Gross Domestic Product (GDP) quantifies total value of all goods and services produced within a nation’s borders. Therefore, it serves as a measure of economic activity. GDP can be computed using three approaches: production, income, and expenditure. Importantly, real GDP adjusts for inflation, providing a true growth picture. Governments, businesses, and economists utilize GDP to understand trends. Hence, it aids in making informed decisions.

GDP Advance Estimate Q1 2025

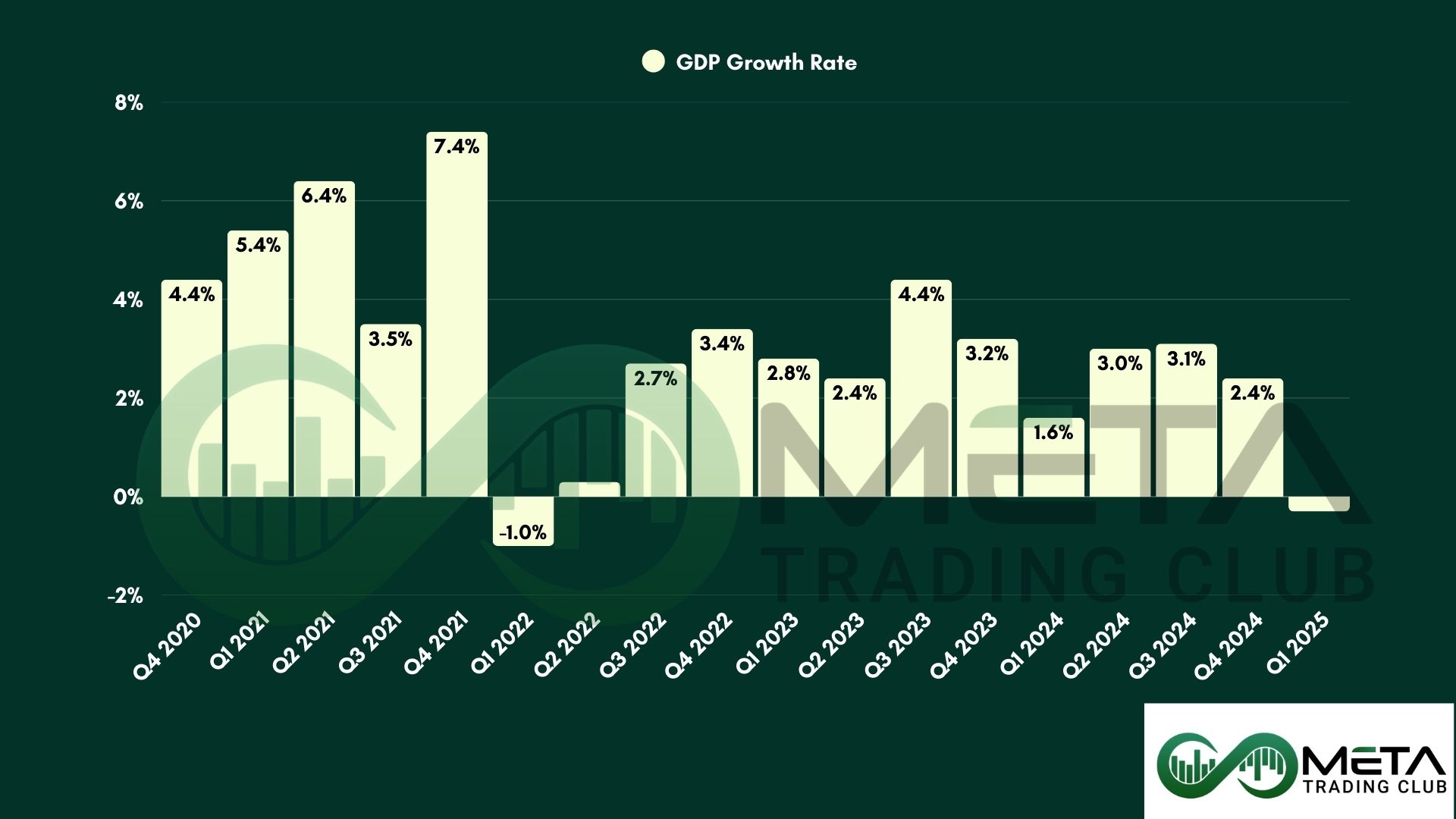

The U.S. economy contracted in the first quarter of 2025, with real GDP decreasing by 0.3% on an annualized basis, according to the advance estimate released by the U.S. Bureau of Economic Analysis (BEA). This marks a sharp reversal from the 2.4% growth recorded in the fourth quarter of 2024.

Factors Contributing to GDP Decline

The decline in GDP was primarily driven by:

- Increase in imports: Higher imports, which subtract from GDP, contributed to the contraction.

- Decline in government spending: Reduced public expenditures negatively impacted overall economic growth.

These factors were partially offset by:

- Growth in investment: Businesses continued to invest, helping to stabilize economic activity.

- Higher consumer spending: Despite challenges, consumer demand showed resilience.

- Increase in exports: Improved trade flows helped mitigate some of the negative impacts.

Economic Indicators

- Real final sales to private domestic purchasers rose 3%, slightly higher than in the previous quarter.

- Price index for gross domestic purchases climbed 3.4%, compared to 2.2% in Q4 2024.

- Personal Consumption Expenditures (PCE) price index increased 3.6%, up fromQ4.

- Core PCE price index (excluding food and energy) rose 3.5%, compared to the prior quarter, indicating persistent inflationary pressures.

Impacts of Report on the Stock Market

A decline in GDP can signal economic challenges ahead, especially as businesses and consumers navigate shifting trade policies, reduced government spending, and rising inflation.

Also, the increase in imports suggests companies may have been stockpiling goods in anticipation of higher costs, which could impact future demand.

Meanwhile, persistent inflationary pressures reflected in the rising personal consumption expenditures (PCE) price index, may affect consumer confidence and purchasing power.

Following the release of the GDP report, the SPY fell 1.5% in pre-market trading. Investors reacted negatively to the unexpected economic contraction, raising concerns about future growth and inflation trends.