillion deficit-expanding bill, which could significantly increase national debt over the next decade. The bill lacked substantial infrastructure funding, leaving investors questioning its long-term economic impact.

Adding to market volatility, President Donald Trump announced new trade measures, including a proposed 50% tariff on EU imports, citing stalled negotiations. Additionally, he threatened a 25% tariff on Apple, urging the tech giant to move iPhone production to the U.S. The announcement sent Apple’s stock down 3% on Friday, highlighting investor concerns over the potential disruption to supply chains.

Overall, uncertainty around fiscal policy, debt expansion, and trade relations weighed heavily on investor sentiment, leading to a broad decline in major stock indexes.

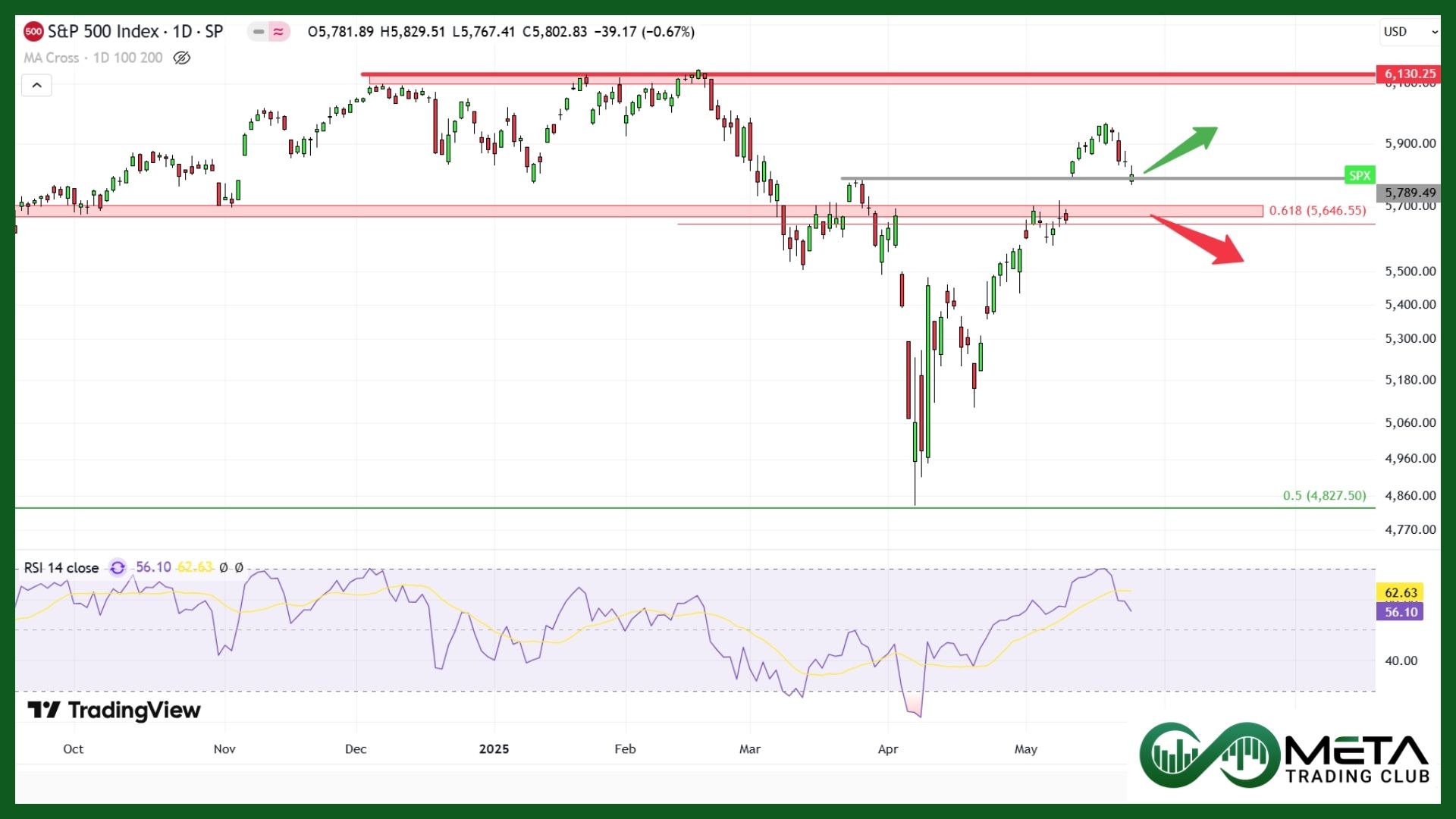

Technically, SPX has reached a crucial level at 5790. If this support holds, the index may rebound from this point. However, if the strong support at 5640 is breached, a further decline is expected.

Stocks

Sector’s Weekly Performance:

Markets saw broad declines, with Real Estates and Technology being the hardest hit.

- Technology plunged 3.2%, with solar stocks plunging after Trump’s tax bill, which may cut green-energy subsidies. Enphase (ENPH) dropped 21%, while First Solar (FSLR) fell 11%. Apple (AAPL) slid after Trump threatened a 25% tariff on iPhones not made in the U.S., and semiconductor stocks sank 4.5%.

- Consumer discretionary declined 2.9%, as Home Depot (HD) warned tariffs may impact product availability and Deckers Outdoor (DECK) lowered its yearly targets due to tariff concerns.

- Energy fell 2.7% as crude and fuel supply data turned bearish, while concerns about OPEC+ increasing output added further pressure. Phillips 66 (PSX) also dropped after a proxy fight outcome.

- Financials dropped 2.3%, with big banks falling as Trump’s tariff plans resurfaced.

- Healthcare fell 1.4% as withdrawal of a COVID-flu vaccine application caused a decline. However, Moderna (MRNA) jumped 6% weekly, but its

- Utilities dropped 0.8%, as NextEra Energy (NEE) stocks fell following Trump’s tax bill advancing toward passage.

- Communication services saw slight losses of 0.5%, but Alphabet (GOOGL) gained after unveiling new AI updates.

- Consumer staples dipped 0.4%, with Target (TGT) tumbling due to tariff pressure and weak demand.

Stock Market Weekly Performance:

Top Performers

Last week saw remarkable stock market performance, with several companies standing out as top gainers:

- GE Vernova (GEV): Surged 8.49% as it announced initiatives worth up to $14.2 billion during President Trump’s state visit, focusing on energy technology, power generation, and grid stability projects.

- Dollar General (DG): Advanced 8.38% raising its full-year outlook due to higher consumer demand for discount retail. Additionally, analysts upgraded the stock, citing improved cost efficiencies.

- Intuit (INTU): Gained 7.44% following better-than-expected earnings, driven by AI-powered financial tools and robust small business software demand. The company also announced new AI-driven product expansions, fueling investor confidence.

- Newmont (NEM): Up 7.09% as gold prices hit a new multi-month high, pushing mining stocks higher. Newmont also reported higher-than-expected production numbers, reinforcing optimism in the sector.

- Cboe Global Markets (CBOE): Rose 4.81% due to record trading volumes amid heightened market volatility.

- Gilead Sciences (GILD): Surged 4.75% after revealing positive results from clinical trials for a new HIV treatment, boosting investor sentiment.

- Seagate Technology (STX): Advanced 4.59% after reporting higher-than-expected revenue growth, driven by strong enterprise demand for data storage solutions.

- Philip Morris (PM): Rose 4.55% following increased adoption of smoke-free products and new partnership in Asia further boosted future growth expectations.

- CrowdStrike (CRWD): Gained 3.72% as cybersecurity spending surged, benefiting the company’s AI-driven security solutions. Positive analyst upgrades contributed to the stock’s momentum.

Commodity

Weekly Performance of Gold, Silver, WTI and Brent Oil:

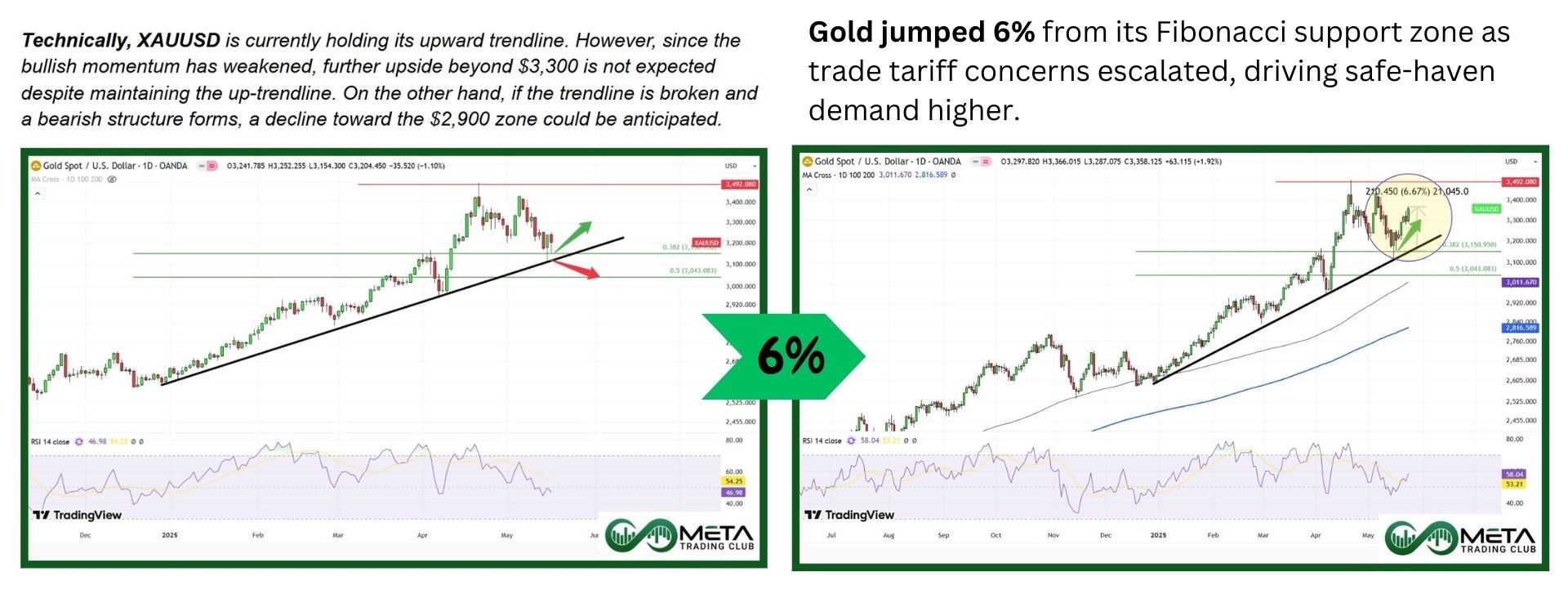

Gold (XAUUSD) jumped last week as the dollar fell after Trump’s new tariff threats against the EU and Apple, driving safe-haven demand.

Trump said trade talks with the EU aren’t working and suggested a 50% tariff on EU imports starting June 1, while also threatening a 25% tax on Apple imports unless iPhones are made in the U.S. This brought back market fears, despite recent easing of U.S.-China trade tensions.

Gold is also heading for its best week in a month, supported by concerns over U.S. fiscal debt. Rising long-term yields, following Trump’s tax bill, are adding to worries that the national debt could grow even more.

Technically, Gold has reached a short-term downward trend line. If the metal manages to break above this level, a further surge is expected. However, if downward momentum persists, the metal could face rejection at the trend line, potentially leading to a decline.

WTI Crude Oil had a choppy week with a volatile trading period, as investors worried about the upcoming OPEC+ meeting on June 1 and the potential production increase of 411,000 barrels per day in July.

Meanwhile, trade tensions resurfaced as President Trump threatened a 50% tariff on EU imports, adding uncertainty.

Separately, the U.S. and Iran concluded nuclear talks in Rome without a deal, though both sides agreed to continue negotiations.

Forex

Weekly Performance of Major Foreign Exchange Pairs:

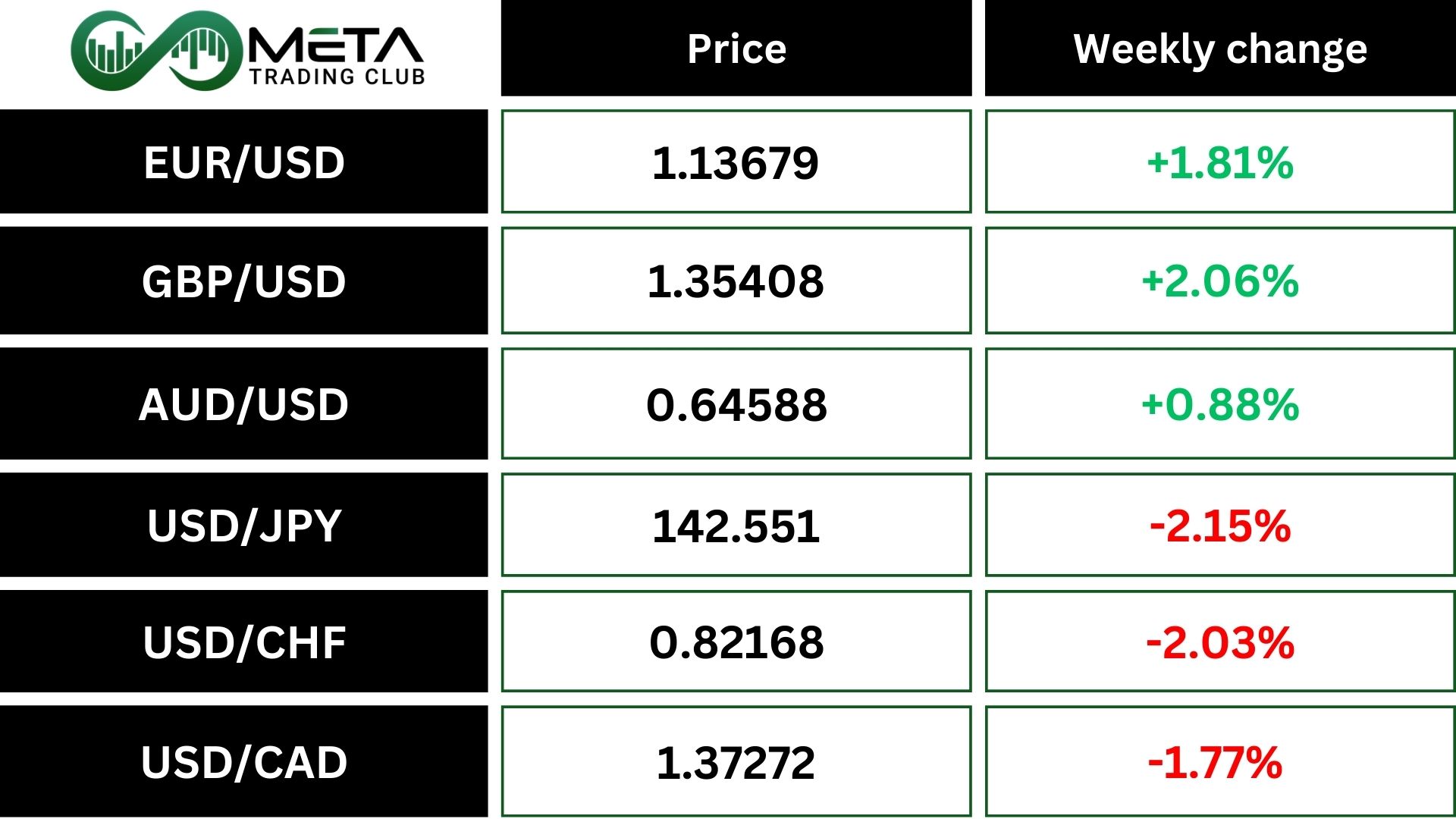

The dollar index (DXY), which tracks the U.S. dollar’s performance against a group of major currencies, dropped to a three-week low, marking its largest weekly decline since early April.

The U.S. dollar weakened over 2% against the Japanese yen (USDJPY), while the euro (EURUSD) gained 1.8% against the dollar. Also, the pound (GBP/USD) was up 2%, posting its largest weekly gain in five weeks.

Crypto

Crypto Market Weekly Performance:

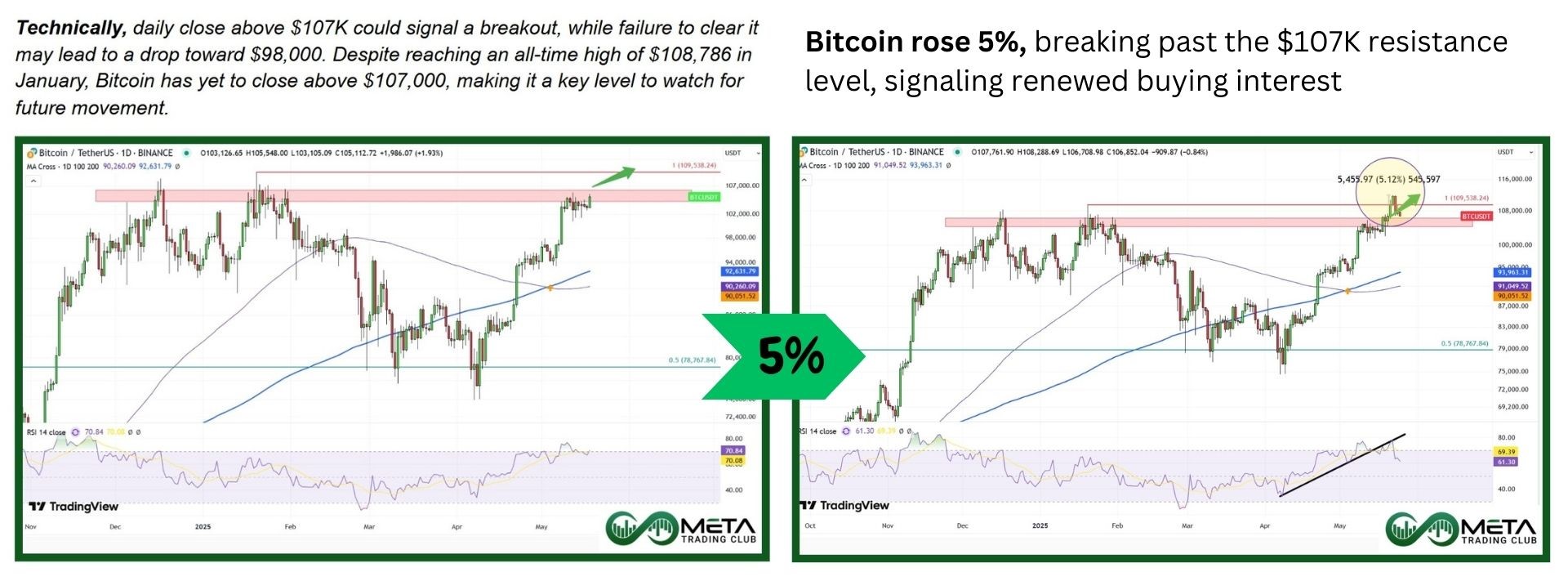

Bitcoin has been on a strong upward trend, breaking past key price barriers to reach a new all-time high. This surge has boosted confidence in its growth across the cryptocurrency market.

Bitcoin hit a new all-time high of $112K, surpassing its previous peak of $109K earlier this week. This surge reflects strong buying interest, but momentum is now slowing.

Currently, Bitcoin is pulling back slightly toward $109K, which is now a key support level. If buyers step in, the price could rise toward $115K or higher. However, if selling pressure increases and Bitcoin drops below $109K, a deeper correction could follow, possibly retesting the $100K level.

Next Week’s Outlook

Economic Events

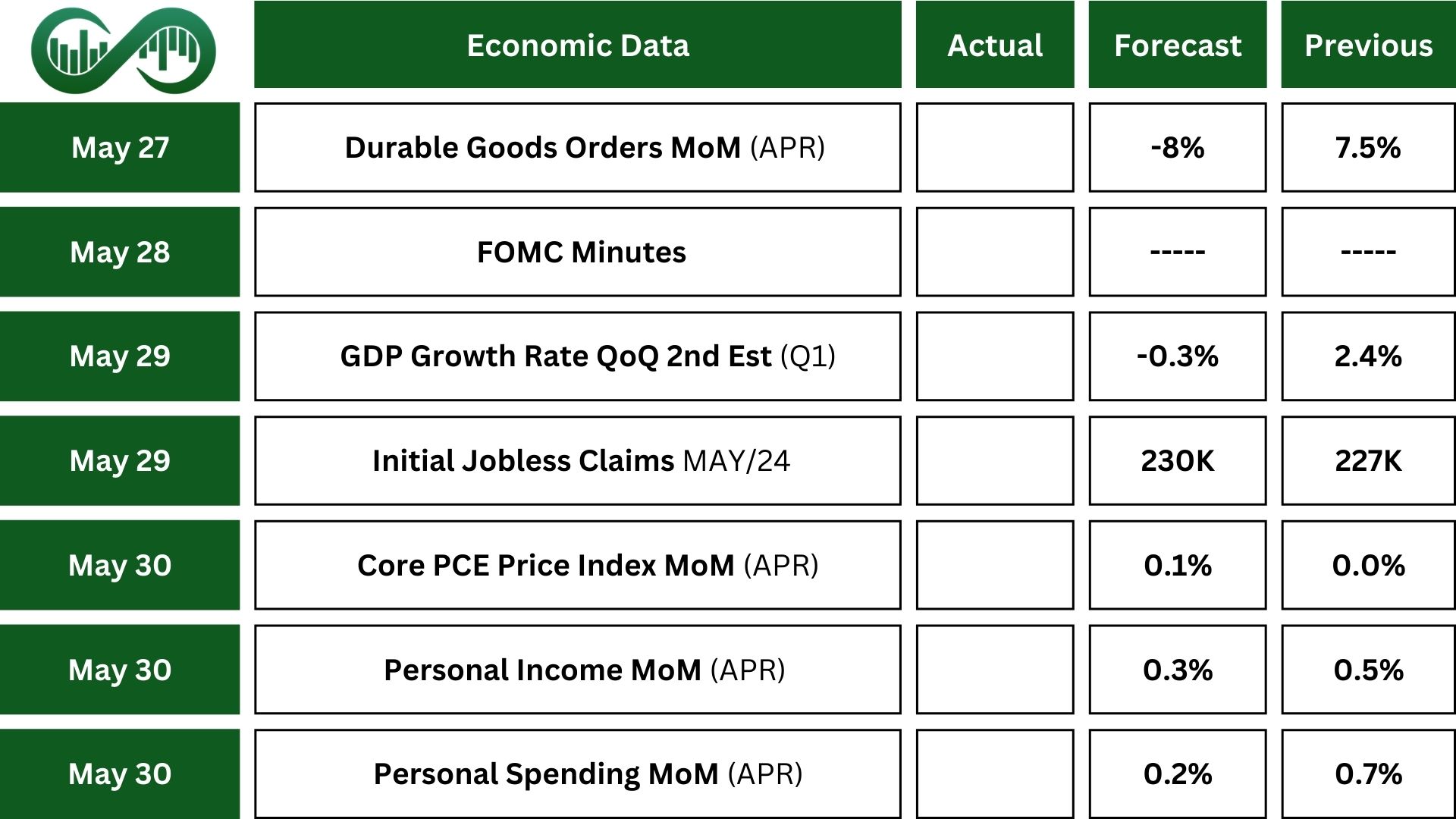

This week, the US stock market will be closed on Monday for Memorial Day.

Markets are set for a volatile week after Trump reignited trade tensions, targeting both the EU and Apple with tariff threats.

We will closely watch Federal Reserve speeches and the FOMC Minutes for insights into policy direction.

Economic data releases will include personal income and spending, the PCE price index, and Q1 GDP, which is expected to confirm the first contraction in three years, largely due to a 41.3% surge in imports.

Other key indicators include durable goods orders, corporate profits, consumer confidence, pending home sales, housing prices, trade balance, wholesale inventories, Chicago PMI, and manufacturing data.

Earnings Events

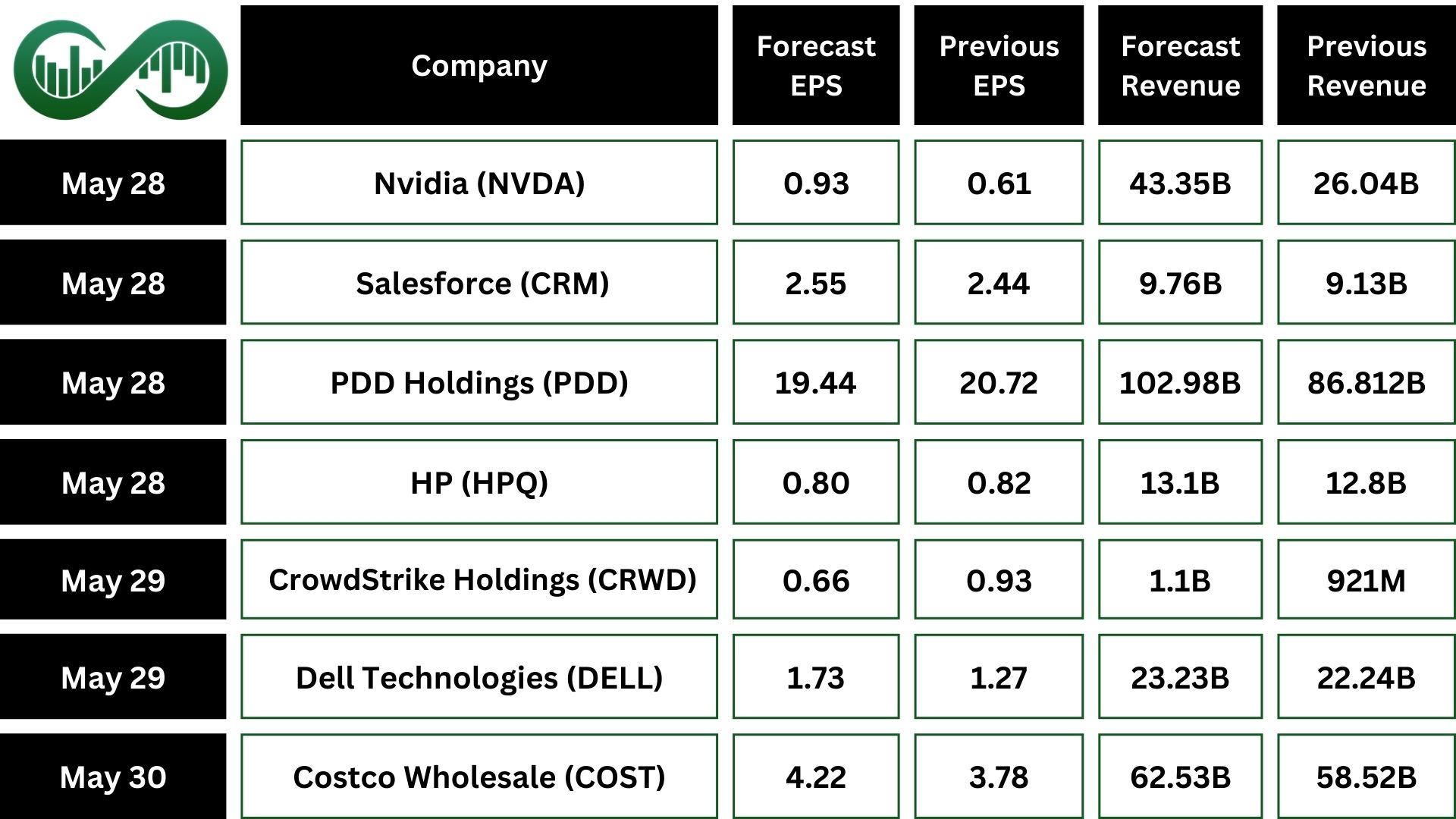

On the earnings front, Nvidia (NVDA) is set to release its financial results, and the market eagerly awaits the report. Other major companies, including Salesforce (CRM), Costco (COST), CrowdStrike (CRWD), PDD, HP, and Dell, are also set to release their earnings.

Disclaimer:

The views and opinions expressed in the blog posts on this website are those of the respective authors and do not necessarily reflect the official policy or position of Meta Trading Club Inc. The content provided in these blog posts is for informational purposes only and should not be considered as financial advice. Readers are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Meta Trading Club Inc shall not be held liable for any losses or damages arising from the use of information presented in the blog posts.