Mastercard is a global company that connects people and businesses by making payments easy and secure. Founded in 1966 and based in New York, Mastercard helps people pay for things in over 210 countries. They aim to reduce the use of cash and make electronic payments safer and more convenient. Mastercard offers different types of cards like credit, debit, and prepaid, and continues to improve digital payment methods.

Besides payments, Mastercard provides extra services like fraud protection, data analysis, rewards programs, and business advice. They also work to help people who don’t have access to financial services. By using new technology and partnerships, Mastercard aims to support economic growth and help people and businesses around the world.

Mastercard Fiscal Q1 2025

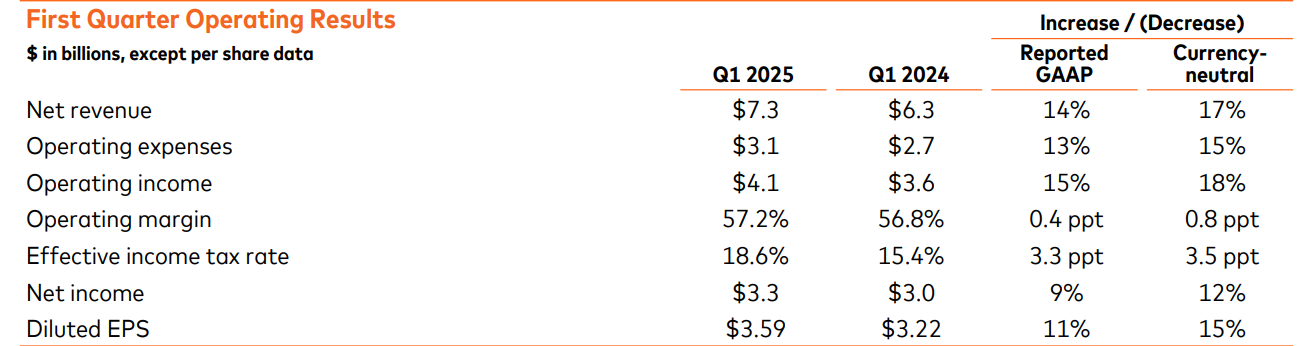

Mastercard (MA) Q1 2025 earnings reported a beating estimated net revenue increase of 14%, or 16% on a currency-neutral basis. This growth was primarily driven by the expansion of the payment network and value-added services and solutions. The impact of acquisitions on net revenue was minimal.

Highlights:

- Revenue Growth: Net revenue increased 14%, driven by growth in the payment network and value-added services.

- Operating Expenses: Increased 13%, mainly due to acquisitions, general and administrative costs, and higher advertising and marketing spending.

- Other Income/Expense: Reported a $72M unfavorable shift due to investment losses and increased interest expenses.

- Tax Rate: Effective tax rate rose to 18.6% due to new 15% global minimum tax rules in Singapore and other regions.

- Shareholder Returns: Repurchased 4.7 million shares for $2.5B and paid $694M in dividends during Q1. An additional $884M worth of shares were repurchased through April 28, leaving $11.8B under approved buyback programs.

Boards Statements

Michael Miebach, the CEO of Mastercard, highlighted the company’s strong start to 2025. Net revenue growth of 14% year-over-year, driven by 15% cross-border volume growth.

He emphasized Mastercard’s ongoing innovation, including the launch of Agent Pay and the Agentic Payments Program, in collaboration with companies like Microsoft and OpenAI.

Miebach also announced a strategic partnership with Corpay to enhance corporate cross-border payment solutions. Despite global uncertainty, he expressed confidence in Mastercard’s diversified, resilient business model and proven strategy to navigate various economic environments effectively.

Impact on the Stock Market

Mastercard’s Q1 earnings had a positive impact on its stock, with shares rising 1% in premarket trading. The company exceeded expectations, reporting adjusted EPS of $3.73 and revenue of $7.25 billion

Strong cross-border volume growth of 15% and a resilient business model contributed to investor confidence. However, future stock performance will depend on Mastercard’s ability to sustain growth amid global economic uncertainties.